- Home

- US Small Business Tax Compliance

- Employee Payroll Taxes

- Payroll for a Small Business Owner

- Part 1 - Payroll Setup and Management

Setting Up and Managing Payroll

For Small Businesses with 10 or Fewer Employees

by L. Kenway BComm CPB Retired

Published January 24, 2025 | Revised January 28, 2025

PREVIOUS SECTION >> Payroll For A Small Business Owner

NEXT SECTION >> Payroll Tax Reporting and Compliance

Table of Contents

Part 1 - Setting Up and Managing Payroll

Getting Started with Payroll

- What You Must Have Now (For Businesses with Fewer Than 10 Employees): State and local requirements, worker's compensation insurance, FUTA, SUI.

- Introduction to Payroll Compliance: Overview of federal, state, and local regulations.

Employee Documentation and Setup - Worker Classification Employee vs. Independent Contractor: Discussion and best practices on proper classification to avoid misclassification, including IRS tests and potential consequences of misclassification and a checklist.

- Form I-9 Employment Eligibility Verification: Detailed completion instructions, compliance requirements, document retention, E-Verify, and anti-discrimination practices.

- Form W-4 Employee's Withholding Certificate Processing and Compliance: Employer responsibilities for processing W-4s, handling employee exemptions, and addressing changes in withholding. Focus on compliance.

- Form W-9 Request for Taxpayer Identification Number and Certification: Hiring independent contractors requires different forms and is a different process than hiring employees.

- Payroll Software and Technology: Suggestions on selecting and implementing payroll software, timekeeping systems, and other relevant technologies.

Payroll Operations - Payroll Processing and Recordkeeping: Best practices for data entry, calculations, reporting, and maintaining accurate records (physical and electronic), data security, and privacy. Includes wage and hour laws.

- Payroll Accounting and Reconciliation: Integrating payroll with accounting systems, reconciling payroll data, generating reports, and resolving discrepancies.

- Compliance changes at the 10-employee threshold: Benefits administration, OSHA and increased complexity.

- Wrap-up

Part 1 - Setting Up and Managing Payroll For Fewer Than 10 Employees

1. What You Must Have Now (For Businesses With Fewer Than 10 Employees)

Section TOC

- State and Local Regulations

- Workers' Compensation (WC)

- Federal Unemployment Tax Act (FUTA)

- State Unemployment Insurance (SUI)

Think of this 'Must Have Now' list as your immediate checklist. These items are non-negotiable for running payroll legally. Think of it like building a house - you need the foundation (state requirements, WC) before you worry about the roof (EEO-1, ACA).

- State and Local Regulations: You know how each state and city has its own personality? Well, they also have their own rules about when certain requirements kick in. For example, once you hit 5 employees in some places, you might need to start offering paid sick leave. Several states, including California, Connecticut, and Arizona, mandate paid sick leave. These laws often specify accrual rates and usage rules. Another example would be minimum wage laws. State and even local minimum wage laws can differ from the federal rate. You MUST pay the highest applicable minimum wage. In other areas, you might need to provide family leave benefits when you reach 8 employees. Or cities like San Francisco and Seattle have predictive scheduling laws, impacting how you create employee schedules.

Here's a tip so you don't get caught off guard; keep a close eye on your employee count and occasionally check your state and local requirements. It's much easier to plan ahead than to suddenly realize you've crossed a threshold and need to scramble to comply.

Want to play it safe? I'd suggest checking your state's labor department website every few months, especially when you're planning to hire. Here is the Department of Labor link to their general state labor department finder to determine the specific requirements for your location. Also, check with your local city or county government for any local ordinances.

And while not entirely about employees, I am going to assume you have your business license, state tax registration, local tax permits, and the required workplace posters. - Workers' Compensation (WC): It is one of those must-haves that can feel a bit overwhelming at first. Think of it as insurance that protects both you and your employees if someone gets hurt on the job. There are potential penalties for non-compliance.

Every state has its own rules about who needs coverage (though Texas is the only state where it's optional - but that's a whole other conversation!). It is required in most states from your first employee. It also needs to be in place before employees start work.

The amount you'll pay depends on things like what type of work your business does and how many people you employ. For example, if you run an office, your rates will be much lower than if you operate a construction company.

