- Home

- Financial Statements

- Income Statement

Advertisement

How To Read Your Income Statement

For The Business Owner Working From Home

by L. Kenway BComm CPB Retired

Published May 2009 | Edited June 3, 2024

Quick Links

- Income Statement Formula

- Revenue, Cash ≠ Sales

- COGS and COGS Formula

- Gross Profit Formula

- Operating Expense

- Operating Income Formula

- Other Income and Expense

- Net Income, Profit ≠ Cashflow

Sidebar chats

The income statement reveals how you made your profit! ... or how you made your loss :0( So watch your income statement carefully to ward off problems.

Most small business owners are familiar with this financial statement and understand the basics. There is so much more information than initially meets the eye! Get your tea ready because ...

... just like the balance sheet, this chat is going to be divided into two separate discussions:

We’ll begin with the basics of reading and understanding this financial statement ... by taking a look at what goes on the income statement ... including looking at the COGS formula. (COGS stands for cost of goods sold.)

Then we’ll go beyond the basics to ratio analysis which uncovers interesting stuff about your business like:

- How profitable your business is (obviously!);

- How you waste your resources;

- How accurate your reporting is;

and more …

Let the fun start now ... as you discover the relationships between the numbers and begin to understand how they affect your business.

Advertisement

Learning How To Read Your Internal Financial Reports

Tools for the Home Based Business Owner

How Your Financial Plan Is A Road Map

How Your Financial Plan Is A Road Map Why You Want The New NTR Report

Why You Want The New NTR Report--Overview--

It shows :

- How much revenue you earned;

- The cost of the goods you sold;

- What your gross profit was;

- How much you spent marketing your products, service, business;

- How much it cost to run the company; and

- How much you made or lost from the sale of assets.

If you remember, the balance sheet was like a snapshot or picture of your business at one specific point in time ... reporting on how healthy your business is. (Don't ignore this important financial statement.)

The income statement is more like a video as it captures your business activity over a specific period of time instead of one point in time.

You will need to read the heading at the top of the statement to determine what period it is covering. The most likely periods are one year, a quarter, or a month. This is how you know what period your financial transactions are being summarized for.

The net income or loss figure is reported on your balance sheet under the equity section.

When we crunch a few numbers in the next section, you will discover the abundance of stuff it reveals about your internal operations - like identifying problem areas that need your attention.

--The Income Statement Formula--

This report gets its name because it summarizes how you made your income. Here's how it does it.

What you sold or earned - (What you paid to make or purchase the product

- What you spent to market and run the company) = Net profit or loss

Restated in accounting language

Income - Expenses = Net income (loss)

or you could expand it like this

Income - Direct expenses = Gross profit

Gross profit - Indirect expenses = Operating income

Operating income - Other income = Net income (loss)

This means that the expenses you have in your small business are from three different sources:

- operating - cost of goods sold, marketing (or selling) and administration (or general) expenses;

- non-operating - gains or losses from non-primary business activities like the sale of assets; or

- irregular items -extraordinary items, changes in accounting policy, discontinued operations.

If we put this into a formula, it would look like this

Income - Operating expenses - Non-operating expenses - Irregular items = Net income (loss)

However Mike Michalowicz, author of Profit First, suggests small business owners should turn this equation around to be profit focused so you earn a decent living at what you are doing.

Income - Desired Net income = Expenses (What's left to run your business)

I can see you thinking ... What's my point?

The idea I want you to see is that the income statement holds information that is important to you as a business owner. You can play around with the formula and rearrange it or rename the parts to something you remember and understand. It doesn't have to be in accounting language.

“The bottom line. That’s what we’re all concerned with. At the end of the day, what’s the final result? But what goes into that bottom line? Whether you want to understand how expenses affect your own earnings, or you’re analyzing a company to invest your money, one of the first things you want to understand is profitability. That’s what the income statement is designed to reveal.”

Lela Davidson, Corporate Finance writer for Bizzia

--How The Income Statement Ties To The Balance Sheet--

Did you know that your profit and loss statement (P&L) ties into and is reported on your balance sheet? Well it does.

