- Home

- Basic Bookkeeping Practices

- Accounting Concepts and Principles

Basic Accounting

Concepts and Principles

Canadian GAAP is both IFRS and ASPE

U.S. FRF for SMEs is an available option to U.S. GAAP

by L. Kenway BComm CPB Retired

Published September 2010 | Updated June 4, 2024 | Revised August 19, 2024

Quick Links

Learning this stuff WILL make you a better bookkeeper! Grab your jug of water and get comfortable for today's chat.

We'll begin our chat on basic accounting concepts by:

- looking at the differences between U.S. and Canadian GAAP; or put another way, the differences in American bookkeeping standards versus Canadian bookkeeping standards;

- understanding CRA's position on GAAP; then

- laying the conceptual framework around which Canadian GAAP was developed ... the foundation for all bookkeeping and accounting training;

- updating you on new Accounting Standards For Private Enterprise (ASPE) in Canada

We'll also look at ASPE changes from the "old" Canadian GAAP that affect small business reporting requirements along with the role of the three accounting bodies that set these standards.

Acronyms

The following acronyms will be referred to in this article. I know it

sounds like a foreign language but this should help you sort it out, especially if you want to know what terms like ASPE stands for:

AcSB - Accounting Standards Board

AICPA - American Institute of Certified Public Accountants

ASPE - Accounting Standards for Private Enterprise (effective January 1, 2011)

CICA - Canadian Institute of Chartered Accountants now rebranded to CPA Canada

FASB - Financial Accounting Standards Board

FAF - Financial Accounting Foundation

FRF for SMEs - Financial Reporting Framework for Small and Medium-Sized Entities (published by AICPA in June 2013 as an alternative to U.S. GAAP)

GAAP - Generally Accepted Accounting Principles

IASB -International Accounting Standards Board

IFRS - International Financial Reporting Standards

ITA - Income Tax Act or The “Act”

ETA - Excise Tax Act (GST/HST is administered under this act)

PCC - Private Company Council

PE GAAP - Private Enterprise GAAP - see ASPE

Let's start with the difference between Canadian and U.S. GAAP for privately owned small businesses; next I'll look at how CRA views GAAP and your books.

What's New With ASPE

AcSB is in the process of reviewing certain emerging issues with private companies since ASPE went into effect. Here are a few:

- Effective for 2024, AcG-20 provides guidance on customer's accounting for cloud computing arrangements. It "provides guidance on accounting for a customer's expenditures in a cloud computing arrangement; and determining whether a software intangible asset exists in the arrangement."

- Under review is the impact of private equity investing. BC CPA* states, "In Canada, this trend has put a new focus on ASPE, because creditors are no longer the main recipients of the financial statements of private enterprises. ... Given that all companies have the option of implementing IFRS, those who want to be considered for equity investments can just adopt the standards on their own."

*Source: BC CPA, ASPE and the changing world by Martha Okot Thomas Love 28, 2023

Good To Know

US vs Canadian GAAP

For my U.S. visitors, a link to U.S. GAAP resources can be found further down this page. For small business purposes, Canadian GAAP is very similar to U.S. GAAP.

As I explain shortly, GAAP was initially designed to be used by large companies with third party investors and lenders. Often times, the rules are not relevant to a small business owner.

The framework for Canadian GAAP follows the FASB approach, but there are some differences. The biggest difference is that Canadian GAAP is principle based while US GAAP is rule based.

It is my understanding that principle based means judgment and flexibility can be used to ensure the substance, not the form, of the transaction is recorded. Principles are by nature general and require interpretation.

It is my understanding that accounting concepts and principles that are rule based means a rule guides behavior that can be acted on without contextualization.

Most home based small business in Canada will be using ASPE as their GAAP standard ... not IFRS as their GAAP standard.

On August 16, 2024, the Journal of Accountancy provided Julie Killian, CPA's overview of the AICPA FRF for SMEs. The overview explains the advantages of the framework over US GAAP:

- emphasizes historical cost vs. fair value;

- uses a simplified consolidation model

- reduces disclosures in addition to disclosure only treatment for derivatives and stock compensation

- uses the traditional revenue recognition approach;

- uses simplified accounting for PP&E, goodwill, leases, and income taxes

- avoids concepts of other comprehensive income and variable -interest entities.

