- Home

- US Small Business Tax Compliance

- Employee Payroll Taxes

U.S. Employee Payroll Taxes

by L. Kenway BComm CPB Retired

This is the year you get all your ducks in a row!

Published in 2010 | Updated November 7, 2024

Part 1 of The Bookkeeper's Notes on employee payroll taxes ... everything in one place ... to use as a handy reference to calculate withholdings and contributions.

Advertisement

Highlights Of This Post

The Bookkeeper's Notes On

- Failing to Exercise Authority and Unremitted Payroll Taxes

- Business Travel Allowances and Per Diem Rates

- Payroll Journal Entries Example

- Introductory Payroll Course

- Early Release Withholding Tax Tables Notice 1036

- Minimum Wages

- Fringe Benefits - Employer Provided Mobile Devices IRS Notice 2011-72; also Circular 15-B for 2012&2013

- Employee Gifts and Awards

- Amending Return Payments on EFTPS, Disability Insurance, Worker's Compensation

- Unclaimed or Uncashed Paychecks

Supporting Articles for Federal Payroll Taxes

The Bookkeeper's Tip

A Good Bookkeeping Practice

Failing To Exercise Authority

This employee payroll tax tip comes to you from the American Institute of Professional Bookkeepers.

If you have the authority to write cheques or enter into contracts, the IRS can hold you personally responsible, under willful failure to pay taxes, for unremitted payroll taxes due along with associated penalties and interest if it can be shown you were aware other expenses were being paid.

Source: AIPB Bookkeeping Tips Volume 8: Issue 15 (Free eNewsletter)

Minimum Wage

Fair Labor Standards Act (FLSA) federal minimum wage for covered nonexempt employees is $7.25 effective July 24, 2009. There may also be minimum wage laws in your state.

Minimum wage for all states can be found at:

dol.gov/whd/state/stateMinWageHis.htm .

The U.S. Department of Labor says that if an employee is subject to both the state and federal minimum wage laws, the employee is entitled to the higher of the two minimum wages.

In Obama's State of Union address in February 2013, he announced that minimum wage will be increased in stages until it reaches $9 in 2015. After that, the minimum wage will be indexed to inflation.

Then in January 2014, he announced an executive order raising the federal minimum wage to $10.10 an hour for future federal contract workers.

FICA Employee Payroll Taxes

Click here for information on FICA Payroll Tax Deposits.

FICA (Federal Insurance Contributions Act) establishes two taxes on self-employed workers, employers, and employees.

... The first employee payroll tax known as the Social Security tax is for Old Age, Survivors and Disability Insurance (OASDI).

... The second employee payroll tax known as the Medicare tax is for Hospital Insurance (HI).

Employers matched the employee's tax portion of FICA in 2013 through 2024; just as they did in 2010. There was an exception in 2011 and 2012 whereby employers no longer matched the employee's tax portion of FICA due to the 2010 Tax Relief Act, the Temporary Payroll Tax Cut Continuation Act of 2011 and the Middle Class Tax Relief and Job Creation Act of 2012. Self employed workers pay both portions of FICA in all years.

FITW for each taxpayer is determined on form W4 Employee’s Withholding Allowance Certificate. Wage bracket tables are located in IRS Publication 15 Circular E Employer's Tax Guide. Lesson three of The Bean Counter's Payroll Course explains how to use the tables.

Changes to Employee Payroll Taxes in 2025

FICA rate for 2025 remains at 7.65% and is made up of:

| 2024 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4% | $176,100 | $10,918.20 EE $10,918.20 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

EE = employee's portion, ER = employer's portion

2020 COVID-19 Payroll Taxes Suspended

Please read IRS Notice 2020-22 regarding the CARES (Coronavirus Aid, Relief, and Economic Security) Act which allowed eligible employers to defer payment of the employer's share of FICA between March 27 and December 31, 2020. The deferred payments are due half by December 31, 2021 with the remainder due by December 31, 2022.