The net profit reported on the last line of the income statement is reported in the owner's equity section of your balance sheet. The two numbers should always match.

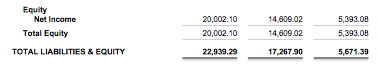

In this quick example, from the sample financial statements, the net income on the income statement is $5,398.08.

The balance sheet below shows the net income of $5,393.08 for the current quarter in the change column because the $20,002.10 represents the cumulative net income since inception of the business.

Take a look at your financial statements right now to see if net income on your statements match.

Why is this? Well if you think back to what we discussed on the balance sheet, you will recall that there were three different sources of funding to purchase company assets.

One of the sources was reinvested profits ... which is equity supplied by the business ... and profits are calculated on the income statement.

Is the Income Statement The Same As Profit and Loss?

At this point you may be getting confused because there are many different names for an income statement. I have purposely been mixing the terminology.

If you hear people talk about the profit and loss statement ... or the P&L ... or the statement of operations, ... or the statement of revenue and expense, ... or the statement of income and loss ... they are all referring to the income statement. Aahhhh!

The income statement is usually presented in the following format.

Sales

Cost of Goods Sold

Gross Profit (Loss)

Operating Expenses

Selling Expenses

Administrative Expenses

Operating Income (Loss)

Non-operating income and expenses

Irregular items

Net Income (Loss)

If you are a visual learner, this sample financial report of a very basic income statement may be helpful to you. You can get a look at what an actual income statement looks like ... just in case you have never seen one.

I am not up on the new International Financial Reporting Standards (IFRS) that came into effect in 2011 when Canada switched from one standard of Canadian GAAP (Generally Accepted Accounting Principles) to different standards for different categories of entities. The standard for public companies is IFRS ...and it is my understanding that the reporting presentation has changed to look like this:

Consolidated statement of profit or loss

- Revenue

- Other income

- Changes in inventories

- Costs of material

- Employee benefits expense

- Change in fair value of investment property

- Depreciation, amortisation and impairment of non-financial assets

- Impairment losses of financial assets and contract assets

- Other expenses

Operating Profit

- Share of profit from equity accounted investments

- Finance costs

- Finance income

- Other financial items

Profit Before Tax

- Tax expense

Profits for the year from continuing operations

- Loss for the year from discontinued operations

Profit For The Year

Profit for the year attributable to:

- Non-controlling interest

- Owners of the parent

Earnings per Share Information

Source: Grant Thornton IFRS Example Consolidated Financial Statements

As mentioned, these reporting changes apply mostly to publicly traded companies or companies requiring international financing.

KEY TAKEAWAY

Most small businesses in Canada switched to Accounting Standards for Private Enterprise (ASPE). You do not need to be concerned with the very complex IFRS reporting standards.

Revenue is the money earned by selling your products or services. It is NOT the amount you are taxed on and it is usually not the amount of cash you have received if you are using the accrual basis of reporting. (Accrual basis mainly refers to the accounts receivable and accounts payable sitting on your balance sheet.)

More For Canadians >> How Sole Proprietors Are Taxed in Canada

You need to have sales to earn a profit. Without sales, you will never be able to pay your bills.

Take the opportunity to track your revenue by categories (turn on the "class" function in QuickBooks) so that you can use this financial statement to help you make sound business decisions. You decide what is most relevant to your business.

- It could be tying your sales to your advertising so you can measure the effectiveness of your advertising dollars.

- It could be by region if you operate in more than one area.

- It could be by type of service such as wedding gigs, karaoke, or company parties if you are a DJ.

Good To Know

Accrual or Cash Basis of Accounting?

In Canada, small business owners must use the accrual basis of accounting. CRA only allows farmers and fishermen to use the cash basis of accounting.

In the United States, businesses with five million dollars or less in sales ... OR ... that carry inventory with under one million in sales can choose cash basis or accrual basis accounting.

Cash vs. Sales

Do not confuse your cash receipts (cash coming into the business) with sales revenue (income that has been earned).

With accrual accounting, you record the revenue when the transaction is complete, whether or not you have collected payment.