More >> Journal of Accountancy November 30, 2012, A quest for relevance: New Framework for SMEs balances costs and benefits in financial reporting

The US FRF for SMEs is "intended for U.S. companies that have no intention of going public".

The US ASPE framework was completed and released in the second quarter of 2013. It's titled, "The Financial Reporting Framework for Small and Medium-Sized Entities" and is available for free download at the Journal of Accountancy.

It will NOT be considered a substitute for U.S. GAAP but a viable reporting option for SMEs where GAAP lacks relevance and the cost of GAAP financial reports prohibitive.

It's interesting to note substantial portions of the CICA Handbook are reproduced (under license), once again demonstrating how similar our GAAPs for small businesses are. Canadian bookkeepers can download CPA Canada (formerly CICA) a comparison guide of ASPE (Part II) and IFPRS (Part I). Grant Thornton has a ASPE Knowledge Centre which is excellent.

US Reporting Option

FRF for SMEs

Goodwill

The New York Times reports that "one area where change appears to be coming is in accounting for good will, which is created when a company acquires another company for more than the tangible assets are worth.

GAAP now requires periodic reviews to see if the good will is “impaired,” and needs to be written down, because the acquired operation has lost value.

The institute framework deals with that by saying such companies never need to review whether good will is impaired.

The proposals from the standards board is slightly less permissive, allowing companies to avoid writing down good will unless it is clear the entire company is worth so little that there is no justification for having good will on its balance sheet."

Wolf & Company, PC explain that under FRF for SMEs, "Asset Impairment: There’s no concept of asset impairment in the FRF for SMEs. Assets (including goodwill and intangibles) are depreciated or amortized and written off when no longer used."

Source: NY Times June 9, 2013, Groups Propose to Simplify Accounting for Small Firms by Floyd Norris; Wolf & Company, PC FRF vs. U.S. GAAP: Key Differences and Potential Benefits

Good To Know

Understanding CRA's Position on GAAP

I often struggle to understand the difference between GAAP and tax principles. The CRA Income Tax - Technical News No. 42 released May 31, 2010 helps explain the relationship between the two.

The Income Tax Act (the “Act”) does not specify that financial statements must be prepared following any particular type of accounting principles or standards to determine profit. As the Supreme Court of Canada stated in Canderel Limited. v. The Queen 98 DTC 6100, the determination of profit is a question of law.

Accounting standards are not law. In seeking to ascertain profit, the goal is to obtain an accurate picture of the taxpayer's profit, for purposes of section 3 of the Act for the given year. The Supreme Court stated that a taxpayer is free to adopt any method which is not inconsistent with: (a) the provisions of the Act; (b) established case law principles; and (c) well-accepted business principles. It is our view that financial statements based on IFRS would be an acceptable starting point to determine income for tax purposes.

In addition, where IFRS financial statements are used by a particular entity, it is our position that references to GAAP in the Act can be read as references to IFRS and all references to GAAP in any Agency publication can also be read as references to IFRS for those entities that report under IFRS.

You can see by the above statement that GAAP is a starting point to determine income for tax purposes ... so you do need to understand basic accounting concepts and principles even if your financial statements are prepared on a tax basis.

What Is GAAP?

With all this talk about GAAP, some of you are probably wondering what GAAP is. It is the foundation for bookkeeping so you do need to understand this.

GAAP is a set of rules (based on accounting concepts) used in the preparation of financial statements by public accountants for companies who have investors or carry debt. It allows third parties to look at similar information in a comparable format ... basically making sure apples and oranges are not mixed together, so to speak.

The GAAP framework refers to guidelines, not rules, because judgement must be used in order to apply the accounting concepts and principles. Therefore the more a bookkeeper has studied and practiced exercising that judgement in a supervised environment before they go out on their own, the more likely they will be to make better decisions when booking transactions.

These basic accounting concepts and guidelines form the basis of all accounting training. If learned and understood, they will help you make better decisions when recording your transactions.