Please read IRS Notice 2020-65 allowing employers to suspend withholding and paying the employee's share of payroll taxes between September 1 and December 31, 2020. It applies to employees earning less than $4,000 in a bi-weekly pay period, concluding salaried workers earning less than $104,00 per year.

To repay the tax obligation, companies suspending withholding of employees' payroll tax initially were to collect the additional amounts from workers' paychecks between January 1 to April 30, 2021. However, President Trump signed the Consolidated Appropriations Act at the end of 2020 which extended the repayment period through to December 31, 2021. Penalties and interest on the deferred unpaid tax liability will not begin to accrue until January 1, 2022.

Reference: SHRM

Historical Employee Payroll Taxes Tables 2010-2024

FICA rate for 2024 remains at 7.65% and is made up of:

| 2024 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $168,200 | $10,453.20 EE $10,453.20 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2023 remains at 7.65% and is made up of:

| 2023 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $160,200 | $9,932 EE $9,932 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2022 remains at 7.65% and is made up of:

| 2022 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $147,000 | $8,537.40 EE $8,537.40 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2021 remains at 7.65% and is made up of:

| 2021 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $142,800 | $8,239.80 EE $8,239.80 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2020 remains at 7.65%. Please see note above regarding Covid-19 payroll tax suspension. It is made up of:

| 2020 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $137,700 | $8,537.40 EE $8,537.40 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2019 remains at 7.65% and is made up of:

| 2019 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $132,900 | $8,239.80 EE $8,239.80 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2018 remains at 7.65% and is made up of:

| 2018 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $128,400 | $7,960.80 EE $7,960.80 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2017 remains at 7.65% and is made up of:

| 2017 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $127,200 | $7,866.40 EE $7,866.40 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2016 was the same as 2015 because there was no increase in COLA. It remained at 7.65% and was made up of:

| 2016 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $118,500 | $7,347 EE $7,347 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

FICA rate for 2014 is 7.65% made up of:

| 2014 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4%* | $117,000 | $7,254 EE $7,254 ER |

| Medicare | 1.45% | 1.45% | 2.9% | $200,000 | $2,900 EE $2,900 ER |

| Medicare | 2.35% | 1.45% | 3.8% | over $200,000 | no limit |

EE = employee's portion, ER = employer's portion

Note 1* - The U.S. Senate allowed the payroll tax cut to lapse when it passed The American Taxpayer Relief Act on January 1, 2013.

Note 2** - Medicare rates were released in mid-November. They are being increased to 3.8% and expanded to cover wage income and investment income for high income individuals ... defined as $200,000 for single filers, $250,000 for joint filers and $125,000 for married filing separately filers. Employers are responsible for withholding the Additional Medicare Tax from wages or compensation it pays to an employee in excess of $200,000 in a calendar year.

FICA rate for 2013 is 7.65%** made up of:

| 2013 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2%* | 6.2%* | 12.4%* | $113,700 | $7,049.40 EE $7,049.40 ER |

| Medicare | 1.45%** | 1.45%** | 2.9%** | $200,000** | $2,900 EE $2,900 ER |

| Medicare | 2.35%** | 1.45%** | 3.8%** | over $200,000** | no limit |

FICA rates for 2012 implementing the Middle Class Tax Relief and Job Creation Act of 2012 for one more year are below.

*Temporary Payroll Tax Cut Continuation Act of 2011 expired March 1, 2012 and was extended to the end of 2012 by the Middle Class Tax Relief and Job Creation Act of 2012.