Here's a helpful tip; as your team grows, keeping track of workers' comp gets trickier. You'll need to be more careful about classifying employees correctly and reporting payroll accurately to your insurance carrier. My two cents? Build a good relationship with your insurance agent - s/he can be a huge help in keeping everything straight. - Federal Unemployment Tax Act (FUTA): I know, another tax, right? But FUTA applies to all employers who pay $1,500 or more in wages in any calendar quarter or have one or more employees for some part of a day in each of 20 different calendar weeks.

The rules are the same whether you have 1 employee or 100 - it's just less paperwork with a smaller group of workers. On the bright side? Since you have fewer than 10 employees, handling FUTA isn't too complicated yet.

QUICK TIP: Mark your calendar when you hire your first employee. That'll help you track those 20 weeks, which can sneak up on you if you're not paying attention!

Go To >> FUTA Employee Payroll Taxes - State Unemployment Insurance (SUI): Think of it as FUTA's state-level cousin, but here's the thing - each state likes to do things their own way. For example, while one state might require you to register for SUI as soon as you hire your first employee, another might not kick in until you have three or four employees. And the rates? They can be all over the map too.

Here's what I recommend; take a few minutes to look up your state's specific rules. Just Google '[your state] unemployment insurance requirements' or give your state's unemployment office a quick call. It is w a a a y better to know this upfront than to find out later you should have been registered months ago!

2. Introduction to Payroll Compliance

Section TOC

- Federal level compliance

- State level compliance

- Payroll processing flowchart

- What is payroll processing?

- What is payroll compliance?

Managing payroll in a small business requires careful attention to federal, state, and local regulations. As an employer, you're responsible for correctly handling employee wages, tax withholdings, and government reporting and remitting requirements.

At the federal level, you must comply with the Internal Revenue Service (IRS) and Social Security Administration (SSA) regulations, including proper tax withholding, timely deposits, and accurate reporting through Forms 941, W-2, and W-3. The Fair Labor Standards Act (FLSA) governs minimum wage, overtime, and recordkeeping requirements.

State-level compliance varies by location but typically includes state income tax withholding, unemployment insurance contributions, and workers' compensation insurance. Local jurisdictions may impose additional requirements, such as city or county income taxes.

For small businesses with fewer than 10 employees, establishing proper payroll procedures from the start is important. While the requirements may seem overwhelming, breaking them down into manageable tasks and maintaining consistent processes will help ensure compliance and avoid costly penalties.

This manual will guide you through the essential steps of payroll management, from new hire reporting to year-end processing, with practical tips to help you maintain accurate records and meet your obligations as an employer.

Once you hire your tenth employee, payroll compliance requirements for a small business owner changes. I'll provide some things for you to consider before you reach the 10-employee mark.