Conceptual Framework of Canadian GAAP

Overview of Basic Accounting Concepts*

A. Objective and Users Generally, financial reporting should

provide useful information based on past transactions to allow users of

financial information (investors and creditors) to predict future

performance and make business decisions.

B. Qualitative Characteristics Useful information should have the following qualities:

(1) relevance meaning it should be timely, predictive and provide feedback;

(2) reliability meaning neutral, verifiable, and valid (reflects substance over form);

(3) comparability meaning consistently using the same policies each year and uniform treatment within the industry.

C. Seven elements of financial statements are revenues, expenses, gains, losses, assets, liabilities, equity.

D. Recognition and Measurement Criteria is broken down into four areas:

D.1 Recognition criteria

deals with when an element should be recognized in the accounts ...

when it meets (1) elements definition, (2 & 3) can be measured and

estimated, and (4) there is a probability of economic benefits received

or given up.

D.2 Environmental assumptions (accounting concepts)

Business Entity Concept assumes business is a single entity.

Continuity (Going Concern) Concept assumes the business will continue operating for the foreseeable future and is not going out of business any time soon.

Unit of Measure Concept

assumes the financial reports are reported in a standard monetary unit

... for example U.S. and Canadian dollars are not intermingled but

everything is converted to one monetary unit.

Time Period Concept assumes information will be broken down into short time periods where one year is the standard.

D.3 Four Implementation Principles ... and

D.4 Four Implementation Constraints

Cost Principle and Constraint of Conservatism

Revenue Recognition Principle and Matching Principle

Reporting Principle of Full Disclosure deals with fair presentation of financial information

Materiality Constraint also called threshold for recognition

Cost Benefit Constraint where benefits out weigh costs to provide information

Consistency Constraint - since 2003 consideration for industry practices is no longer GAAP**

*resource used for the overview of this accounting training, Intermediate Accounting 7th Canadian Edition by Nelson, Conrod, Dyckman, Dukes, and Davis

**CGA Magazine Nov-Dec 2003 Generally Accepted Accounting Principles - An overiew of what you need to know about financial statement preparation and GAAP by Stephen Spector

Who Develops These Accounting Concepts and Principles?

There are three main bodies that have influenced or affected the development of the accounting concepts and principles that make up Canadian GAAP today.

- Canadian AcSB

AcSB stands for Accounting Standards Board and is the Canadian equivalent of the U.S. FASB (Financial Accounting Standards Board). It is operated and funded by CICA.

The Board works at harmonizing Canadian GAAP with international standards and U.S. GAAP.

The basic components of the financial statement and accounting concepts were developed in 1987 I believe ... and included in the CICA Handbook Section 1000 in 2003 (at least they used to be ... not sure now with the restructuring of the handbook).

- The International Accounting Standards Board

|

The International Accounting Standards Board (IASB) replaced the International Accounting Standards Committee created in 1973 to address emerging needs of cross border business. IASB was created in 2000 when the European Union announced it would adopt IFRS for publicly listed companies. IFRS is now mandatory or permitted in more than 100 countries. China, Japan, India, Canada, Brazil, and South Korea are set to adopt IFRS in 2011. Companies using IFRS can list in the United States without preparing a costly reconciliation of their numbers to US GAAP. IASB is responsible for setting IFRS. |

|

It is funded by contributions from banks and companies who have an interest in promoting or using international standards.

Here is an example of the IFRS balance sheet format ... and the IFRS income statement format.

Your bookkeeping resource for more information on IFRS can be found at IASB's website; located at ifrs.org.

IASB are holding a series of free wbinars between September 2013 and November 2013. Find more information here.

Bookkeeping resource used for IASB information: Origins and Rationale for IFRS Convergence by Peter Walton at qfinance.com

- U.S. FASB GAAP

FASB is the Financial Accounting Standards Board within the U.S. It is a private, not-for-profit organization created in 1973. The Canadian equivalent is the Accounting Standards Board (AcSB).

FASB is independent of professional organizations and businesses. It is funded through an accounting support fee paid by mutual funds and public companies.

