- Home

- Accounting Systems

- QBO Conversion Issues

QuickBooks Desktop QBO Conversion Issues That Aren't Really Problems

Learning QuickBooks Online | Focus on Bookkeeping

by L. Kenway BComm CPB Retired

Published January 2016 | Revised October 18, 2024

WHAT'S IN THIS ARTICLE

Introduction | What To Do Immediately After Migrating Your QBD Data | QBO Handles Sales Tax Differently Than QBD | Other QBO Conversion Issues That Aren't Problems | What You Need to Know About QBO Sales Tax | Steps to Convert From QBD to QBO

NEXT IN SERIES >> How To Use QuickBooks Online: A Beginner's Guide

Do QBO conversion issues bring a tear to your eyes?

Do QBO conversion issues bring a tear to your eyes?After any conversion to QuickBooks Online (QBO), you want to ensure your data converted correctly. It's important to compare your financial statements in QuickBooks Desktop (QBD) immediately before the conversion to QBO immediately after the conversion. Do not skip this conversion step!

Intuit recommends you compare these reports as a minimum: balance sheet, trial balance (all dates), customer and supplier balance summaries (all dates), sales tax summary (for the most recent period).

In Canada, one problem you may run into after doing a QBO conversion from QBD is to have your Balance Sheets not match. Your first reaction may be to cry or swear. But don't get your shirt in a knot, the reason is simple ...

QBO handles certain items differently than QBD such as:

- Sales tax amounts filed with CRA

- Valuation of inventory

- Multi-currency adjustments

Warm up your tea, take a deep breath and exhale slowly. Let's examine why you really don't have a problem.

QBO Conversion Issues

What To Do Immediately After Migrating Your QBD Data

You've migrated your data successfully from QuickBooks Desktop to QuickBooks Online using QBO's migration tool. To avoid QBO conversion issues, you have to complete these tasks BEFORE you start using QBO:

- Check your data by comparing reports: discussed above

- Confirm company settings: Enter the relevant information - found under the Gear icon (⚙️)

- Configure your sales tax settings.

- Connect bank and credit card accounts.

- Clean up bank reconciliations: Trusting you reconciled your desktop accounts prior to migrating to QBO, you need to reconcile the relevant QBO accounts as of the conversion date; this will mark all transactions up to the conversion date as reconciled, so it only considers future transactions for reconciliation.

- Link payments and credits to open invoices: Migrated transactions (invoices) downloaded into QuickBooks Online are not linked with their respective payments. If you notice names that have zero balances in your A/R and A/P aging reports, you can easily link credits and payments to your open invoices by turning on the 'Automatically apply credits' preference found under the Gear icon (⚙️) > Accounts and Settings > Advanced > Automation.

- Review your accounts’ detail types: QBO has an additional level of account hierarchy which allows you to be more specific with your account structure. Run the 'Account Listing' report and review the 'Account Subtype' column. Make any corrections necessary. For example under 'Account Type' Cost of Goods Sold, you have five different detail selections available.

- Complete payroll setup.

- Link your Payments account: This applies if you use QuickBooks Payments

- Add users: found under the Gear icon (⚙️) > Manage Users.

- Invite an accountant: found under the 'My Accountant' tab. You can invite two users at no charge; which are usually your accountant and your bookkeeper.

Source: Intuit's QuickBooksHelp article titled 'Migrating from QuickBooks Desktop to QuickBooks Online with Intuit's internal tool'

QBO Conversion Issues

QBO Handles Sales Tax Differently Than QBD

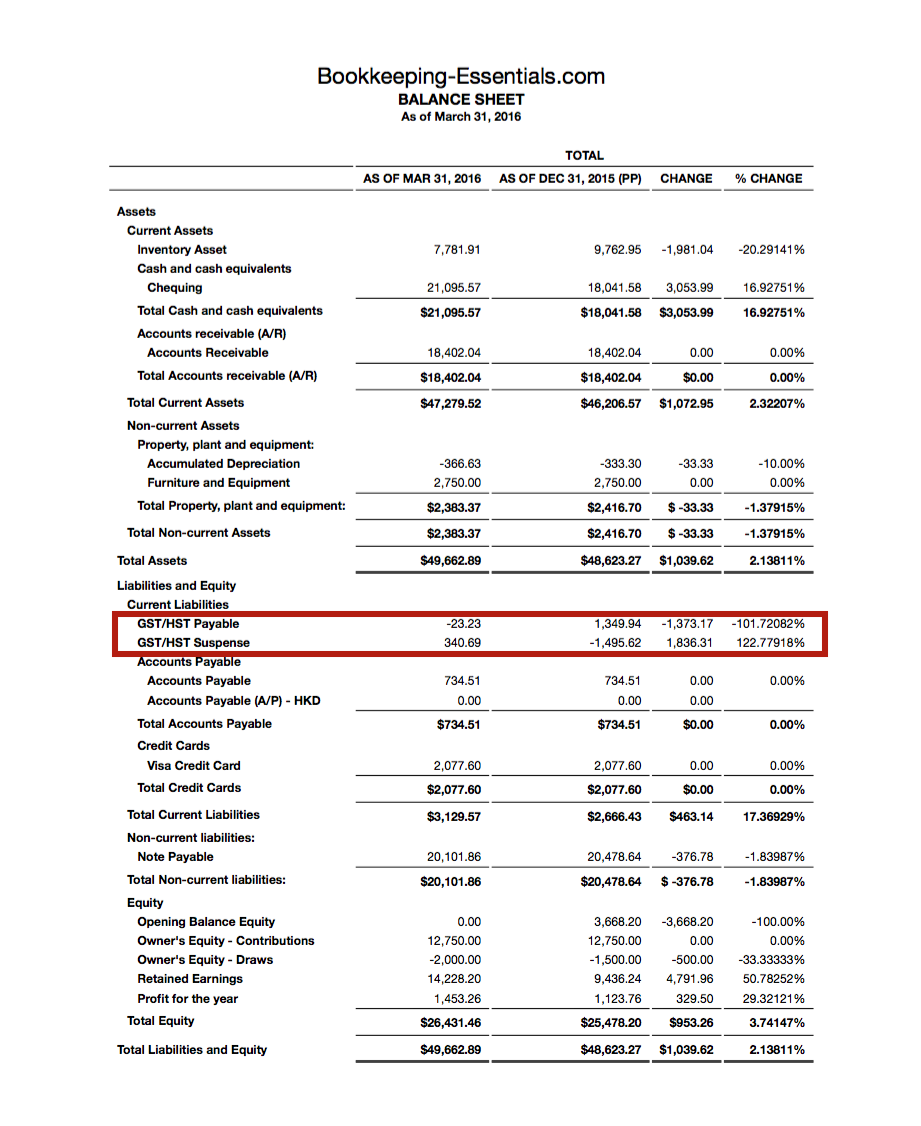

QuickBooks Online (QBO) uses suspense accounts to handle sales tax amounts that have been filed with the appropriate government agency like CRA or eTaxBC. I like this method of handling sales tax because in one glance at the liability section of your balance sheet you see if there are any amounts pertaining to the latest reports filed. Take a look at the sample QBO Balance Sheet below. It shows a sales tax return has been filed with CRA but the $340.69 payment has not been made yet.