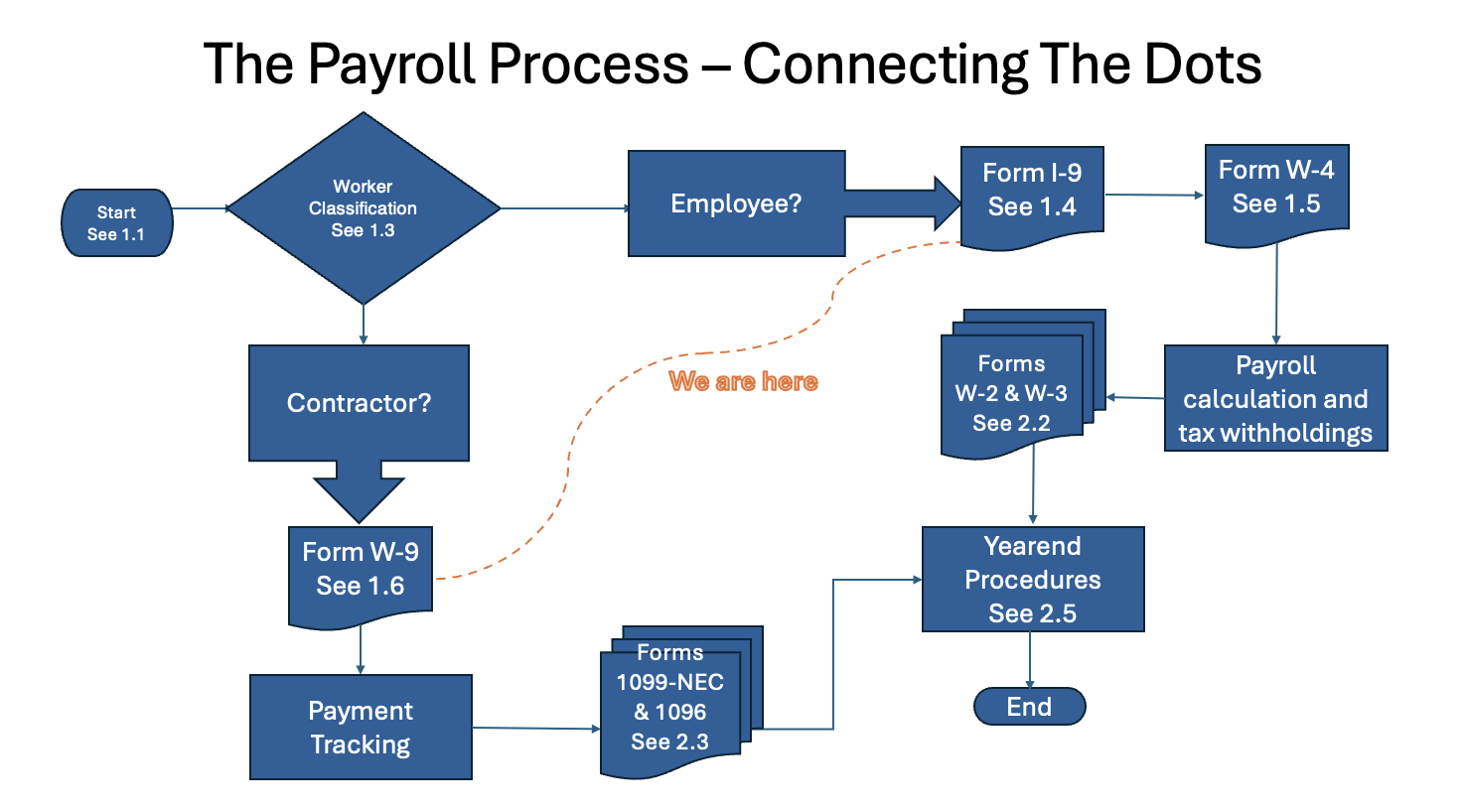

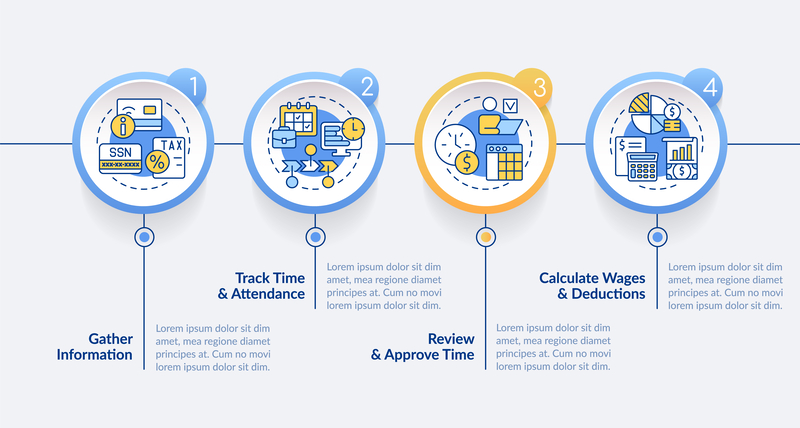

Let's look at a flowchart to give you a clear overview of the entire payroll process. It shows you how the different forms and procedures relate to each other.

We are looking at the payroll setup and management section now.

We are looking at the payroll setup and management section now.Let's look at the difference between payroll processing and payroll compliance.

What is payroll processing?

Think of payroll processing as the routine task where you figure out how much to pay your employees, handle the necessary tax deductions, and make sure you're following the rules that apply to small businesses in the U.S. It's about getting the right amount of money to your employees on payday and keeping everything organized on your end to avoid any compliance headaches. For you as a small business owner, getting this right helps keep your employees happy and your business running smoothly.

