- Home

- Basic Bookkeeping Practices

- Bookkeeping Entries Link Index

- About Adjusting Entries

About Adjusting Entries

For Month End and Year End

by L. Kenway BComm CPB Retired

Published May 2010 | Edited August 30, 2024

In this article, I will chat about the types of adjusting entries your professional bookkeeper or accountant would likely book as they work on your accounting records ... including accruals and deferrals.

Unless you have formal bookkeeping training or supervision, it is best if you leave adjusting entries to your certified professional bookkeeper or accountant.

INDEX for Common Bookkeeping Entries Series

I've already discussed month end procedures and basic bookkeeping entries. This chat builds on that.

My main goal today is to keep this very simple for you. I am going to attempt to give you a more in depth understanding of the numbers in your general ledger and behind your financial statements.

Your main goal is to understand what types of entries are best left to your accountant ... but as with most things, you are the best judge of your bookkeeping capabilities.

About Adjusting Entries

So what exactly are these adjusting entries that you keep hearing about? What is their purpose?

Adjusting entries are journal entries that are made at the end of an accounting period (like month end or year end) to adjust the books to ASPE GAAP.

Adjusting entries can be done any time throughout the accounting year ... not just at month end or year end.

Examples of Adjusting Entries

Here is a list of the various types of adjusting entries ... this list will give you an idea of possible instances you (or your bookkeeper) might want to book an adjusting entry:

- Reclassifying a transaction ... maybe because it was posted to the wrong account or job ... or the interest expense from a loan payment was booked to the Loan account on the balance sheet.

- If the entry is to correct something not booked properly, I like to start the memo with EC (for error correction) so that when I'm reading the ledger, I know it is a correcting entry.

- At year-end, you will want to reclassify the current portion of your long term debt. You would not start this type of entry with EC as it is not an error correction.

- Reversing a transaction ... in a prior accounting period that has been closed. Some reasons why you might want to reverse a transaction are:

- remove and reissue a stale dated cheque;

- reverse an accrual to book a revised accrual or because the actual has been booked (look in your Accrued Liabilities account for accruals currently on your books);

- correct an accounting error discovered so you can book the correct entry ... it's just plain wrong and not a simple classifying error described above.

- Estimating expenses such as amortization or bad debt allowance on a ASPE GAAP basis.

- Remember recording amortization for the period is a non-cash entry that debits amortization expense on the income statement and credits accumulated amortization on the balance sheet ... no cash is involved ... you spent the cash when you purchased the assets.

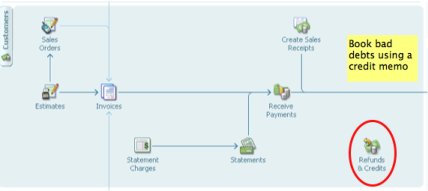

Write off an individual customer bad debt in QuickBooks®

- In QuickBooks®, write off an individual customer bad debt using the "Credit Memo" button on your invoices or sales receipts ... be sure you have setup a bad debt item as an Other Charge in your item list (coded to the account bad debt allowance NOT bad debt expense) ... and select the bad debt item when recording the credit memo.

- Note: GAAP books bad debt using the bad debt allowance account. If you are doing your books on a tax basis, your Other Charge item would be coded to bad debt expense instead of bad debt allowance.

- To complete this transaction, go to Receive Payments and apply the credit memo to the outstanding/unpaid invoice. If you were using the specific method of write-off for your bad debt allowance, you will have to do a journal entry to reverse/remove this item from your bad debt allowance.

- You should also understand how GST/HST affects bad debt and what reporting needs to be done.

The Bookkeeper's Tip

A Good Bookkeeping Practice

A QuickBooks® Tip - Most month end adjusting entries should be done using the proper QuickBooks® form rather than the manual journal entry if you want the entry to post and report properly.

- Amortization, loan interest, and tax provisions should be done through a manual journal entry.

- Inventory or payroll should NOT be done through a manual journal entry. Your subsidiary ledger will not balance to your general ledger if you use the manual journal entry.

What is An Accrual and A Deferral?

Accruals and deferrals are regularly booked as part of doing year-end. So what exactly are they?

Sometimes, the paperwork has not come through for expenses or revenues that have happened before your year end ... so it is necessary to book an accrual.

An accrual is for expenses that have been incurred but not reflected in your records yet ... or for revenues you've earned but not booked yet.

Two good examples of accruals would be interest. Interest expense on a bank loan may have to be accrued or interest income may need to be accrued for a term deposit.

Sometimes, accounting events / transactions have occured during the accounting period that affect more than one accounting period ... so it is necessary to book a deferral.

A deferral is where a portion of the income or expense relating to a transaction has to be allocated in a future accounting period.

Two good examples of deferrals would be prepaid expenses or unearned revenue from customer deposits.

More examples of accruals and deferrals

Accruals and deferrals are two more types of adjusting entries. Here are some more examples of what they look like:

- Accruals for unrecorded transactions that have occurred such as professional fees ... just as an example.

- If any expenses have been accrued, you will probably see an account on your balance sheet entitled Accrued Liabilities.

- At year-end, you will want to accrue your payroll for earned but not yet paid wages, salaries, and bonuses.

- Deferrals for prepaid expenses and revenue collected in advance ... and allocating previously deferred items.

- You need to expense the portion you have used of expenses paid in advance, like insurance or rent.

- You need to book the amount of income you have earned for the month by a customer who paid in advance.

While accruals and deferrals can be booked during month end, most small businesses don't need to concern themselves with them until year end ... particularly if your financial statements are prepared for internal use only.

Where do accruals and deferrals show up on your financial statements?

Accruals and deferrals affect both the income statement and the balance sheet.

The portion of the accrual or deferral entries on the income statement side of the transaction are booked to the account the entry is affecting, however that is not normally so for the balance sheet part of the entry.

For small businesses, most (not all) month end or year end accruals on the balance sheet will be found in one of two accounts ... accrued liabilities (a current liability account) or accrued receivables (a current asset account).

My sincere gratitude to all my readers ... without you I'd have no website. Blessings to you all. My suggestion to you ... enjoy a tall cool glass of lemon water while you click and poke and peek and snoop this site ... perhaps start with the blog which lists the most recent updated articles.

I Hope You Enjoy Your Visit Today,

Your Tutor

QuickBooks and QuickBooks ProAdvisor are registered trademarks and/or registered service marks of Intuit Inc. Screen shots © Intuit Inc. All rights reserved.