Under the cash basis of accounting, you record the sale only when you receive payment.

Let's Chat About ...

How to Record A Sale Extending Customer Credit

How to Receive Payment on the Invoice

Under accrual accounting, you will setup an accounts receivable entry when you invoice your customer that you are extending credit to and ...

...reduce your accounts receivable when you receive payment.

The transaction when you invoice your customer looks like this:

Debit (Increase) Accounts Receivable - current asset account on your balance sheet

Credit (Increase) Sales - income account on your income statement

Credit (Increase) GST Payable (Federal Sales Tax) - current liability account on your balance sheet

Credit (Increase) PST Payable (Provincial Sales Tax) - current liability account on your balance sheet

The transaction when you receive payment from your customer looks like this:

Debit (Increase) Cash in Bank - current asset account on your balance sheet

Credit (Decrease) Accounts Receivable - current asset account on your balance sheet

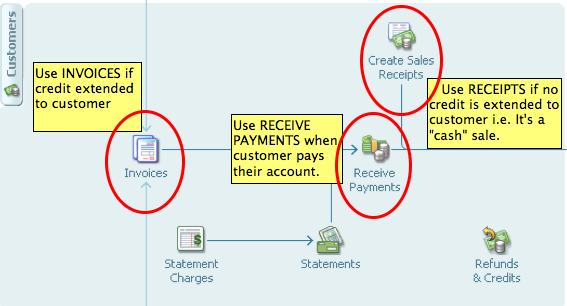

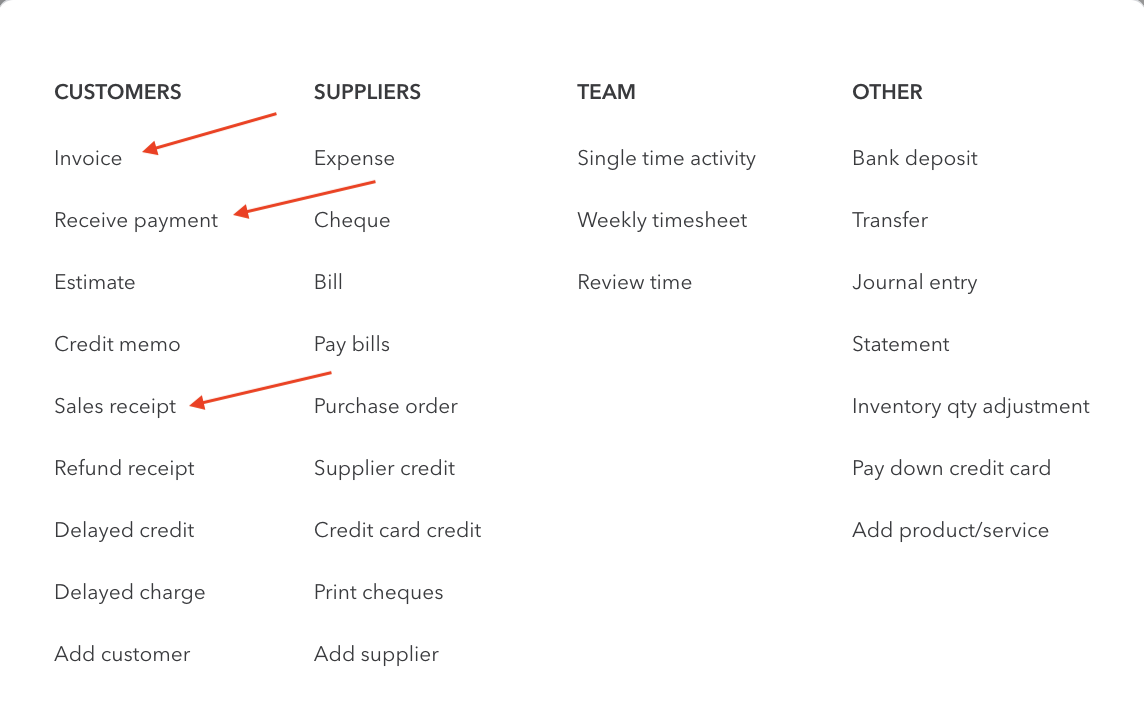

If you are using QuickBooks Desktop or QuickBooks Online, it important to remember that if you created an invoice for your customer (shows up on your accounts receivable report), then you must use "receive payments" in the customer center to record the payment ... so it reduces your accounts receivable.