What is payroll compliance?

Payroll compliance is a bit different but related. It's about making sure that your business is following all the laws and regulations surrounding payroll, like properly withholding taxes, adhering to minimum wage laws, and reporting accurate information to the government. While payroll processing is the actual act of calculating and delivering paychecks, payroll compliance ensures that every part of that process meets legal requirements, keeping you out of trouble with tax authorities and other regulators. Essentially, compliance is about doing everything by the book, while processing is about getting the job done.

Supporting Articles for Federal Payroll Taxes

3. Worker Classification Employee vs. Independent Contractor

Section TOC

- Worker classification

- Documentation tip

- Factors to consider

- Pro tip

- Independent Contractor Checklist

Proper worker classification is one of the most important decisions you'll make as an employer. Misclassification can result in significant penalties and back taxes. Misclassification penalties can include back payroll taxes plus interest, up to $1,000 per misclassified worker in federal penalties, potential state fines, and liability for unpaid overtime and benefits.

Independent contractor rules assist the IRS in determining whether you have correctly classified your employees and contractors. Some states have stricter contractor tests (like California's ABC test). Make sure you check your state's requirements.

Employee payroll tax rates and benefits are more costly to the employer. It can be advantageous to hire an independent contractor (IC) instead of an employee ... that's why it is a frequently audited area.

Make sure you verify that your independent contractors actually meet the criteria ... and are not really employees.

DOCUMENTATION TIP: Always maintain a written independent contractor agreement, copies of contractor business licenses/insurance, invoices and payment records, and documentation supporting your classification decision.

Learn More >> Independent Contractor Rules

How do you determine if someone should get a W-4 and W-2 or a W-9 and 1099-NEC? Consider these factors:

- Behavioral control: Do you set work hours? Do you provide detailed instructions? Do you require specific tools/methods?

- Financial control: Can they work for others? Do they invoice you for work? Do they have business expenses?

- Relationship type: Is the work ongoing/permanent? Is the work core to your business? Do you provide benefits?

If you control the work method, they're likely an employee (W-4 & W-2). If they control their work method, likely contractor (W-9 & 1099-NEC).

PRO TIP: When in doubt, classify as an employee. It's safer than risking misclassification penalties. Consider consulting a tax professional for borderline cases and use Form SS-8 as a last resort in unclear cases.

Learn More >> When to use the Form 1099-NEC

Understanding Forms W-9 and 1099- NEC for Independent Contractors (A Checklist)

- Get a W-9 completed and signed BEFORE the first payment is made. The W-9 gives you their correct Tax ID/SSN and verifies their business name and address. Keep this in your files.

- It is strongly recommended you have a written contract. It would be prudent to have it reviewed by a lawyer. It should include the scope of work, payment terms, project deadlines, independent contractor status clearly stated, both parties have signed. Keep a copy for your records.

- Keep detailed payment records. Track ALL payments to each IC. If you pay an IC $600+ in a year, you MUST issue a 1099-NEC. Keep receipts/invoices from IC.

- Set a calendar reminder for the 1099 deadline. Prepare 1099-NECs by January 31st. Copy A to IRS. Copy B to contractor. Keep Copy C for your records.

- Tax form 1096 (similar to a W-3, but for 1099s). Submit to IRS with Copy A of 1099s.

- Consider using a 1099 filing service.

Warning Flag

If IRS reclassifies an IC as employee, you're liable for back payroll taxes, penalties, interest, and benefits.

More >> Independent Contractor Rules

4. New Hire Documentation and Reporting

Section TOC

- What is the purpose of an I-9 form?