QBO Conversion Creates a GST/HST Suspense Account to Capture Taxes Filed But Outstanding

QBO Conversion Creates a GST/HST Suspense Account to Capture Taxes Filed But OutstandingOne reason for this change might be because the new ASPE (Accounting Standards for Private Enterprise) standards that came into effect in 2011 reduced and simplified the disclosure requirements. A significant disclosure requirement that was added was the necessity to disclose the amount payable for government remittances other than income tax at the end of each period.

Lenders, as the primary users of small business financial statements, want to see the status of government tax compliance remittances because they have priority status in a bankruptcy.

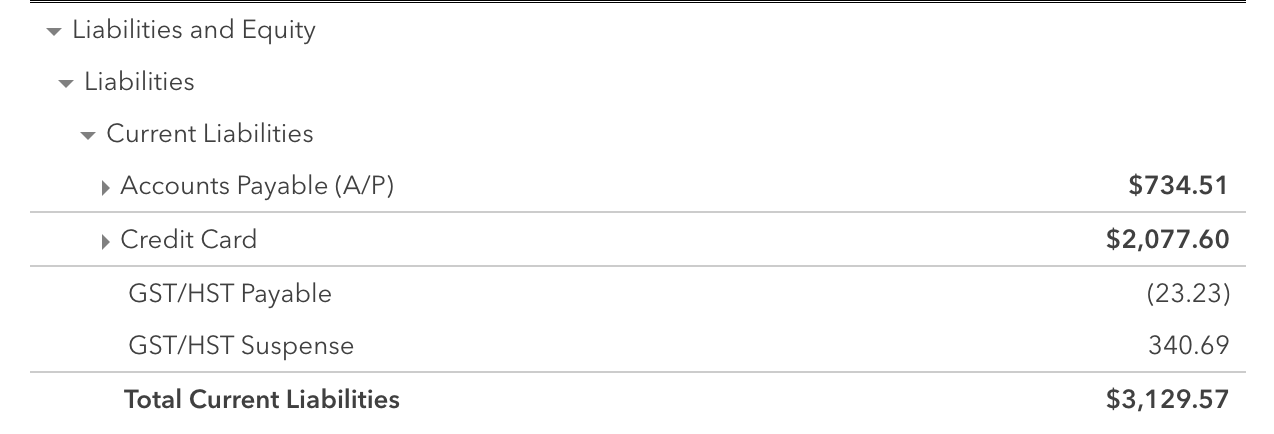

As you can see in the 2016 QBO Balance Sheet above, QuickBooks Online placed the government remittance payables BEFORE trade payables. In 2024, sales tax payable now shows up below trade payables and credit cards in the current liability section.

2024 Sales Tax Payable Presentation On Balance Sheet

2024 Sales Tax Payable Presentation On Balance SheetDuring the QuickBooks Online conversion process from QuickBooks Desktop, any receivables or payables to the Receiver General or the Minister of Finance (in BC) are pulled out of your receivables or payables and allocated to the GST/HST Suspense or PST Suspense account.

If this is your problem, it means your Balance Sheet isn't really out, it's just rearranged but still in balance.

Rachel over at Fischbooks has an excellent blog that walks you through exactly what happens during the QBO conversion process. She compares QuickBooks Desktop reports to QuickBooks Online reports so you can visually see the differences between the two software packages.

Her article concludes with the following advice, "You now have two options:

- Move the balance back to AR or AP since that tax return has already been filed anyway, or

- Leave it where it is and just make sure when the tax payment is made or tax refund is received, that you offset the Suspense account."

My preference is to just leave the balance where QBO puts it. When you make future payments or record future refunds received, use the new QBO method to do so.

QBO Conversion Issues

Other QBO Conversion Problems That Aren't Problems

Inventory Valuation: In case you weren't aware, you may also have problems with inventory valuation during conversion because QBD uses the weighted average valuation method and QBO uses the FIFO (First-in First-Out) valuation method. QBO will automatically recalculate any existing and future inventory transactions using the FIFO method. Use the first day after your last tax filing period as your inventory start date during conversion to avoid having to refile amended forms.

Multicurrency Adjustments: I haven't done a QBD conversion in years as all my clients that were on QBD transitioned to QBO. However, I do remember multi-currency valuations made it next to impossible to get a clean conversion without making manual adjustments ... but that was in 2013 and 2014. Intuit may have come up with a solution since then.

Transfers Between Two Foreign Cash Accounts: Since January 2019, QBO now handles USD transfers. If you are doing a CAD to / from USD transfer, enter the transactions from the USD bank feed side not the CAD side if you want the entry to book correctly.