| 2012 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 4.2% | 6.2% | 10.4% | $110,100 | $4,624.20 EE $6,826.20 ER |

| Medicare | 1.45% | 1.45% | 2.9% | unlimited | no limit |

FICA rates for 2011 implementing the 2010 Tax Relief Act are:

| 2011 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 4.2% | 6.2% | 10.4% | $106,800 | $4,485.60 EE $6,621.60 ER |

| Medicare | 1.45% | 1.45% | 2.9% | unlimited | no limit |

FICA rate for 2010 is 7.65% made up of:

| 2010 FICA | EE Rate | ER Rate | EE+ER Rate | Wage Base Limit | Maximum Tax |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4% | $106,800 | $6,621.60 EE $6,621.60 ER |

| Medicare | 1.45% | 1.45% | 2.9% | unlimited | no limit |

FUTA Employee Payroll Taxes

FUTA stands for Federal Unemployment Tax Act. It is a payroll tax that funds unemployment benefits. As a small business owner, you are required to pay FUTA. As this is an employer tax, nothing is withheld from employees paychecks. Click here for information on FUTA Payroll Tax Deposits requirements.

If you pay amounts on time, you are eligible to receive a FUTA tax credit. The percentage you get back depends on whether your state has any outstanding federal unemployment insurance loans.

2012 to present FUTA and July to Dec 2011 FUTA deposit rate is 6.0% with a maximum credit available of 5.4%. The minimum FUTA deposit rate is 0.6% (6.0% - 5.4%). Please read note on FUTA credit reduction states and rates. The rate may be different for household workers or farm workers.

2010 FUTA and Jan to June 2011 FUTA deposit rate is 6.2% with a maximum credit available of 5.4%. The minimum FUTA deposit rate is 0.8% (6.2% - 5.4%).

The FUTA tax applies to the first $7,000 (FUTA taxable wage base) you pay to each employee during a calendar year after subtracting any payments exempt from FUTA tax. Tax exempt wage base is earnings over the taxable wage base.

Year |

FUTA Deposit Rate | Maximum Credit Available | Minimum Deposit Rate | Taxable Wage Base |

|---|---|---|---|---|

| 2012-present | 6.0% | 5.4% | 0.6% | $7,000 |

| Jul - Dec 2011 | 6.0% | 5.4% | 0.6% | $7,000 |

| Jan - Jun 2011 | 6.2% | 5.4% | 0.8% | $7,000 |

| 2010 | 6.2% | 5.4% | 0.8% | $7,000 |

For 2011 forward, there was a new simplified Form 940 that replaced previous Form 940 and 940-EZ. You CANNOT average the two rates in 2011. Each period is reported separately on the new form.

Get a listing of SUTA for your state at https://apspayroll.com/resources/payroll-taxes-rates-changes/suta-wage-bases/

Lesson four of The Bean Counter's Payroll Course explains FUTA and SUTA.

The Bookkeeper's Tip

A Good Bookkeeping Practice

Amending Return Payments On EFTPS

When making employee payroll tax payments, sometimes you need to adjust a prior period.

If you need to amend an prior tax period using EFTPS, DO NOT select the screen option "Federal Tax Deposit" as this will apply your payment to the current period.

Instead select one of two other options - Payment due with a return OR Payment due on an IRS notice. Either one of these options will allow you to enter the period the payment applies to.

Source: NACPB June 10, 2011 Payroll Tax Update

Employee Payroll Tax and

Disability Insurance

State temporary disability insurance applies in a handful of states where you have to withhold and/or pay taxes that fund the state's program.

Use CCH's Map of Disability Insurance Taxes at toolkit.com/small_business_guide/sbg.aspx?nid=P07_1298 to see if which jurisdictions have this tax.

Employee Payroll Tax and

Workers Compensation

Workers Compensation varies from state to state. You can find your compensation board on Department of Labor's website at dol.gov/owcp/dfec/regs/compliance/wc.htm .

Payroll Taxes and Tax Deductions

All employee payroll taxes paid by the employer, which does NOT include the employee withholdings as they are part of your gross wage expense, are a tax deductible expense.

Your chart of accounts should include balance sheet accounts called payroll payable and payroll taxes payable. The payroll taxes payable will include federal income tax, social security, medicare, state income tax and state disability insurance. You should also have a direct labor, office wages and (employer) payroll taxes expense accounts on your income statement.

Payroll Journal Entry Example

Click here for Canadian payroll journal entries.