- Federal and state new-hire steps

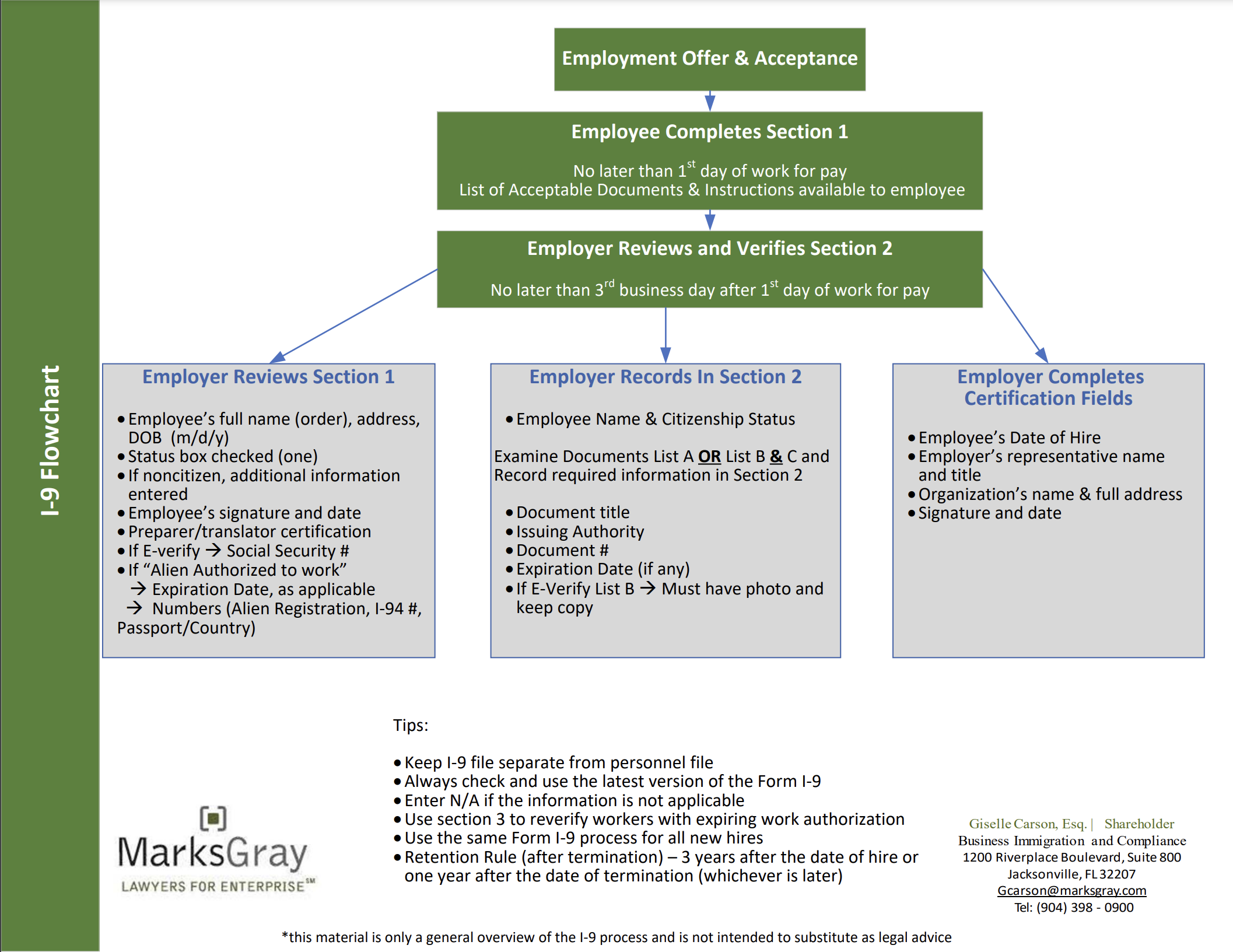

- I-9 flowchart

- Remote worker I-9 reporting

- Deadlines - Form I-9 and new hire reporting

- Best Practices for New Hires, a Checklist and Tips

- Timeline and requirements for Federal Form I-9

- Tips on making it easier for yourself (remote workers, penalties for non-compliance, workflow suggestions)

A visual for you of the header of an I-9 form

A visual for you of the header of an I-9 formStarting fresh with a new hire? Making sure you are compliant from day one can set your business up for success. Consider this story:

During tax season last year, Jessica, who owns a local café with nine staff members, was overwhelmed by the mounting paperwork. She had missed a couple of changes in the tax law that affected the W-4 forms. After a frantic search online and a last-minute call with her CPA, she realized the importance of staying updated and having a clear, step-by-step process for managing these forms. This experience prompted her to revise her approach. Now she emphasizes accuracy and compliance. It’s stories like this one that illustrate why having a structured procedure in place is so necessary.