If the money you are receiving was from a cash sale (you received payment - cash, cheque or credit card - at the time of the sale), use the Sales Receipt window to record the cash receipt.

QuickBook Desktop

QuickBook Desktop QuickBooks Online

QuickBooks Online... Do NOT use the Make Deposits window under banking to record the receipt of money from sales. Use this window only to record the bank deposit portion of the transaction.

Read how QuickBooks Undeposited Funds account works, so you can understand why it is a two step process.

Let's Check In

How are you doing? If you are feeling a bit overwhelmed, it helps to take a few deep breaths and get some oxygen flowing to your brain.

I think a sip of water to hydrate is good too.

For that matter, take a moment and do a few stretches in your chair ... especially if you have been sitting in front of the computer for awhile.

--Expenses and The Income Statement--

What You Bought or How Your Used Your Funds

There are two general kinds of expenses ... direct and indirect. Let's chat about direct expenses first.

This section of the income statement shows your direct costs related to the sale of the product or service.

This type of expense is sometimes referred to as a direct expense because you can link the expense directly to the sale.

Generally this is where we report sold inventory items ... inventory being:

- the goods that are bought for resale (purchases); OR

- the materials and labor (includes salaries) used to make goods for sale (goods manufactured).

This section of the income statement may include sub contracts if the cost is directly associated with the inventory items or providing your service.

You should break it down into the same categories as your sales so that you can calculate your gross profit by category.

To calculate your cost of goods sold, you will need some inventory information.

The COGS formula for a retailer is:

Beginning inventory + Net purchases (for merchandisers) = Goods available for sale

Goods available for sale - Ending (or closing) inventory = COGS

Your beginning (or opening) inventory value comes from (should be equal to) the ending value of your inventory from last year. If your business is new, your opening balance will be zero.

Purchases normally includes the cost of freight or delivery (usually tracked in a separate account) but not returns, allowances or discounts (also tracked in separate accounts - see sidebar below). It should also include any other costs involved with getting the product ready for sale like storage and insurance.

Remember too that if you have used or consumed any of your inventory for personal use, you need to remove that as well.

Let's summarize it like this:

Cost of inventory (purchases) = invoice prices - discounts - returns + freight + storage + insurance - personal use or personal consumption

Do not confuse your inventory purchases (purchase accounts if you have a periodic inventory system) with your inventory sold (COGS account).

If you noticed in the COGS forumla I made reference to Net Purchases.

Net purchase is made up of three 'temporary' income statement accounts:

- purchases - normal balance is a debit

- purchase returns (contra account) - normal balance is a credit

- purchase discounts (contra account) - normal balance is a credit

What is a contra account?

- A contra account is an account that offsets the main or related account. In this case, purchases is the main account.

- A contra account always has a "normal" balance that is the opposite of the main account which means it is subtracted from its related account.

- The purpose of a contra account is to provide more information than the net value to users of financial information.

These 'temporary' accounts are closed to the COGS account at year-end ... so you start your new year with a zero balance.

After you take your physical inventory count, you will book an entry to adjust your inventory balance to match your physical count.

To increase your inventory value (to make the books match your physical inventory count), you will make the following entry:

Debit (Increase) Inventory (balance sheet)

Credit (Increase) COGS (income statement)

Make the opposite entry if you need to decrease your inventory value (to make the books match your physical inventory count).

In QuickBooks, this entry is accomplished, NOT through a journal entry, but by using the inventory adjustment feature. (Do NOT use inventory adjustment for normal, every day inventory transactions.)

While doing your inventory count, you are going to keep an eye out for inventory items that are obsolete and/or broken. If you need to make an inventory adjustment for obsolescence, your entry should debit an expense account like Shrinkage instead of COGS.

Other items to consider that affects inventory are demonstration samples or giveaways. You should record these transactions when they occur so that your year-end inventory counts are not out.