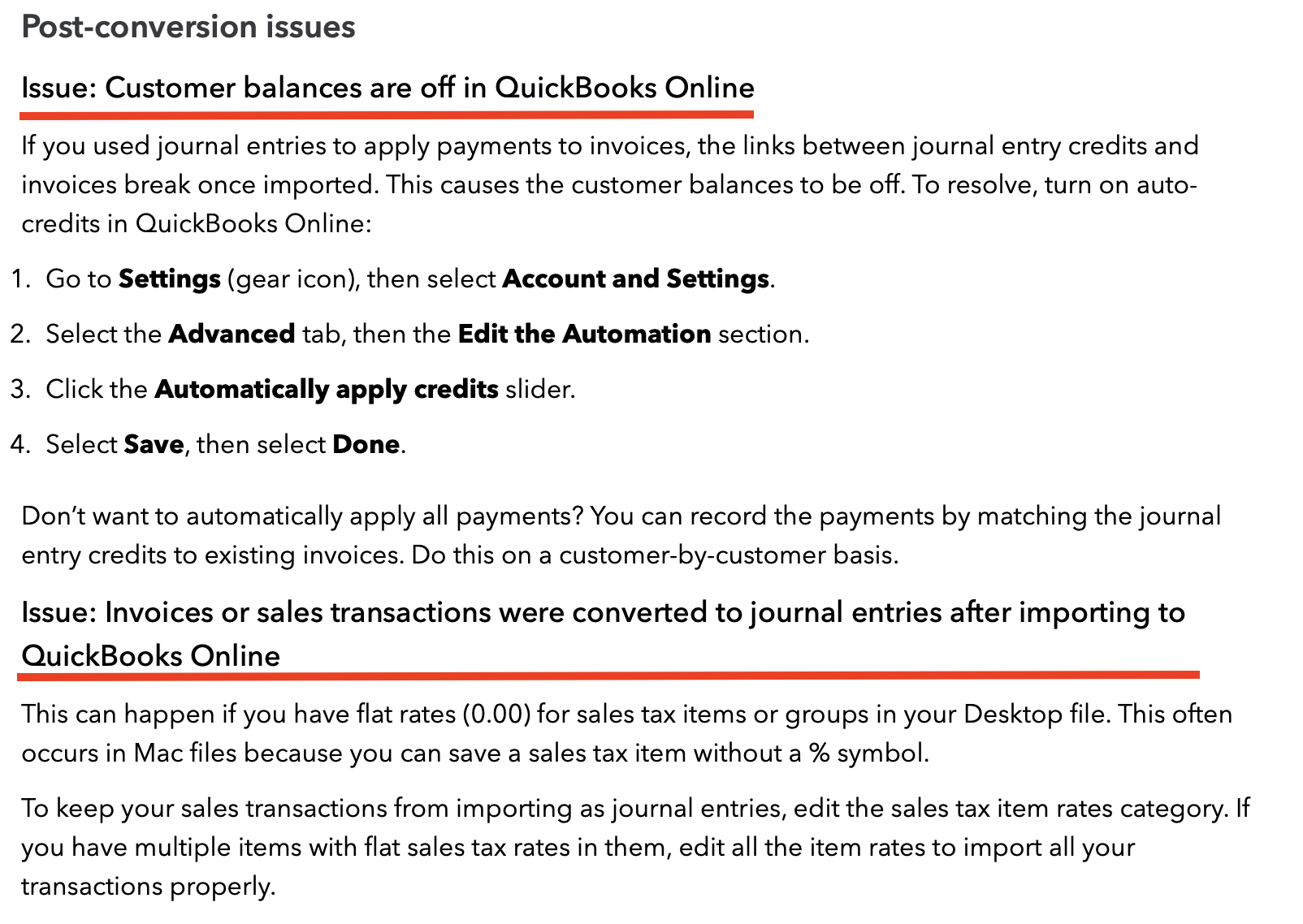

Customer Balances Are Off: Journal entries are a powerful tool for adjusting your books, so they should be used sparingly in QBO. They should not be used for accounts receivable (or payables) transaction. See Intuit's recommended fix below:

Source: Intuit's QuickBooksHelp article titled 'Migrating from QuickBooks Desktop to QuickBooks Online with Intuit's internal tool'

Source: Intuit's QuickBooksHelp article titled 'Migrating from QuickBooks Desktop to QuickBooks Online with Intuit's internal tool'P.S. If you are converting from Sage to QBO, check out this Intuit article on Sage conversions.

P.P.S. If you aren't happy with how your data migrated, QuickBooks Online Essentials, Plus and Advance subscribers have 90 days to delete your data and start over with a new company file.

QBO Conversion Issues

What You Need to Know About QBO Sales Tax

Marnie Stretch of thinkquickbooks.com has an article titled 'The top 10 things you need to know about QuickBooks Online and GST/HST' that explained how GST/HST worked in 2014 QuickBooks Online (QBO). Since then, Intuit has made lots of improvements.

Here's a brief summary updating how things work ten years later in 2024:

1. You need to setup sales tax in order for it to be active.

More >> How To Setup GST/HST in QBO

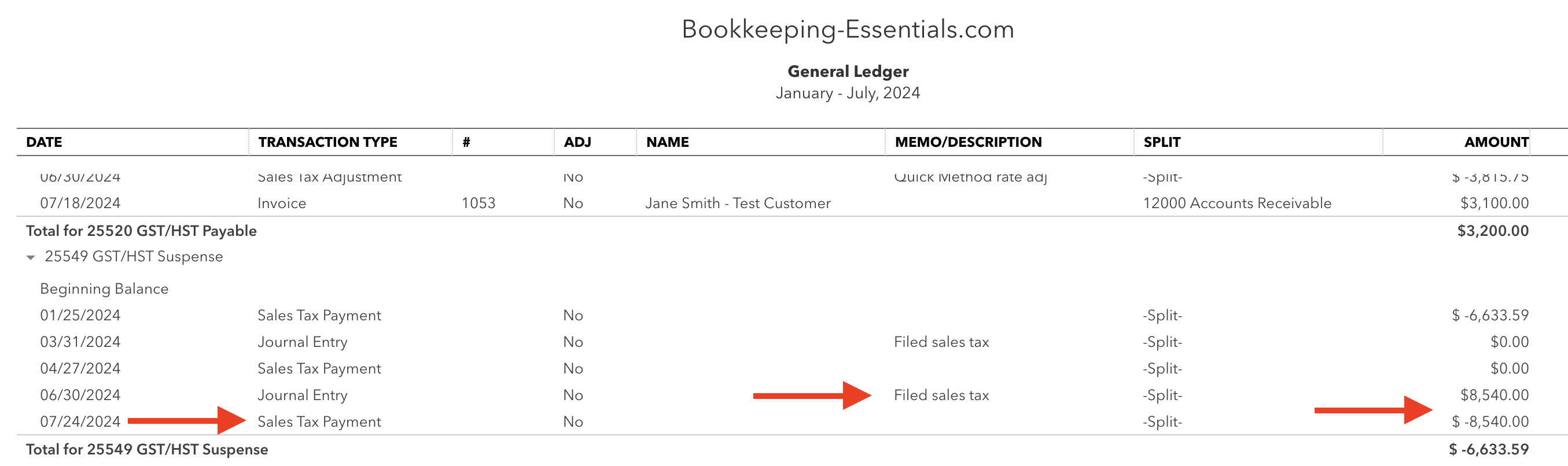

2. QBO automatically creates two accounts once sales tax is active - GST/HST Payable and GST/HST Suspense. Filing a return moves sales tax amounts filed with CRA to the suspense accounts making it easy to distinguish unfiled sales amounts versus filed sales tax amounts outstanding.

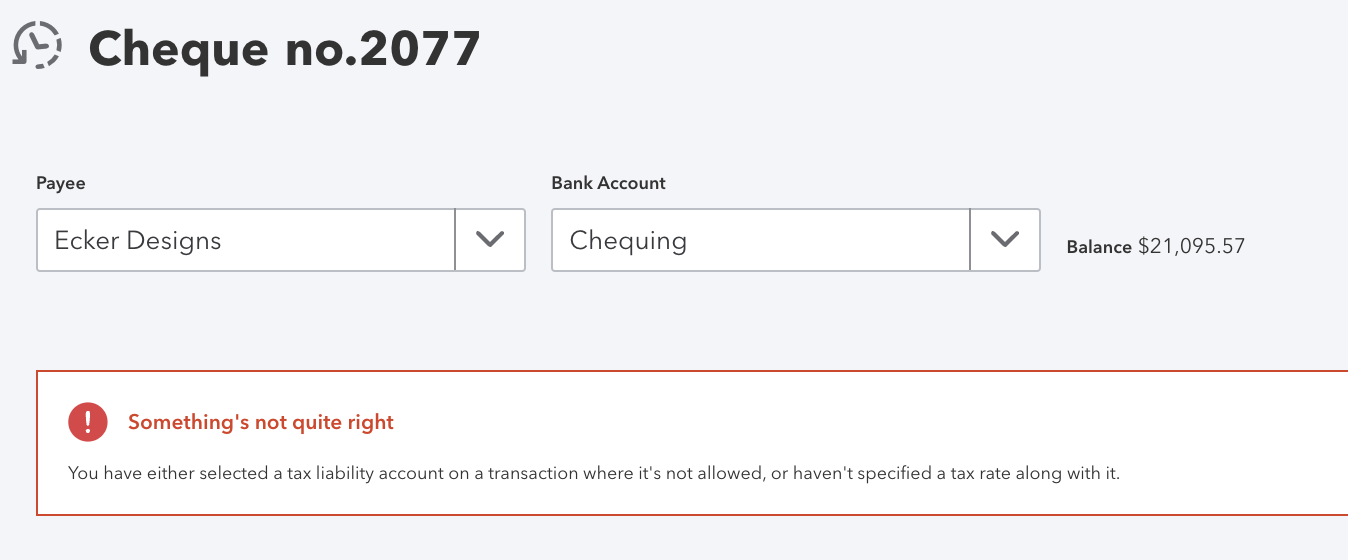

As Marnie pointed out, you cannot write a cheque to GST/HST Payable but you can post to the GST/HST Suspense.