What is the purpose of an I-9 form?

An I-9 Employment Eligibility Verification form is a document that employers in the U.S. need to fill out whenever they hire someone. Its main purpose is to check that new employees are who they say they are and that they’re allowed to work in the U.S. Both U.S. citizens and non-citizens have to fill it out.

The I-9 is your proof that you've verified your employee can legally work in the U.S. Think of it as your protection - it shows you've done your due diligence as an employer.

If this is an issue for your small business, it is recommended you consult an attorney specializing in immigration law for specific legal guidance.

I-9 Overview (Getting your new hire started right)

Federal And State New-Hire Steps

(What you need to do when you hire a new employee)

Let's separate the I-9 vs new hire into two distinct processes - it's easy to get mixed up, but they're different obligations:

PROCESS 1: Federal I-9 Requirements (This is all about verifying work eligibility.)

1. Get the latest Form I-9 from uscis.gov/i-9.

2. Have your new employee complete Section 1 by their first day.

3. You complete Section 2 within 3 business days.

4. Check their original identity and work authorization documents.

5. Keep the form for 3 years after hire or 1 year after termination (whichever is later).

As a new employer, your first task is completing the Form I-9 with your new hire. This form has two parts - one for your employee to fill out and one for you. Your new employee needs to show you original documents (not copies) that prove who they are and that they're legally allowed to work in the U.S.

PROCESS 2: New Hire Documentation (This is about taxes and reporting.)

Federal Requirements:

1. Have employee complete Form W-4 for tax withholding.

Your new employee needs to fill out Form W-4 (Employee's Withholding Certificate) so you know how much federal tax to withhold from their paycheck. Many states have their own version of this form too - you need to check if your state requires one.

You need to know that if your employee doesn't turn in their W-4, the IRS requires you to withhold at the highest rate - as if they're single with zero adjustments. Also, if you have employees who were hired before 2020, they can keep using their old W-4 unless they want to change their withholding amount.

2. Report new hire to your state (yes, it's federal law, but states handle it). See how under state requirements below.

State Requirements (check your state's website for specifics):

1. State tax withholding forms

Have the employee complete and submit your state withholding form if applicable (in addition to the federal Form W-4 Employee's Withholding Certificate).

2. New hire reporting (deadlines vary)

As a business owner, you'll need to report each new employee to your state agency - it's a federal requirement but handled at the state level. The good news is it's usually pretty straightforward: in most cases, you can simply submit a copy of their W-4 electronically.

It would be prudent for an employer to visit your state's new hire reporting website to find out three key things:

- Your state's specific reporting deadline

- Whether they need their own state withholding forms

- Any extra documentation they might want

For example, some states want the information within 20 days of hire, while others give you less time. See the Reference Guide Resource section to find out how to find your state's specific new hire reporting program.

3. E-Verify (mandatory in some states)

Use the U.S. Citizenship and Immigration Services' E-Verify system at dhs.gov/e-verify to verify "whether the employee’s name and social security number (SSN) match the government’s records". While some states make E-Verify optional, others require it. Also, if you're working as a federal contractor, you must use E-Verify.

Smart Moves for Getting it Right

- Ask to see their Social Security card (This isn't mandatory but it is best practice.)

While not required by law, it's smart to ask your new employee to show you their Social Security card. This helps you double-check that you've got their name and Social Security number exactly right in your records - which really pays off when you're filing W-2s and other tax forms later. You can make a copy of the SSN card for your files, but heads up - some states have restrictions about copying personal documents, so you might want to check your state's guidelines first. - Verify their SSN through SSA's online system (ssa.gov/employer/ssnv.htm)

While not required, I strongly recommend using the Social Security Administration's online verification tool. It's a free service that lets you check if your employee's name and Social Security number match the SSA's records.

- Register for SSN verification before you need it. There is a registration process to use this service, so think ahead and register in advance. It will save you time when onboarding new employees.

- If you ever run into a situation where an employee hasn't provided their SSN, head over to socialsecurity.gov/employer/critical.htm for what your next steps are.

Remember: These are two separate processes that happen to occur at the same time. Don't mix them up!