Esther Karp in Hey What Happened to All My Stuff recommends that if you are using QuickBooks, use Sales Receipts to enter the transactions. Setting the sales price to $0 removes the items from inventory without creating sales revenue. You will use an item pre-coded to promotions, or advertising and promotions.

Your ending inventory value should come from the physical

inventory count you took on the last day of your fiscal year (December

31st for most sole proprietors).

If you didn't take a physical inventory count because you didn't know you had to ... don't sweat it ... you can't undo the past. Make a point to take a physical count at the end of this month or at the end of your quarter. Then mark it on your perpetual calendar and year-end check list.

When you have made a sale, the sales item is removed from inventory (current asset account on the balance sheet) and reported on the income statement ... matching revenue with expense. How an item is removed from inventory depends on whether you have a periodic or perpetual inventory system.

If you use an accounting software program to do your books, it will normally handle your inventory transactions ... but it is always good to know how something works manually (I think) and not just rely on the program. It helps you know when something is "off".

When reading computer generated reports, you always want to be thinking in

the back of your mind, "Does this report or these numbers make sense?" Question it if it doesn't. Resolve any issues you find. It's important your reports maintain their integrity of accuracy and completeness so third parties can rely on them and to ensure you are making sound decisions from solid information.

The formula is:

Net Sales - COGS = Gross Profit

You can see now that the purpose of calculating the COGS using the

COGS formula ... apart from expensing inventory items that were sold so

that they match the revenue earned on the sale ... was to figure out

your gross profit.

If the gross profit calculated is positive, you have made a profit. :O)

If gross profit is negative, you made a loss. :O(

In the ratio analysis section, we will use this number to calculate your gross profit margin.

Remember, if you don't have any inventory, your income statement

will not have a cost of goods sold (COGS) line or Gross Profit line. It

will only show your sales and then your operating expenses (see a sample income statement without inventory) ... which is what we are going to look at next.

Generally, costs reported in this section are matched to revenues, not by a direct association like the cost of goods ... but rather by the accounting period that they were used in.

YOU usually have the ability to control or manage these costs.

Selling expenses are expenses incurred to generate revenue. They can include:

- salaries of staff in marketing or commissions paid,

- marketing expenses such as:

- advertising,

- delivery costs to customer,

- some types of signs (some types of signs need to be capitalized) ... and

- in large companies, an overhead charge that has been allocated to this function.

It is unlikely that you will use an overhead allocation with your business but I thought I'd mention it just so you are aware of its possibility.

An overhead allocation prorates fixed expenses like office space, rent or employee benefits - perhaps on square footage occupied - and allocates their portion to the selling function for example.

General and administration expenses include costs related to:

- salaries of staff in admin

- accounting,

- hiring employees,

- office space,

- supplies, or

- building utilities.

These expenses usually relate to running the company not producing the product or service. Many of these expenses can be fixed expenses which means the cost is the same every month whether or not you make a sale.

If you have set up your chart of accounts to make income tax preparation easier (recommended for the self-employed), then many of your expense accounts will closely follow the tax form T2125 Statement of Business or Professional Activities or the tax form Schedule C in the U.S..

More for Canadians >> The T2125 Statement of Business or Professional Activities - Line By Line

Should it be Expensed or Capitalized?

CRA has some questions to ask to help you decide if a purchase should be capitalized or expensed. They help you make better decisions when deciding where to record something in your books.

Let's Chat About ...

Should it be Depreciated or Amortized? Hmmm

As you can tell from the previous chat above, capital assets have to capitalized, not expensed, because they have a useful life of more than one year ...

... and in accordance with the matching principle, we report "the using up" of the asset as an expense on the income statement over the useful life of the asset.

In your chart of accounts, there is a contra account in the capital asset section called Accumulated Amortization (or Accumulated Depreciation).

Accumulated amortizaton accounts are always contra accounts.

This account tracks the cumulative amount of amortization that has been expensed over the years ...

... so you can always tell at a glance what the original cost was and how much of the asset has been expensed to date.