QBO 2024 error message if you try to post directly to the GST/HST Payable account

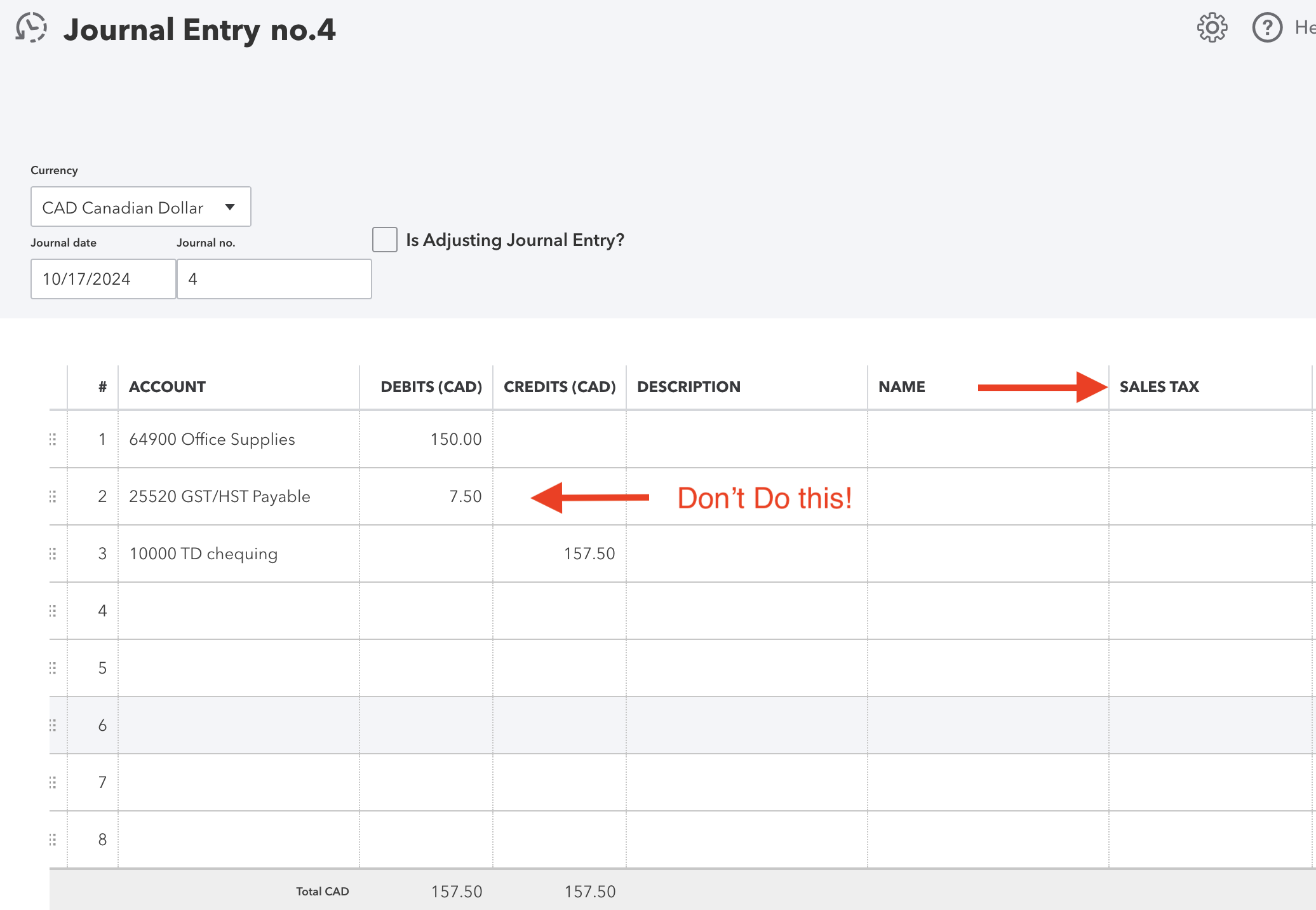

QBO 2024 error message if you try to post directly to the GST/HST Payable accountQBO does let you post a journal entry to the GST/HST Payable but it is not a good idea. However, if you post directly to the GST/HST Payable account, the entry will NOT show up when you go to file your sales tax return. As Marnie said, this is BAD. This feature is probably available so that accountants making year-end adjusting entries can do so but I repeat it is not recommended. Use the proper module when able to do so.