Before You Start (Let's get organized before you jump in)

This section is about preparation - getting your ducks in a row before you actually start filling out I-9s. It's like checking your ingredients before starting to cook.

Remote Worker I-9 Reporting

Here are general guidelines for remote workers.

- Remote workers generally report to the state where the employee physically works.

- For multi-state workers, they report to their primary work location, in other words where they spend the most time working.

- If a worker is fully remote, s/he reports to the state of their residency.

- Some states require reporting even if employee only works there part-time.

Form I-9 and New Hire Reporting Deadlines

(Federal and State requirements are different)

Let's break this down into two separate requirements - they're related but different:

1. Form I-9 (Federal Requirement)

This is all about verifying employment eligibility. The timeline is strict and the same nationwide*:

- Section 1: Your new hire must complete this by their first day

- Section 2: You need to complete this within 3 business days of their start date

No exceptions here - these deadlines are set in stone.

2. New Hire Reporting (State Requirement)

This is different from the I-9 and varies by state. - it's mainly for state tax and child support enforcement. Here's what you need to know:

- Different deadlines: Each state sets its own deadlines typically 7 - 20 days.

- Different submission methods: Many states prefer electronic submission and might even offer incentives for filing this way. Electronic submissions are optional, not mandatory.

- Different requirements: There are states that have their own new hire reporting systems and occasionally request additional information beyond the federal baseline, such as the employee's start date or expected wage.

Quick Tip: While I've given you the general picture, state requirements can change. I recommend bookmarking your state's new hire reporting website and checking it periodically. See the Reference Guide Resource section to find out how to find your state's specific new hire reporting programs.

Remember: Don't mix these up! The I-9 stays with you (it's for your records), while the new hire report goes to your state (they need it for their records).

*It is generally accurate to say that states follow the 3-day federal deadline for I-9 completion. There might be some minor state-specific variations or additional requirements, but the core 3-day rule from the date of hire is the federal standard that applies nationwide. It's always best to consult official government resources or legal counsel for definitive confirmation in specific situations.

Getting It Right (Step-by-setup ...)

This is where I walk through exactly what you need to do, in plain English, to complete and process I-9s correctly. Think of it as your "I-9 recipe" - following these steps will help ensure success.

Let's Chat About ...

Best Practices for New Hires, a Checklist and Tips

(Because you don't have an HR or Payroll department)

As an owner of smaller business, need to be especially diligent about your new hire practices because you don't have a dedicated HR/payroll department. You (the owner) are most likely handling these responsibilities yourself. This gives you less room for error in terms of compliance penalties. So here are your best practices which I will follow up with some tips.

1. Before/On First Day:

- Have employee complete Form W-4.

- Have employee complete state tax withholding form(s).

- Have employee complete I-9 Section 1.

- Collect direct deposit information.

- Gather emergency contact information.

2. Within 3 Business Days of Start Date:

- Complete I-9 Section 2 (employer portion).

- Review and verify employee's identification documents.

- Make copies of ID documents (recommended but not required).

3. Within Required State Timeline (varies by state):

- Submit state new hire report.

- Typically 20 days, but check your state requirements.

4. File Management:

- Store I-9 forms separately from personnel files.

- Maintain a secure filing system for confidential information.

- Keep payroll records for at least 4 years.

5. Payroll System Setup:

- Enter employee information immediately.

- Set up tax withholdings based on W-4.

- Configure direct deposit if applicable.

- Document pay rate and schedule.

Practical tips for a business with under 10 employees:

- Keep a simple calendar or checklist for these tasks.

- Set up reminders for key dates in your phone or on your computer.

- Consider using basic payroll software (like QuickBooks Payroll or Gusto) to automate some of these tasks.

- Maintain a basic spreadsheet tracking system logging when forms were completed / submitted.

- Ensure a person (doesn't have to be you) verifies all personal information like SSNs, banking information, etc.

- Keep copies of everything, even if you are using an electronic system.

Note: The main difference between large and small businesses isn't in WHAT needs to be done (the compliance requirements are the same), but in HOW it's managed. Small businesses need simpler, more straightforward processes that can be handled by one or two people.