Here is an example of a common U.S. payroll journal entry that records payroll. You can see all the different employee payroll tax liabilities which represents withholdings from the employee's pay.

Debit (Increase) Wages or Salaries Expense for employees gross wage (expense account on the income statement)Credit (Increase) Federal Income Tax Payable (current liability on the balance sheet)

Credit (Increase) State Income Tax Payable (current liability on the balance sheet)

Credit (Increase) Social Security Payable (current liability on the balance sheet)

Credit (Increase) Medicare Payable (current liability on the balance sheet)

Credit (Increase) Insurance Payable (current liability on the balance sheet)

Credit (Increase) Other Deductions Payable like retirement contributions or health care insurance (current liability on the balance sheet)

Credit (Increase) Cash in Bank for the amount of employee net pay (current asset on the balance sheet)

Here is an example of a common U.S. payroll journal entry that records the employer's portion of payroll taxes and benefits. You can see the expense side of the transaction represents the employer's share of payroll taxes.

Debit (Increase) Employment (or Payroll) Tax Expense (expense account on the income statement) (Increase) Social Security Payable (current liability on the balance sheet)

Debit (Increase) Employee Benefits Expense (expense account on the income statement)Credit

Credit (Increase) Medicare Payable (current liability on the balance sheet)

Credit (Increase) FUTA Payable (current liability on the balance sheet)

Credit (Increase) SUTA Payable (current liability on the balance sheet)

Credit (Increase) Insurance Payable (current liability on the balance sheet)

Credit (Increase) Other Payroll Payable like retirement contributions (current liability on the balance sheet)

When it is time to remit your employer and employee payroll taxes to the government, you will record the following government remittance journal entry:

Debit (Increase) The Appropriate Employment (or Payroll) Tax Liability (current liability on the balance sheet)

Credit (Increase) Cash in Bank (current asset on the balance sheet)

IRS Rules for Gifts and Awards

Employee payroll taxes can be complex ... so it is important to know the rules.

Here are the IRS rules for De Minimis Fringe Benefits such as cash benefits, gift certificates and achievement awards given to employees.

Cash awards are a taxable wage and subject to all taxes and withholdings.

Near cash gifts such as gift certificates or gift cards, are never excludable from income, even for de minimis items. They are taxable which means they are subject to taxes and payroll withholdings.

A non-cash gift or award has special rules that must be met to be excluded from employee wages. Generally, include the fair market value in wages subject to FIT, FITW, FICA and FUTA.

The November 29, 2010 AIPB free newsletter (which got me started researching this subject) says "Nontaxable gifts: Fruit baskets, hams, turkeys, wine, flowers and entertainment tickets such as to a show or sporting event, generally are de minimis (nontaxable) fringes if they have a nominal value and are given infrequently."

You can find the information on the IRS website under IRS > Forms and Publications> Publication 15(B) Fringe Benefit Guide ... but I found the supplemental publication Taxable Fringe Benefit Guide explained the rules much more clearly.

There is also a good article at www.aicpa.org titled Giving Employees Gifts May Require Giving to the Tax Collector Too. It is located under Publications> Newsletters> The Practicing CPA> 2008> December. This article includes some planning guidelines ... and explains the long standing rule regarding the $25 limit.

IRS publication 525 Taxable and Nontaxable Income also has some concise information on bonuses, awards and achievement awards. Here is the excerpt pertaining to employee payroll taxes found under Miscellaneous Compensation in the publication:

"Bonuses and awards. Bonuses or awards you receive for outstanding work are included in your income and should be shown on your Form W-2. These include prizes such as vacation trips for meeting sales goals. If the prize or award you receive is goods or services, you must include the fair market value of the goods or services in your income. However, if your employer merely promises to pay you a bonus or award at some future time, it is not taxable until you receive it or it is made available to you.

Employee achievement award. If you receive tangible personal property (other than cash, a gift certificate, or an equivalent item) as an award for length of service or safety achievement, you generally can exclude its value from your income. However, the amount you can exclude is limited to your employer's cost and cannot be more than $1,600 ($400 for awards that are not qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that do not create a significant likelihood of it being disguised pay.