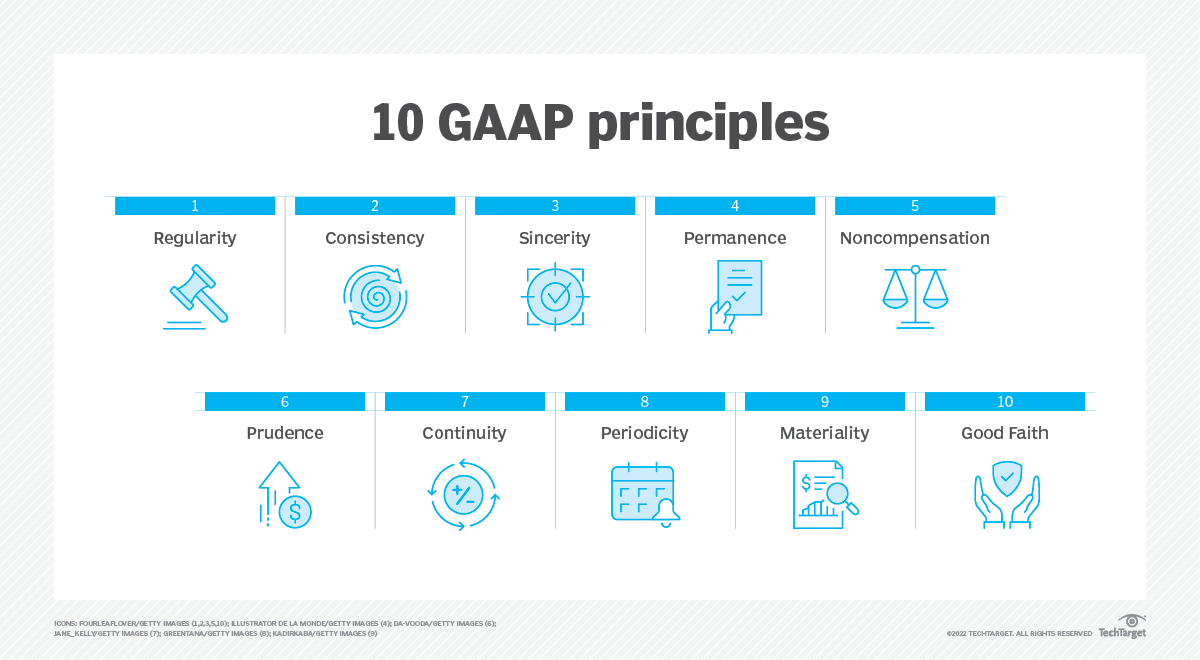

If you are looking for a bookkeeping resource on the Generally Accepted Accounting Principles set by FASB, the TechTarget WhatIs? has an excellent March 2022 article titled GAAP (generally accepted accounting principles). The image below is from their article. Click on it to go to the article as it also discusses the four additional guidelines to support the consistency and accuracy of financial statements.

Courtesy of TechTarget WhatIs? GAAP (generally accepted accounting principles) by Stephen J. Bigelow

Courtesy of TechTarget WhatIs? GAAP (generally accepted accounting principles) by Stephen J. BigelowA 2007 paper entitled, "IFRS vs. US GAAP: A Sixty Minute Waltz in the Classroom" (you can google it) makes suggestions for incorporating significant aspects of international standards in the accounting classroom prior to 2014. This paper explains that ...

International accounting standards were designed to be flexible and are principle-based while US GAAP standards were designed with the goal of protecting investors through conservative accounting practices. Its rule-based construction provides comfort to a profession that operates in a highly litigious environment.

The U.S. is moving towards convergance with IFRS in 2014. In August 2008, the Securities and Exchange Commission put forth a timetable to move U.S. GAAP towards a more principle based accounting system that is more in line with IFRS and the creation of a global standard.

PWC started a new publication in the Fall of 2012 titled US GAAP Today. I don't know if it is still being published. What's important to understand is why they started the publication. They began the publication because some Canadian companies use US GAAP as their financial statement standard because they are a U.S. subsidiary or are SEC issuers electing US GAAP over IFRS reporting perhaps because they have significant U.S. operations or U.S. competitors.