AUDIT READY

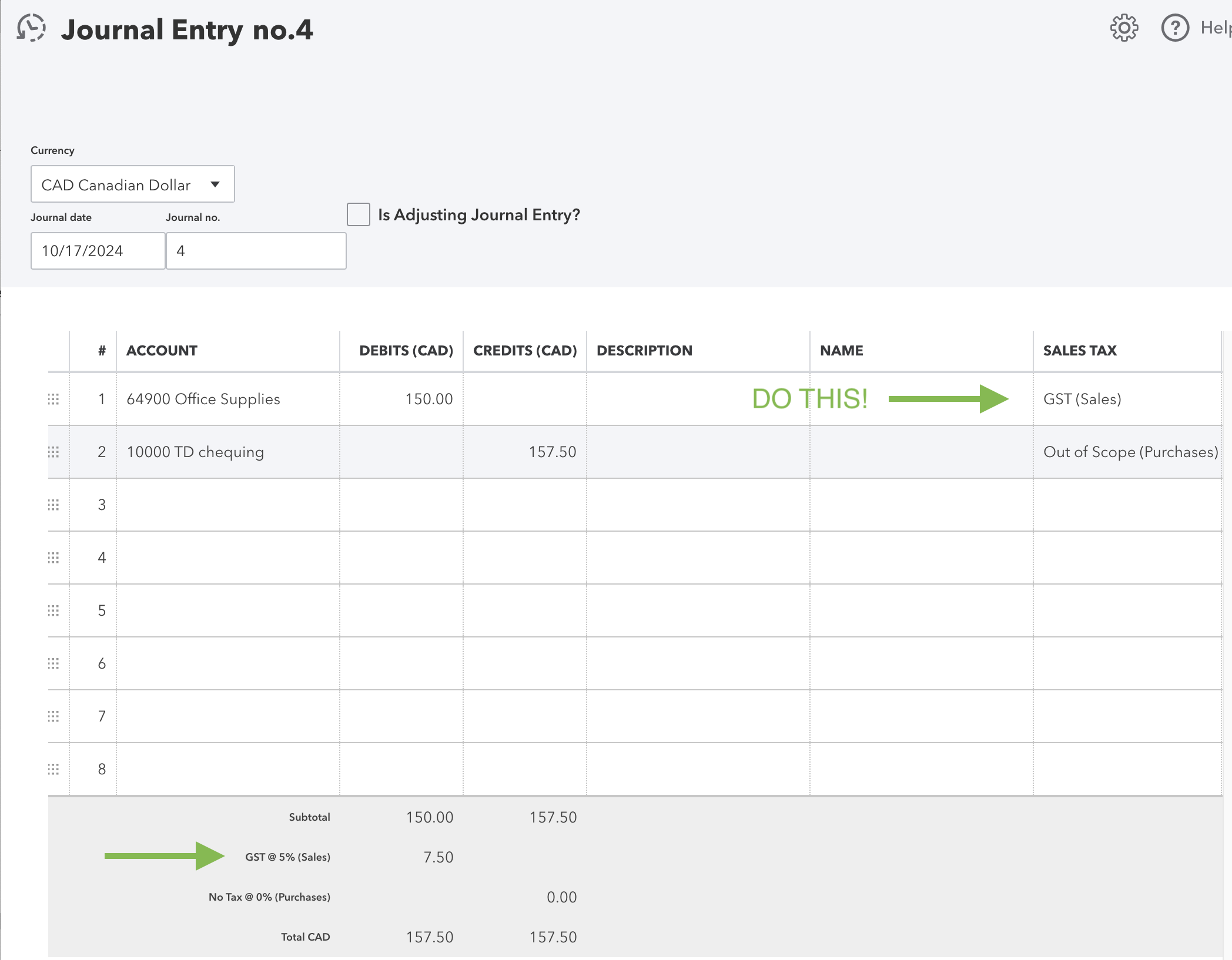

To avoid this error, make sure you assign a tax code to every single line of any journal entry you prepare and post alleviating the need to post directly to the GST/HST Payable account.

3. QBO does not have sales tax items like QuickBooks Desktop. This means journal entries are done a bit differently. QBO Canada lets you assign a sale tax code to each line of the journal entry instead. See point 9 for more information on this feature.

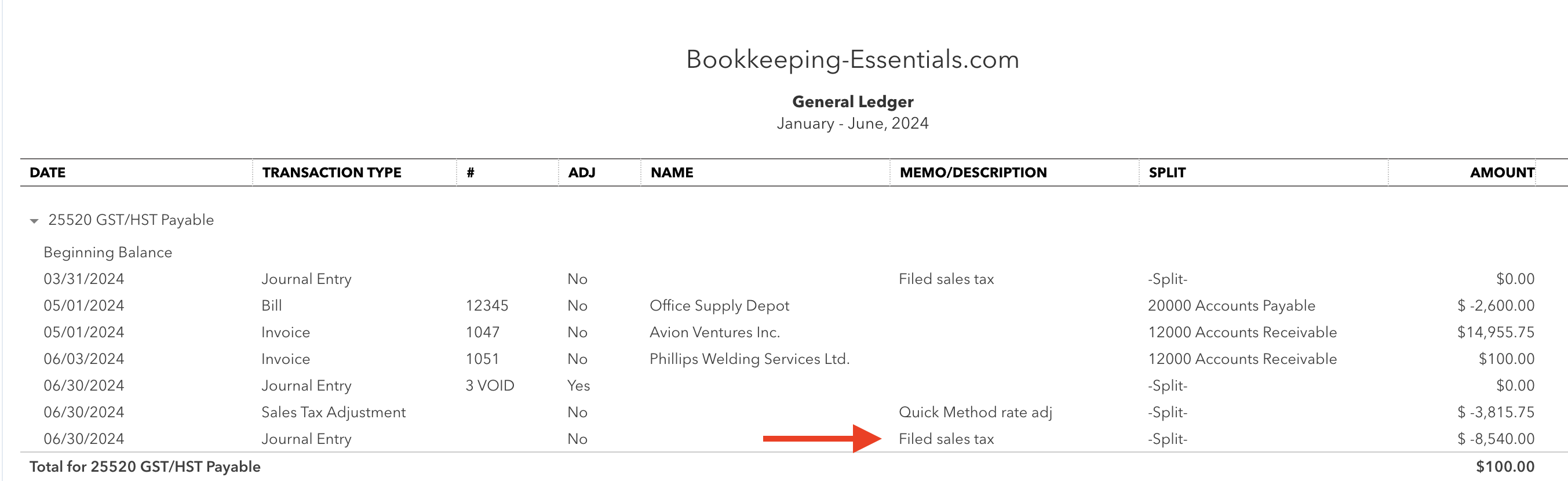

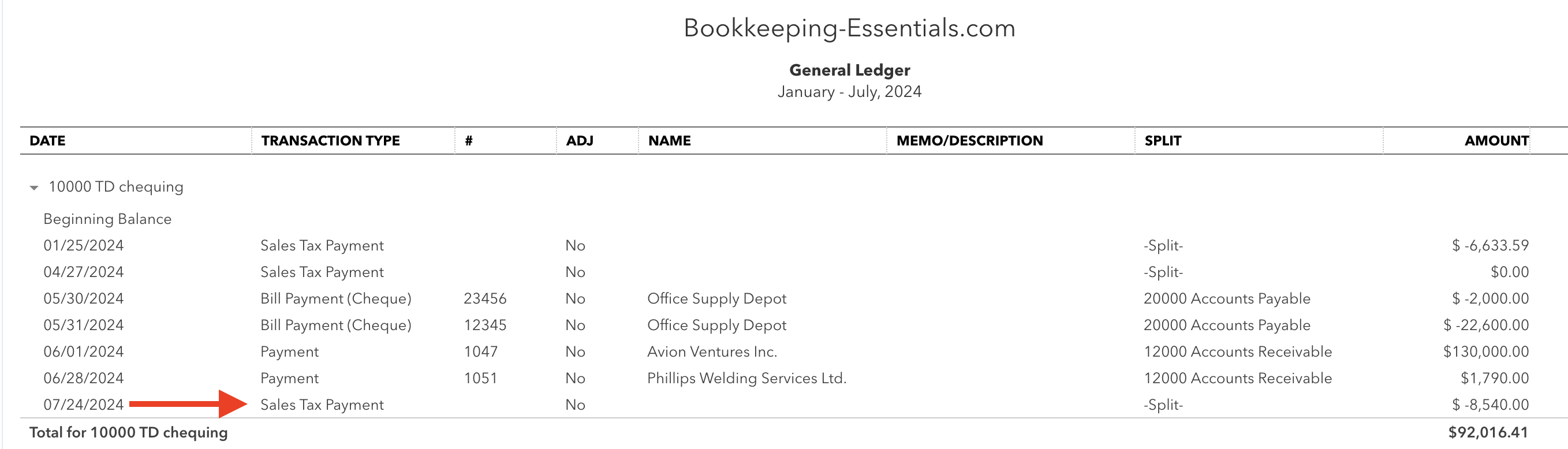

4. Completing a sales tax return creates an automatic journal entry moving what you owe (or your refund) from GST/HST Payable to GST/HST Suspense instead of recording an accounts payable (receivable) entry. This means sales tax payments debit the suspense account and credit your bank account; sales tax refunds received credit the suspense account and debit your bank account. The screen shots below show you the flow of the entries through various QBO accounts - GST/HST Payable to GST/HST Suspense to Bank Account.

