- Home

- Record Keeping Systems

Index of Record Keeping Systems Chats

How To Organize Small Business Bookkeeping Files

BOOKKEEPER'S HANDY REFERENCE

by L. Kenway BComm CPB Retired

Published in 2013 | Edited July 29, 2024

I have a confession to make that may shock you ... I hate filing! Yes, I do. I really do. So I developed a "lazy man's" record keeping system to organize my own business receipts. You too can develop a system that works for YOU.

You have options. Look through them and pick the one that best matches your organizational style. I've got to say that a shoebox filing system is not a style … it's just plain lazy! But hey that's okay because I've got a filing system for lazy filers like me too!

Three Points To Keep In Mind

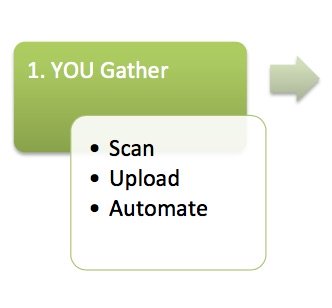

File organization doesn't have to be difficult or complex to work. I attended Document Snap's Paperless Action Class early in 2012. In lesson two, Brooks Duncan started the lesson with three great points that you should keep in mind as you start to organize your files:

- Take a step back and relax.

- Remember that there is not one “right” way to do things.

- Focus on what will work best for you.

An excellent article by Sherrill St. Germain on reverse budgeting (how to put your budgeting on autopilot with no detail tracking) talks about four elements to examine when organizing anything ... including your recordkeeping system (i.e. business finances):

- Your style - detail or big picture oriented

- Your money (or filing) personality - saver or spender (keep every receipt or lose every receipt)

- Your goals - file your taxes or know if you are making money

- Your time constraints - not enough hours in a day or make time for administrative details of running your business

YOU HAVE OPTIONS ... you really do!

Blueprint for Success

"... [Learning] a proven system for tackling your return and sorting tax documents - you'll better meet compliance obligations with the CRA by filing an audit-proof return. Consider it a blueprint for success in making the tax preparation process work in your favor, both at tax time, and all year long, rather than against you."

-- Evelyn Jacks, author Master Your Taxes --

IMAGE INDEX For Easy Office Filing Systems Series

Document Management Questions

The Bookkeeper's Tea Break

Be Present to the Moment

Before we start. Bring your mind here to this page. Let every other thought go … just for now. Take a deep breath and let it out slooooowly …. if that felt good, do it one more time. Okay here we go.

We've been chatting about record keeping systems today. The question will arise ... Should you be using computer software ... the second item in my list of good bookkeeping practices categories?

I suggest you consider (or re-consider) one of the cloud solutions such as QuickBooks Online. Why?

- Your business lives or dies by cash flow.

- Cloud solutions with automated bank feeds and app integrations like LedgerDocs reduce data entry errors giving you confidence in the accuracy of your information ... though you may initially need help mapping where the data goes.

- All your devices are synced automatically with QBO throughout the day.

- Attach your receipt to an entry so you don't lose it ... and no more hunting for it when you try to lay your hands on it.

- Your time is valuable. QBO learns and auto populates many of your figures allowing you to allocate your valuable time to another area of your business.

- The mobile app gives you real-time access to help you make business decisions and allows you to access and manage your books from anywhere.

- Company snapshots lets you quickly check if you are on target for the month.

- QBO lets you send invoices, manage and pay bills, scan receipts, track your sales tax, pay your employees and work with your bookkeeper or accountant.

Executive Summaries

|

Small Business Record Keeping Systems

|

|

Filing Forum

|

|

Paperless Technology - Organize Your Documents

Attention: Brooks' publications are no longer available for sale. I am in the process of looking for another source. Paperless technology lets you organize your documents like never before ... and it's affordable. In addition to information on how to purchase this extremely useful guide, you will find a link to a free eCourse on going paperless. Worried about losing your scanned documents ... learn how to backup up documents onsite and off-line ... keep them safe. Once you've moved towards a paperless system ... can you ever be totally paperless? ... how you send private information to your customers / clients becomes a bit of a dilemma. "Mr. Paperless" explains the best practices in sending sensitive information online. It really isn't a good idea to send it by unencrypted email! |

|

Small Business File Organization

|

|

Books and Record Retention

|

|

Bookkeeping With A File BoxLearn the benefits to organizing your bookkeeping documents using a simple banker's file box. |

I Hope You Enjoy Your Visit Today,

Your Tutor

Bookkeeping Essentials › Record Keeping and Filing Systems