This is useful information, as it gives you a gauge as to when the asset may need to be replaced ... good to know when preparing your budget and financial plans.

Be aware that if you are depreciating your assets based on the CCA rate instead of the useful life of the asset, your net book value will not be a gauge for alerting you to when an asset may need to be replaced.

The name of the account that captures the expense side of the transaction on the income statement is called Amortization Expense (or Depreciation Expense).

But why is amortization expense also referred to as depreciation? Click here to find the answer.

Book Depreciation vs. Tax Depreciation

You also might have heard the terms book depreciation (depreciation for book purposes) and tax depreciation (depreciation for tax purposes). What is the difference between the two?

Depreciation for book purposes refers to recording of depreciation in your general ledger that is based on accounting principles.

Depreciation for tax purposes is based on income tax regulations in your country. In Canada it would be capital cost allowance or CCA. In the U.S. it is calculated on IRS Form 4562 Depreciation and Amortization. Check out A Brief Overview of Depreciation on the IRS website for more information.

How to Record Amortization/Depreciation

Debit (Increase) Amortization Expense (on your income statement)

Credit (Increase) Accumulated Amortization (a contra account in your asset section of the balance sheet)

This adjusting entry is recorded during your month-end procedures. However, most small business owners don't need to worry about this entry. Your bookkeeper will record the entry for you each year-end when your annual financial statements are prepared.

The formula is:

Gross Profit - Operating Expenses = Operating Income

If the operating income (loss) number calculated is positive, you have made a profit. :O)

If operating income (loss) is negative, you made a loss. :O(

Something you may be wondering about is ... why do statements always says profit (loss) or income (loss) with loss in brackets?

This means that when you are reading the report, if the number is positive (a credit balance on your trial balance), then you have made money ... something to smile about!

If the number is in brackets (a debit balance on your trial balance), then you have lost money. :0( You need to make a few changes to your operations so you can start to make money.

This practice is standard whenever you read any accounting report.

Income and expenses that are not directly related to operating the company show up in this section.

What would that include? Things like:

- interest income and expense,

- income taxes,

- transactions relating to non-recurring events such as

- gains or losses on the sale of equipment,

- the effects of changing an accounting policy, or

- discontinued operations.

- If the net income calculated is positive, you have made a profit.

Whoo hoo! :O)

- If net income is negative, you made a loss. :O(

Don't fret, as Jessica Salzman from Behind the Scenes says, "You can turn problems into profits."

As discussed earlier, this number is carried over to the equity section of the balance sheet.

In a way, the whole income statement is a "working paper" that backs up the net income figure reported on the balance sheet ... so they always have to match. Think of it as a schedule attached to the balance sheet.

In the old days of manual bookkeeping, each year-end (or at the end of any reporting period), all the income and expense accounts were closed to an income summary account which was then cleared to the equity account.

The purpose was (and still is) to clear all temporary income and expense accounts to zero so you could begin calculating your net income for the next period. Accounting programs now do this for you automatically which makes the procedure a little less obvious.

It is important to understand that profit is NOT cashflow.

Follow the link to understand the difference ... it's IMPORTANT.

This concludes the discussion on the income statement. Now we will move on to ratio analysis.

But before that ... it's time for recess! YES! I gotta go have a kayak break ... :0)

This is a reminder to fit in some play time and family time during all the working and bookkeeping ... work to live!

When the ice came off Cluculz Lake was a big deal. I loved watching the days it took for the ice to come off the lake. It's a very noisy event.

April 12, 2015

April 29, 2013

May 6, 2012

May 6, 2011

April 17, 2010

May 6, 2009

I moved to Radium in 2013, so I'll track when the ice comes off Lake Windermere now.

March 23, 2015

April 10, 2014

April 2, 2013

Did you remember to play today?

When the ice came off Cluculz Lake

April 12, 2015

April 29, 2013

May 6, 2012

May 6, 2011

April 17, 2010

May 6, 2009

I moved to Radium in 2013, so I'll track when the ice comes off Lake Windermere now.

March 23, 2015

April 10, 2014

April 2, 2013

Did you remember to play today?