QBO Canada entry made to GST/HST Payable after filing a sales tax return with CRA

QBO Canada entry made to GST/HST Payable after filing a sales tax return with CRA QBO Canada entry made to GST/HST Suspense after making a sales tax payment to CRA

QBO Canada entry made to GST/HST Suspense after making a sales tax payment to CRA QBO Canada entry made to bank account after making a sales tax payment to CRA

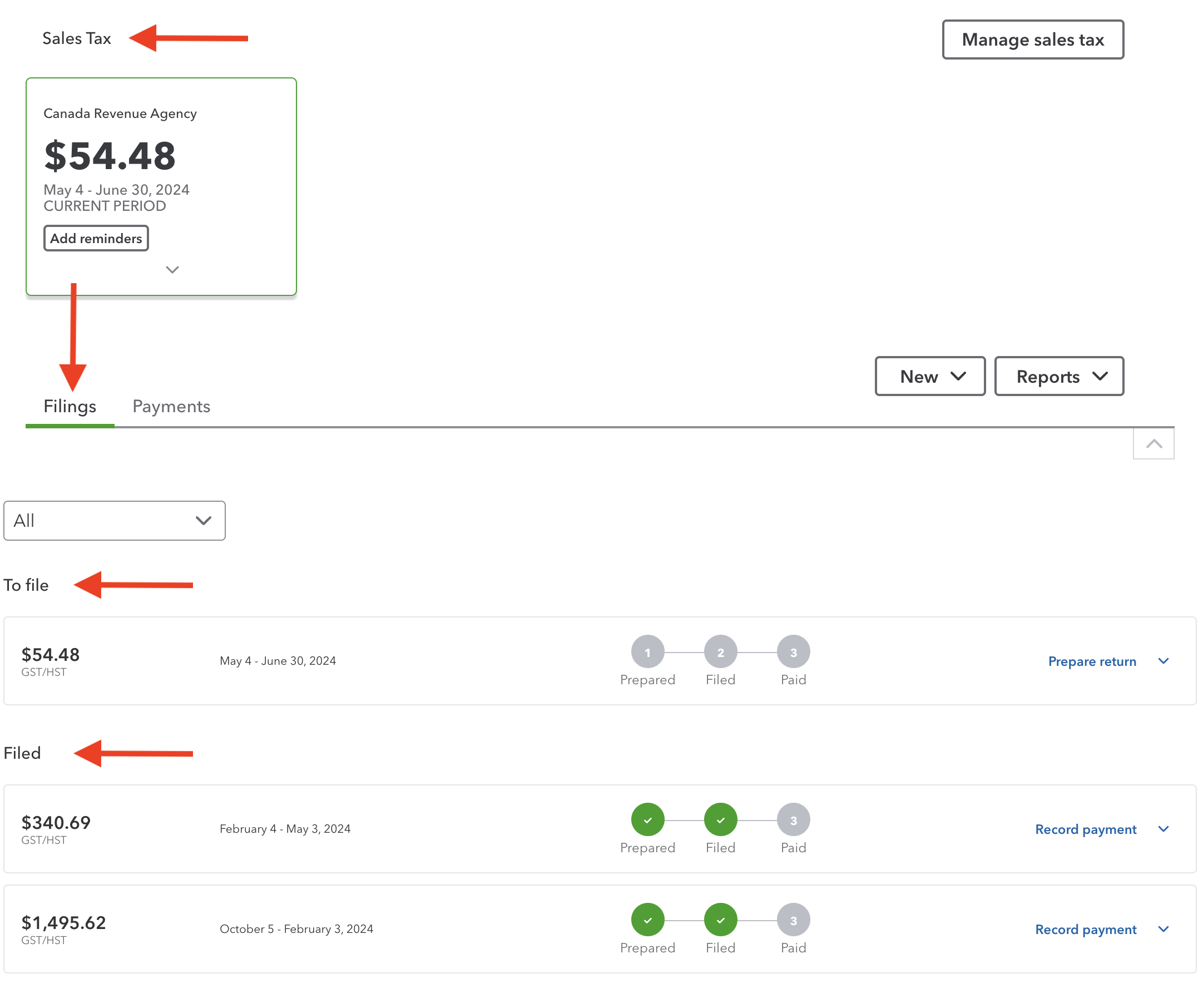

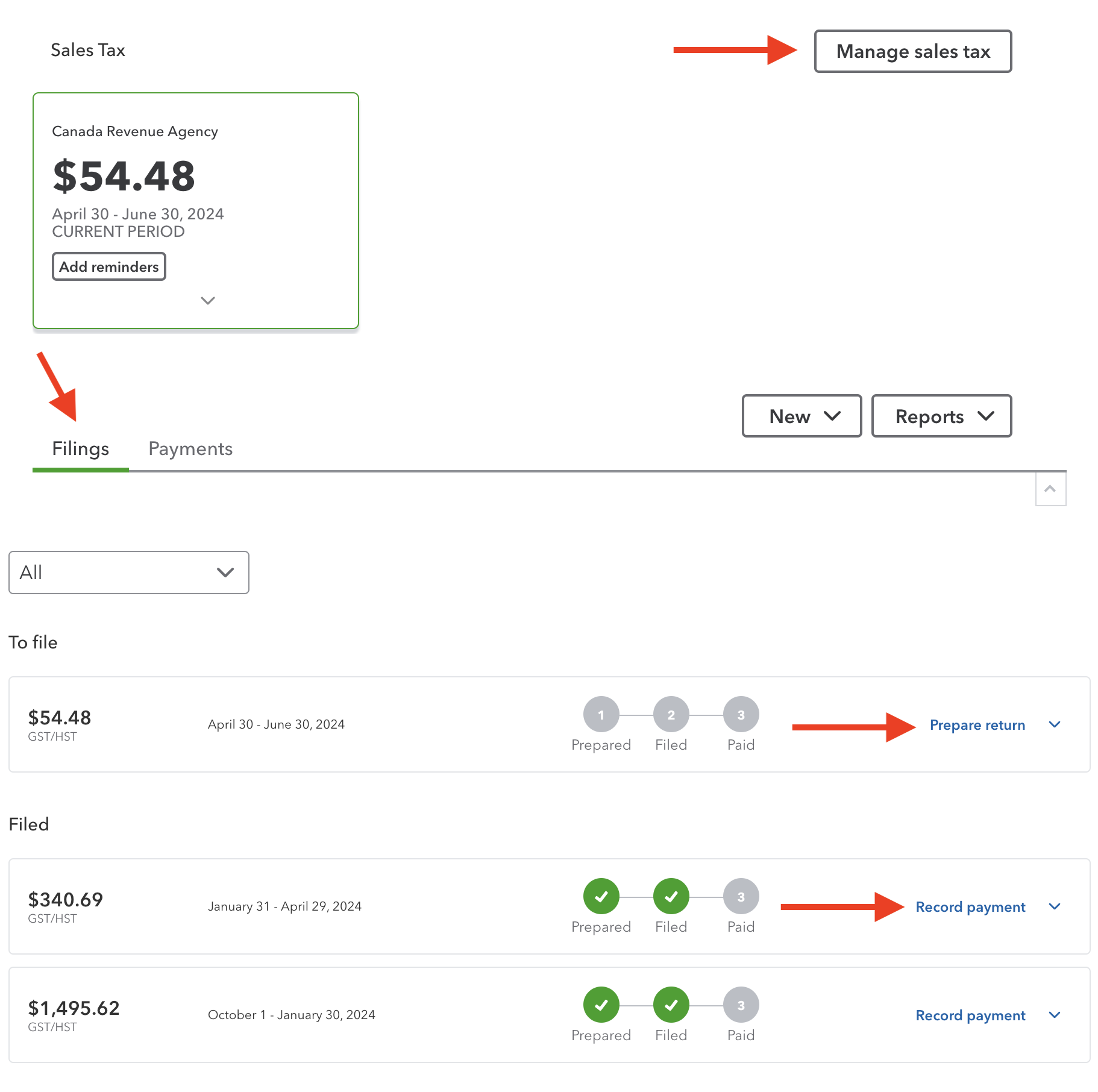

QBO Canada entry made to bank account after making a sales tax payment to CRA5. When preparing your return, make sure you select the correct period if you are behind in filing your GST/HST tax returns. The Filings tab is split into a 'To File' section and a 'Filed' section so it is very easy to see which periods have been filed and which haven't. See point 6 on why it's very important to be careful before hitting the 'Mark as Filed' button.

QBO Sales Tax screen is organized into 'Filed' returns and' To File' returns