However, the exclusion does not apply to the following awards.

- A length-of-service award if you received it for less than 5 years of service or if you received another length-of-service award during the year or the previous 4 years.

- A safety achievement award if you are a manager, administrator, clerical employee, or other professional employee or if more than 10% of eligible employees previously received safety achievement awards during the year."

I take this to mean that service awards are not taxable (do not attract employee payroll taxes) after five years of service ... but are taxable (do attract employee payroll taxes) if presented before five years of service or if given more frequently than five year periods.

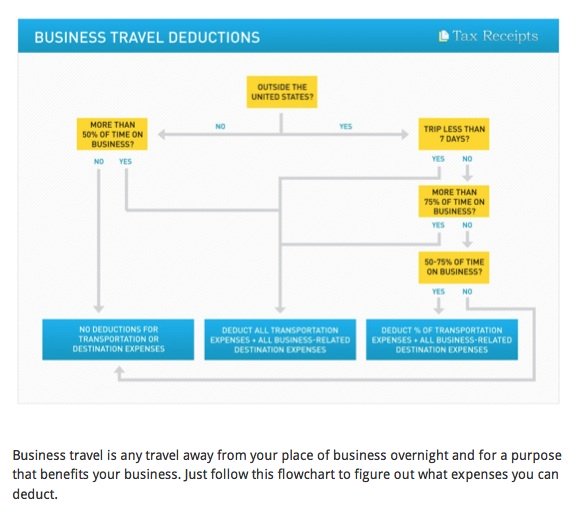

2024 Business Travel Allowances

Tax Receipts has an excellent flowchart summarizing your business travel deductions. It simplifies this complicated and often confusing expense claim. If you have no "tax home" then you are considered a "transient" by the IRS and cannot deduct travel expenses. You can easily establish a "tax home" by simply maintaining a consistent mailing address.

Claiming Expenses Incurred While Travelling Away From Home For Business

The GSA annual per diem rates and IRS special per diem rates are both standards set by the U.S. government that relate to travel costs incurred for business purposes. They are both used to claim amounts for ordinary and necessary business expenses incurred while traveling away from home. However, they are established by different federal entities and used for different situations.

1. GSA Annual Per Diem Rates: These rates are determined by the U.S. General Services Administration and apply to federal employees traveling on official government business. The GSA per diem rates include the maximum allowable reimbursement amounts for lodging, meals, and incidental expenses that employees can claim while on business travel.

The GSA rates come into effect on October 1, 2023 with the standard CONUS per diem rate increasing from 2023. Visit the GSA's per diem "search map" to determine if you are in a nonstandard area.

2. IRS Special Per Diem Rates: These rates are set by the Internal Revenue Service and apply to employers for tax purposes when reimbursing employees for travel expenses. Using these rates helps simplify the tax-compliant substantiation of those expenses. The IRS rates come into effect on October 1, 2023.

It is not mandatory to use the high-low substantiation method when travelling for business. It's an optional method provided by the IRS to simplify expense tracking. The method simplifies deductions by providing a single per diem rate for high-cost areas, and another for all other areas within the Continental U.S., instead of having to find a per diem rate for each city visited.

The alternative would be using the actual expense method, where you keep track of and document all business-related expenses. This can include transportation costs, meals, lodging, and incidentals. The IRS needs to be able to substantiate these expenses, so keeping organized and itemized receipts is crucial.

Find out more about per diems and the current per diem rates here.

The Bookkeeper's Tip

A Good Bookkeeping Practice

Employee Payroll Taxes

U.S. Business Travel Expenses

I subscribe to the free AIPB Bookkeeping Tips newsletter. Every so often it includes a quiz to help you determine if your knowledge is up-to-date.

