- Home

- Good Bookkeeping Practices

- Month-End Bookkeeping Procedures

MonthEnd Bookkeeping Procedures

21 Simple Steps

The Bookkeeper's Notes on

How To Prepare Internal Financial Statements

What Do You Do Once The Data Is Entered?

Today I want to chat about how to implement monthend bookkeeping procedures in your business.

Hi, I'm a retired Professional Bookkeeper with 30+ years finance/accounting experience in Canada; the last 14 years before retirement as a self-employed bookkeeper.

I like to help work from home business owners learn not only how to do their own books if they are so inclined, but also how to supervise their bookkeeper if they are not so inclined.

As I've already said, I want to chat about how to do monthend bookkeeping in a small sole proprietor structured business.

Monthend bookkeeping procedures … we are NOT talking data entry here folks ... is often neglected by home based business owners. Many of you tend to stumble along haphazardly and once a year you file your tax return … or not! But here's the PROBLEM ...

You don't know what you don't know … you know! My simple eManual can help you figure out some, not all, of what you don't know.

I ask you:

- If month-end procedures were broken into simple steps, would you perform the tasks every month? or at least every quarter?

- If you could be confident your financial statements were accurate, would you rely on them to help make better business decisions?

- If you could receive your financial statements on a timely basis while the data is fresh, would you use them to look for trends, find errors proactively?

- Have you been wondering what you are supposed to do BEFORE you close your accounting software for the month?

What is a Certified Professional Bookkeeper?

The CPB designation is a national bookkeeping standard set and maintained by CPB Canada. It reflects the level of knowledge, education, and skills necessary to carry out all key functions through Accounts Payable, Accounts Receivable, Payroll, Sales Taxes, Inventory and General Bookkeeping. It also means annual continuing professional development requirements must be met and a code of conduct must be adhered to.

|

This is NOT just a manual. It is a bookkeeping TOOL for preparing monthly |

|

I dare you to learn how your business is doing … take away the mystery behind the numbers!

Make this the year you learn what your books are trying to tell YOU. Manual includes printable checklist.

Skip reading to purchase YOUR Procedure eManual NOW.

A Certified Professional Bookkeeper shares

21 simple bookkeeping steps

on what to do after you've entered in all your data

Who Is This eManual Designed For?

Home based sole proprietors as well as newbie freelance bookkeepers will benefit from this easy to follow procedure guide.

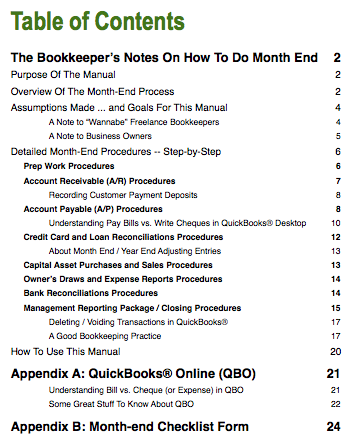

The manual is designed to assist small business owners and bookkeepers in:

- performing monthend bookkeeping procedures;

- preparing accurate and timely internal financial statements for use by the business owner;

- helping you audit proof your books for preparation of your annual income tax return.

By working your way through Laura's checklist and manual, you can prepare books that are accurate … no more crossing your fingers and hoping for the best.

Bookkeeping employees may also benefit. However, a caveat … as the procedures are geared to a small business running out of their home; payroll, inventory and accounting software integration / associated entries are NOT covered.

Good To Know

Laura says, "You can learn the numbers behind your business. You decide if you or your bookkeeper will perform the tasks. If you decide to delegate the tasks, you will know what the bookkeeper is supposed to be doing."

What You Receive

|

Laura will e-mail you a link to:

This is an e-product delivered by download after you click on a link. |

Please note that while month end adjusting entries are mentioned, this manual does NOT lay them out for you. You will find adjusting entries are discussed in another chat on this site … just search for it in the site search box in the upper right hand side of most pages. |

The Bookkeeper's Tip

A Good Bookkeeping Practice

Laura says her procedures can reduce your bookkeeping costs by ensuring you:

- Learn a systematic approach to monthend bookkeeping;

- Learn what documents the government auditor wants so you have audit ready books; and

- Prepare accurate and timely internal financials … if you work through the manual.

Here is the link to make your internal financials a reality this year.

What YOUR eManual Will Help Accomplish

- A way to control bookkeeping costs;

- A systematic approach that should reduce or eliminate mistakes in your books; and

- Help you start to understand what your accountant is saying at year-end.

What YOUR eManual Will NOT Help Accomplish

- Assistance to move to a paperless system;

- Assistance moving to a virtual bookkeeping workflow; or

- How to integrate today's technology into your bookkeeping process.

This manual is simply a process that you can utilize in a no tech, low tech, or affordable tech solution. It's up to you!

Don't wait 'til tax time this year ... start using this systematic approach to bookkeeping now.

I dare you to learn the mystery behind your business numbers!

My 30 Day Guarantee

Take a full 30 Days to put the “The Month-End Procedures Manual” to the test. If this manual doesn’t show you how to systematically perform your monthly bookkeeping tasks, Laura will refund your purchase.

BUNDLE and SAVE

Save 10% When You Buy The Month-End Procedure Manual AND It's Companion eBook Bookkeeping Checklists $22.50 CAD

Click on the ADD TO CART button above for immediate access to YOUR manual.

Let Laura's experience help you produce a better set of books!

It's been great chatting with you.

Your Tutor

Bookkeeping Essentials > Month-End Checklist

Home > The Store > Monthend Bookkeeping Manual and Checklist