QBO Sales Tax screen is organized into 'Filed' returns and' To File' returns6. You cannot modify or delete the journal entry created automatically by QBO when you file a sales tax return unless you have the Accountant's version of QBO Canada. Intuit listened to the accountants and bookkeepers and provided a tool to handle this problem. The Accountant's Version has the ability to reverse or 'undo filing' a sales tax return. Be careful using this feature if you have already filed the return with CRA* as undoing the filing can mess things up a bit.

- *Note: QBO does not file the actual return for you with CRA. You have to manually do this through My Business Account or GST/HST Netfile.

AUDIT READY

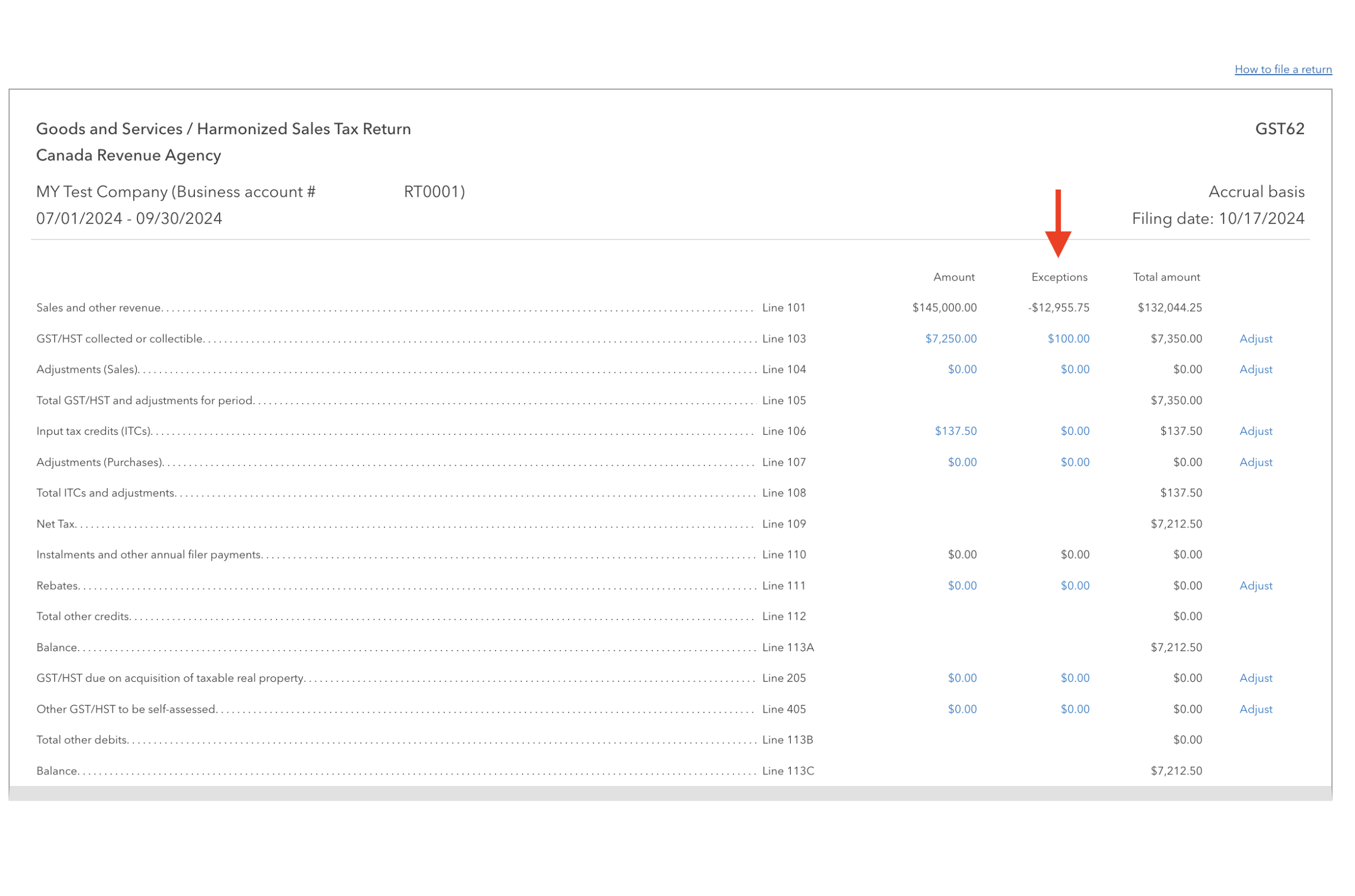

If you just missed including some transactions in a filed period, do not use the 'undo filing' feature. QBO does a good job of tracking prior period changes. If you post any transaction to a period that has already been filed with CRA, QBO will report these 'exceptions' the next time you file a return. You can find the prior period entries by running the GST/HST Exception report. I always save a PDF of the GST/HST Exception report after filing a return, even if it has nothing to report.