In their June 22, 2015 newsletter they had a short quiz on tax deductions for travel expenses. So here is a reminder that you must be away on business for travel expenses to be deductible. (Pretty obvious.) Your tax home is the city / town of your principal place of business. Your residence can be your tax home ONLY if there is NO principal place of business. In the U.S. the tax home is defined by where a taxpayer earns income not where they reside.

One question in another quiz (AIPB May 2, 2011 newsletter) explained that "business travel expenses are deductible by an individual or reimbursable to an employee tax free only when incurred while temporarily away from the tax home, which means no more than one year."

Renee Daggett, EA at Admin Books shared this May 18, 2012 tip on FaceBook ...

"For travel and entertainment expenses (other than lodging) receipts are generally NOT required for expenses below $75. You still need to show the time, place, amount and business purpose."

This is background information from a 2010 CPA Daily News article [this publication is no longer available] titled Simplified Per-Diem Rates Lowered for Post-Sept. 30 Business Travel Rev Proc 2010-39, 2010-42 IRB ...

"Background. An employer may pay a per-diem amount to an employee on business-travel status instead of reimbursing actual substantiated expenses for away-from-home lodging, meal and incidental expenses (M&IE). If the rate paid doesn't exceed IRS-approved maximums, and the employee provides simplified substantiation (time, place and business purpose), the reimbursement is treated as made under an accountable plan—it isn't subject to income- or payroll-tax withholding and isn't reported on the employee's Form W-2. Receipts of expenses aren't required.

In general, the IRS-approved per-diem maximum is the GSA per-diem rate paid by the federal government to its workers on travel status. This rate varies from locality to locality. These rates in effect for the federal government's fiscal year period beginning Oct. 1, 2010, may be found at http://www.gsa.gov. However, in applying the per-diem, M&IE, and incidental-expenses-only allowances, an employer may continue using the CONUS (continental U.S.) rates that were in effect for the first nine months of 2010 for CONUS expenses in all of 2010, instead of using the GSA rates that are effective Oct. 1, 2010, provided that the employer consistently uses those prior rates for the last three months of 2010. (Rev Proc 2010-39, Sec. 3.02(1)(a))"

Unclaimed or Uncashed Paychecks

When dealing with employee payroll taxes, you as a business owner need to be aware of escheatment rules and regulations.

If you have employees who did not cash their paychecks, you will find important employee payroll tax information regarding how to handle this type of transaction in QuickBooks on Intuit's website at:

http://payroll.intuit.com/support/kb/1000763.html .

The article is titled Escheat regulations for unclaimed or uncashed wages.

The article explains why "under no circumstances should the funds from uncashed paychecks be returned to the general checking account."

The general rule is the amounts are returned to the state after 1 year. However there are some exceptions.

Unclaimed paychecks for North Carolina, North Dakota and Pennsylvania are returned to the state after two years.

Unclaimed paychecks for Kentucky, Massachusetts, Maryland, New York, and Oregon are returned to the state after three years.

Unclaimed paychecks for Delaware, Illinois, Montana, and Mississippi are returned to the state after five years.

According to AIPB's free newsletter Bookkeeping Tips dated December 20, 2010, you must make a reasonable effort to contact the employee. In addition, you remain liable for any unclaimed wages until they are paid or turned over to the state.

The unclaimed wages must be reported to your state annually during the holding period. AIPB says the reporting information required is:

- employee’s name,

- last known address,

- description of the abandoned property (“wages”),

- the date the wages became payable,

- the dollar amount involved, and

- the date of the last transaction with the employee.

Penalties and interest charges will be levied if you attempt to spend or keep the unclaimed wages.

The Accounts Payable Network (www.theaccountspayablenetwork.com) states that you should void the uncashed checks. If the owner reappears, they have a right to their property so just reissue a check at that time. They say use of the money in the interim is a business decision.

I would open up a separate bank account specifically to hold these voided and unclaimed paychecks.

The Accounts Payable Network has a list of escheatment resources if you need more information. Look under AP Compliance Suite> Escheatmet> Escheatment Resources.

Don't forget to check out my other chats on employee payroll taxes.