US GAAP UPDATE

Going Concern

Going concern is one of four accounting concepts that GAAP is built upon. (See above for a definition.)

New reporting requirements about when management must disclose the company's potential to not continue as a going concern were released in August 2014 by FASB.

The new reporting standards provide "principles and definitions for management that are intended to reduce diversity in the timing and content of disclosures provided in footnotes". The Board developed the new standards because they felt "financial statement users would benefit more from ongoing disclosures about risks and uncertainties."

The new standard is effective December 16, 2016.

Source: JOA FASB defines management's going-concern responsibilities, Ken Tysiac published August 27, 2014

One Global Standard?

Many countries have already made the changeover. Public companies in Canada switched to this accounting standard in 2011, which means companies started reporting IFRS standards in 2010 so they had their comparatives for 2011. The U.S. is still working towards converging with this accounting standard.

In 2015 it was announced by IFAC (International Federation of Accountants) that "Declaring (and rightfully so) that their main goal is to protect US investors’ interests, the SEC notes that IFRS lacks consistent application, allows too much leeway with judgment, and is underdeveloped in many specific areas, for which the US GAAP has detailed and accepted guidance and established practice".

As of December 2009, Canada adopted Accounting Standards for Private Enterprise (ASPE). These good bookkeeping rules will be used by most small businesses instead of IFRS ... which will be the accounting standard for publicly traded companies, companies who seek to do business outside Canada or need international financing.

Most of the articles on this site were written for Canadian GAAP. As I learn how the accounting concepts, principles and standards, if any, change with ASPE, I will edit the articles as needed. For the most part, I will not address IFRS as this website is for small business.

Prior to Canada's adoption of ASPE,

there was very little difference between Canadian GAAP and US GAAP for

small business. Most of the differences between the two standards arose

when dealing with the more advanced reporting required of publicly

traded companies. With the introduction of ASPE in Canada and FRF for SMEs in the U.S., the gap is still very narrow.

GAAP UPDATE

ASPE Standard Revenue Recognition

PWC has an excellent overview of the differences in revenue recognition between APSE (most flexible), IFRS (middle of the road), and US GAAP (least flexible).

The seminar notes share best practices in revenue recognition as we wait for the converged FASB and IASB standards to be effective after December 15, 2016. (The new converged reporting standard was released May 28, 2014). The link takes you to the converged standard being proposed.

For ASPE and US GAAP, the basic criteria is:

- Collectability is reasonably assured

- Delivery has occurred or services have been rendered

- Persuasive Evidence of an arrangement exists

- Seller’s price to the buyer is Fixed or determinable

IFRS fundamentals (IAS 18) are relatively consistent with the ASPE/US GAAP criteria ... Collectible, Delivered, Evidence of the arrangement and Fixed fee ... an easy way to remember your "ABC's".

The New Five Step Transition Process as summarized on the JOA website by Ken Tysiac (July 1, 2014) is as follows:

- Identify the contract with a customer.

- Identify the separate performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the separate performance obligations in the contract.

- Recognize revenue when (or as) the entity satisfies a performance obligation.

The March 21, 2012 PWC notes can be found at pwc.com under emerging company publications.

New Accounting Concepts and Principles

This One Takes A Bit To Get Your Mind Around It!

Canadian GAAP is Now IFRS and ASPE

Canadian GAAP changed in 2011. Let's look at a brief history so we can understand the change.

The Canadian Institute of Chartered Accountants (CICA), now rebranded as CPA Canada, developed a handbook in 1968 which contained Canadian GAAP: guidelines and recommendations for accounting.

In 1975, the handbook was incorporated in the Canada Business Corporations Act. It is now the reference all accountants use to ensure external financial statements are prepared in accordance with GAAP.

The CICA Handbook was restructured in 2009. It now reflects different standards for different categories of entities. All the standards now reflect Canadian GAAP.

So in a nutshell, here is what I think you need to be aware of since the change:

- The new standards still maintain the common accounting concepts and principles framework discussed above.

- ASPE (PE GAAP) acknowledges and reflects that private enterprise has different reporting needs than publicly accountable entities. The CICA Handbook was used as the starting point and foundation for the development of ASPE (PE GAAP).

