- Home

- Basic Bookkeeping Practices

- Getting Ready For Yearend

What to do now to have a smooth year-end.

What to do now to have a smooth year-end.Getting Ready For Yearend

Focus On Bookkeeping

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published September 2014 | Edited June 18, 2024

I have spent time on this site explaining how to setup your filing system and read your financial statements. In this chat, I thought I'd look at what you need to be doing NOW to have a smooth yearend.

Getting Ready For Yearend Now

One way to make sure your year-end goes smoothly is to keep an eye on your balance sheet accounts all year long. What do I mean by that?

At yearend, your bookkeeper or internal accountant will (or should) go through every account on your balance sheet and tie it to a third party source document. You can reduce your yearend preparation costs if you submit a clean set of books.

Advertisement

Getting Ready For Yearend List

Here are a few examples of what you should do before year-end:

- Bank accounts AND credit card accounts should be reconciled EVERY month. At year-end, your bookkeeper or accountant is going to want, at a minimum, your reconciliation for the last month in your fiscal year AND the first month in your new year. (They use it for accounts receivable and payable cutoffs). Click here to learn what a bank reconciliation is.

- Your accounts payable subledger should be reconciled to vendor statements. If you haven't been doing this during the year or don't receive vendor statements, call today to request one. Payables that are outstanding for two or more years should be brought into income. Click here to learn how to reconcile these accounts.

- If you have a bank loan, you probably have been receiving loan statements. What have you been doing with them? Hopefully you have been comparing them to your bank loan balance on your balance sheet and making any adjusting entries necessary. Click here to learn how to record your monthly bank loan payments.

- Clean up those miscellaneous over and under balances on your accounts receivable and payable reports. Review accounts outstanding more than 90 days. Your bookkeeper or accountant will to want to know if you think they are collectable. Identify any balances that over two years old so you can bring them to your bookkeeper or accountant's attention.

- If you have inventory, mark your calendar to take a physical count on the last day of the fiscal year. If you have a periodic inventory system, learn about your yearend journal entries.

- Reconcile your payroll account(s). Make sure they match what you have reported and remitted to CRA/IRS. If there are discrepancies, have an analysis that explains them. Starting this now will make T4/W2 issuance much easier to accomplish on time.

- Canadian visitors, reconcile your GST/HST (sales tax) account(s) to your CRA reports and your PST accounts to your submitted provincial reports. If there are discrepancies, have an analysis prepared explaining them. For my U.S. visitors, the equivalent for you would be your sales and use tax reporting to various levels of governments. Make sure your exemption certificates are in order.

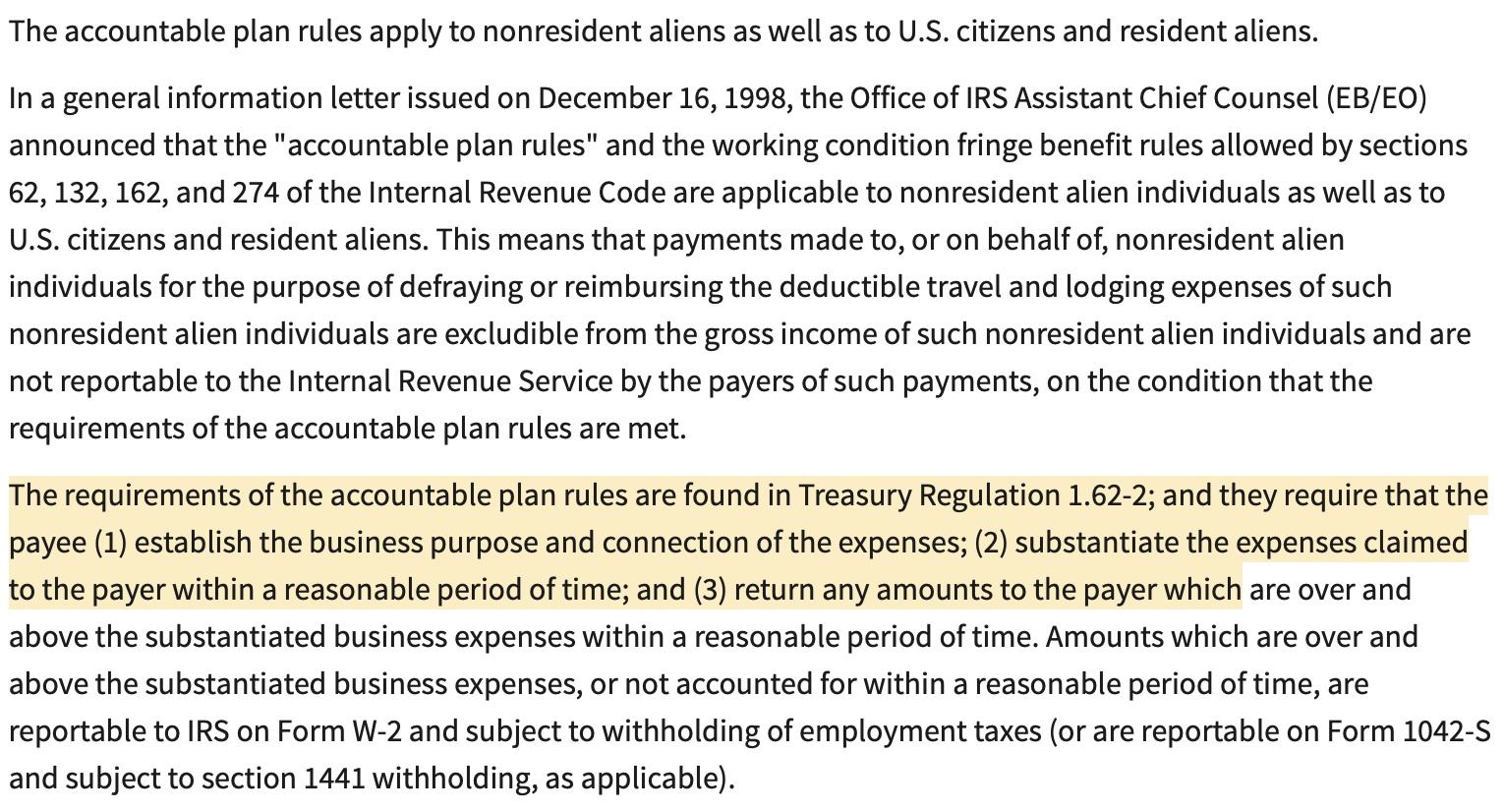

- Take a look at how you handled any reimbursement of expenses. GAAP requires they be recorded as income and NOT netted against the expense. My U.S. visitors also have to determine whether you have met the accountable plan rules / criteria.

IRS Accountable Plan Rules

Source: IRS Nonresident Aliens and the Accountable Plan Rules Reviewed or Updated 03 May 2024

Source: IRS Nonresident Aliens and the Accountable Plan Rules Reviewed or Updated 03 May 2024While this list should keep you busy well into December, my Bookkeeping Checklists eBook can help you all year long.

Advertisement

Happy reconciling! ... Oh and you may want to read some answers to common yearend bookkeeping questions.

See you on the next page ...

Your tutor

Help getting all your ducks in a row

Source: A version of this chat was first published in October 2011 issue of The Bookkeeper's Notes Newsletter.

Bookkeeping Essentials › Accounting Training › Preparing for Year-end