TIP

ITCs are claimable within the first four years following the fiscal year they apply to. Don't get upset if you miss claiming an input tax credit on your CRA return. You can claim it on the next return as long as it is within the four year window.

QBO captures sales tax adjustments to prior periods under the 'Exceptions' column

QBO captures sales tax adjustments to prior periods under the 'Exceptions' column7. QBO dates the automatic journal entry for your sales tax return filed to the last day of the period you are filing. For example, if you are filing for the period April 1 to June 30, QBO sets the posting date of the journal entry to June 30. As Marnie's article points out, it wasn't always this way.

8. When making a payment or receiving a refund, you need go to the 'Sales Tax' Filings tab. You will click on the 'Record Payment' link to make a GST/HST payment. To record a refund received, click on the 'Record Refund' link (which isn't showing in my example screen shot).

DO NOT DO THIS!

Do not use 'Cheque', Expense' or 'Pay Bill' to make a sales tax payment to CRA (or a provincial Minister of Finance). Do not use 'Bank Depot' or 'Receive Payment' to record a refund received from CRA (or a provincial Minister of Finance).

9. It is not a good idea to post a journal entry directly to the GST/HST payable account. As discussed earlier, when you post directly to the GST/HST Payable account, it will not show up on your return when you go to file your sales tax return.

AUDIT READY

To avoid this, make sure you assign a tax code to every single line of any journal entry you prepare and post alleviating the need to post directly to the GST/HST Payable account.

DO this in a journal entry

DO this in a journal entry DON'T do this in a journal entry

DON'T do this in a journal entryMore >> When To Use Journal Entries in QuickBooks Online

10. You cannot edit sales tax payments posted. You must delete the payment and repost it.

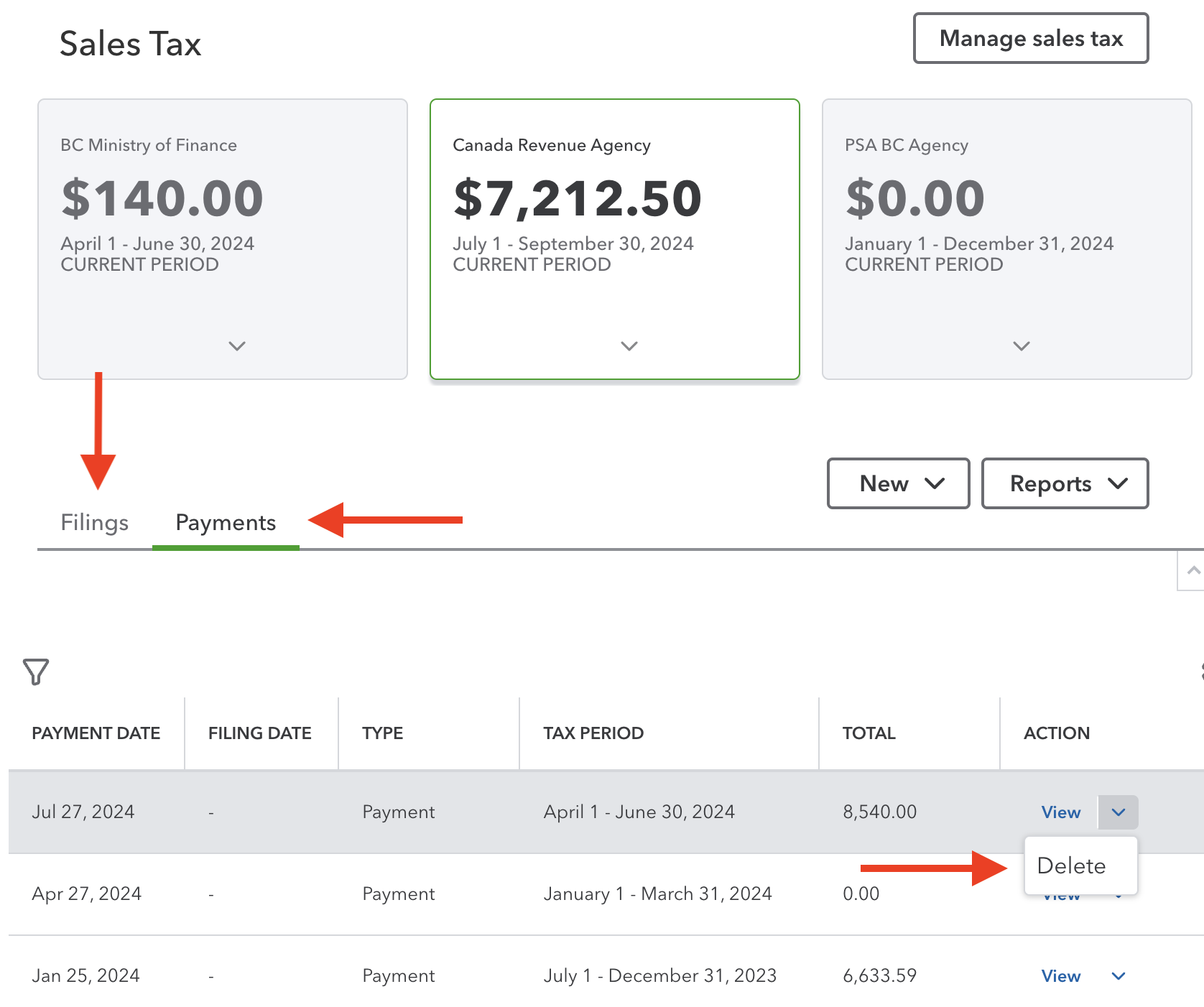

You can delete the payment by going to the Sales Tax > Payments tab. Click on the drop down menu for the selected payment and choose 'Delete'. (See screenshot.) Once that is done, click on the 'Filings' tab and record the payment again.

QBO Conversion Issues

Steps to Convert From QBD to QBO

- Follow Intuit's instructions on what you need to do in Desktop prior to migrating your data to QBO. Don't skip any steps unless you want your conversion to mess up. The list includes things like: (1) backing up your company file, (2) updating QBD to the latest version then run your payroll if this is applicable, (3) checking your total targets (Ctrl+1). If the Targets number is over 700,000 for Canada you can only do a list and balances conversion, for companies outside Quebec, (4) removing Ministere du Revenu from the Vendor Center, (5) turning off Desktop payroll, (6) saving your tax liability reports, (7) exporting your reports and lists, and finally (8) creating a QBO account.

- In QBD, export your company file selecting QBO as your destination through Company > Export Company File to QuickBooks Online.

- Import each of your exported lists (from step 1.7) to QBO separately: COA, products and services, customers, suppliers.

- Setup inventory if applicable.

- Follow Intuit's instructions on tasks you must complete in QBO before you start using it.

Source: QuickBooksHelp - Migrating from QuickBooks Desktop to QuickBooks Online with Intuit's internal tool

It's been great chatting with you.

Your Tutor

12 Part QuickBooks® Primer

QuickBooks® is a registered trademark of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.

Click here to subscribe to QuickBooks Online Canada. I do not receive any commissions for this referral.

Bookkeeping Essentials › Bookkeeping Systems › QuickBooks Online - QBO Conversion Issues