- Small businesses in Canada switched to the new standards in 2011 where a choice was made to follow ASPE (PE GAAP) or IFRS. There were transitional rules and elections that had to be made when switching to the new accounting standard, particularly IFRS. These are found in Section 1500 First Time Adoption.

- Business owners should have spoken with their accountant in 2010 about what information they needed to obtain to make the transition ... as it required a restatement of prior year figures. New accounting policies and elections were available to business owners. Some elections had to be made in 2010 if a reduction in the cost of applying the new rules was desirable.

If you are looking for more information on the new Canadian Accounting Standards for Private Enterprise released in December 2009

... I have listed some resources I have found useful in the comments section of IFRS and ASPE.

You will find a link to transitional elections businesses were eligible to make in 2010 in this forum posting as well.

The forum posting also has information on how to decide whether your business should be adapting IFRS or ASPE (PE GAAP).

... and I have been inserting some notes throughout the site (see below) ...

Quick Links to GAAP Update ... ASPE (PE GAAP)

GAAP UPDATE

Changes in Tax Laws

ASPE requires reporting of changes in tax laws and rates in the fiscal period of substantive enactment if they are using the future income taxes method.

IFRS requires reporting of changes in tax laws and rates in the fiscal period of substantive enactment.

US GAAP requires reporting of changes in tax laws and rates in the fiscal period of enactment which happens when it receives Royal Assent.

Substantive enactment happens when a tax bill is introduced and receives its first reading in the House of Commons.

For example, Bill C-48, Technical Tax Amendments Act, 2012 became substantively enacted on November 21, 2012 for ASPE & IFRS reporting purposes. Royal Assent was received and enacted as of June 26, 2013 for US GAAP reporting purposes.

This bill is/was important because some of the measures had been outstanding for more than a decade.

When learning basic accounting concepts and principles, you need to understand GAAP ... and therefore how GAAP has changed under the new guidelines.

I have been placing bookkeeping resource notes on any changes I am aware of at this time throughout this website.

To find the ASPE / PE GAAP updates, follow these links ... and you will see the actual application of the accounting concepts discussed above. I will also work on introducing FRF for SMEs updates.

These links are in no way all the changes that could affect small business owners who work from home. These are just the ones I thought would be most relevant to site visitors.

- Cash Flow Statement

- Callable Debt

- Disclosures and Fair Presentation

- Employee Bonus

- Government Remittances

- Income Tax Payable

- Inventory

- Property, Plant and Equipment

- Temporary Investments

- Basic revenue recognition criteria

Just an interesting tidbit that is more tax related than bookkeeping ... in the U.S. taxpayers get to deduct the interest on their first $1.1 million of their mortgage debt annually, which reduces the tax they pay.

However, when Americans sell their principal residence, Americans pay capital gains tax on profit over $250,000; $500,000 for couples. In Canada, we don't have the have annual mortgage interest deductiblity. The plus side is our principal residences do not attract a capital gains tax upon sale.

So Why Do I Want To Know This Stuff?

Learning GAAP makes you a better bookkeeper.

Learning GAAP makes you a better bookkeeper.Taking the time to have a general understanding of the basic accounting concepts and principles ... will help you prepare a better and more accurate set of financial records ... as they are the foundation and structure behind every bookkeeping entry you make.

GAAP has changed ... but the basic conceptual framework around which it was built ... the accounting concepts and principles are still being maintained ... and will continue being its foundation.

You should be aware that there is now more than one GAAP standard in Canada ... but they are all considered Canadian GAAP. Many small businesses don't have GAAP financial statements at all ... but base the bookkeeping work done in accordance with tax accounting principles ... whose starting point is rooted in basic accounting concepts and principles.

While accounting concepts were fairly stabilized, accounting standards currently in both Canada and the U.S. between 2011 - 2014.

If you are new to Bookkeeping Essentials ...

My sincere gratitude to all my readers ... without you I'd have no website. Blessings to you all. My suggestion to you ... enjoy a tall cool glass of lemon water while you click and poke and peek and snoop this site ... perhaps start with the blog which lists the most recent updated articles.