One of the advantages small businesses have is flexibility and a personal touch. For instance, while large companies might rely on automated systems and an HR (Human Resources) department to manage employment forms like I-9s, a small business owner, like yourself, can personally review these forms for completeness and accuracy. This chat with your new hire not only keeps you compliant but also helps you connect with them right away.

Federal Form I-9 Requirements and Timeline

(Timely compliance avoids potential fines and legal issues)

Employers must complete Form I-9 for verifying the employment eligibility of new hires. This is a mandatory federal requirement.

In general, at the federal level, I-9 paperwork must be completed within 3 days after the date the employer hires the employee even if you are using paper filing methods. The completed form is retained by the employer, and there is no requirement to submit it to USCIS unless specifically requested during an audit or investigation. Missing I-9s is a serious violation.

Making It Easier For Yourself (Tips)

This section shares practical advice and shortcuts.

1. Additional Tips for Remote I-9s

Employers can designate an authorized representative (anyone they choose) to complete Section 2 of the Form I-9 for remote hires. This person does NOT need to be a notary. However, the employer remains liable for any errors the authorized representative makes.

Utilizing electronic I-9 systems is recommended. These systems can simplify the hiring process, especially for remote hires. They also provide secure storage and audit trails.

2. Penalties for I-9 Non-Compliance

It's extremely important to be complainant with I-9 requirements. Penalties can range from civil fines to criminal sanctions. Here's a breakdown of I-9 penalties (June 28, 2024 rates) that could apply:

- Fines can range from $281 to $2,789 per violation for paperwork errors (like missing or incorrect information).

- Knowingly hiring or continuing to employ unauthorized workers carries significantly higher penalties, ranging from $698 to $5,579 per violation for a first offense, and up to $27,894 per violation for subsequent offenses.

- Employers engaging in a pattern or practice of I-9 violations face even steeper penalties, up to $27,894 per violation and potential criminal sanctions.

- E-Verify employers failure to inform DHS of continuing employment following a final nonconfirmation (FNC) carry penalties ranging from $973 to $1,942 per relevant individual employee.

- Employers cannot discriminate against individuals based on national origin or citizenship status when completing the I-9 process. Discrimination penalties can be severe.

If this is an issue for your small business, it is recommended that consult an attorney specializing in immigration law for specific legal guidance.

3. My Suggestions

- Use electronic submissions where possible to minimize errors and streamline processes. That said, you must carefully confirm documents presented in person as I-9 software does not provide safe harbour. Remember, remote verification practices ended July 31, 2023.

- Always check to ensure you are using the most recent version of Form I-9.

- Employers should consider maintaining a new hire checklist to ensure consistent compliance with all these requirements for each new employee. This is especially helpful for small businesses that hire infrequently and may not have established HR procedures. I included a generic checklist above under Best Practices.

Go To Reference Guide* >> SSA / IRS Employment Tax Forms - Form I-9

*The I-9 section of this manual is like me sitting with you saying, "Okay, here's what you need to DO," while the tax forms reference guide is your technical backup. It includes stuff like some common issues to watch for.

5. Processing and Compliance of Form W-4 Employee's Withholding Certificate

Section TOC

- What is the purpose of a Form W-4?

- Quick Overview

- Biggest Misconception

- When do you need a new W-4?

- Reviewing W-4s

- Federal Income Tax Withholding Calculator

- The IRS Lock-In Letter

- W-4 Best Practices

What is the purpose of a Form W-4?

A W-4 Employee's Withholding Certificate is a key piece of the onboarding puzzle. Think of it as your employee's "tax recipe card" - it tells you how to withhold their taxes

When you hire a new employee, you need them to fill out this form to determine how much federal income tax to withhold from their paychecks. It captures details like their marital status and number of dependents, which affect tax calculations. Having accurate W-4 information helps ensure that the tax withholding is just right, so the employee isn't surprised by a big tax bill or refund at the end of the year. It's all about getting the balance right from the start!

Quick Overview

Here's a quick overview of how to process W-4 forms:

- Every new employee must complete this tax form BEFORE their first paycheck. Employees must complete Form W-4 by their first day of work. If they fail to provide a W-4, withhold at the highest rate - single with no adjustments.

- The tax form tells you how much tax to withhold from their paychecks.

- Get this signed on day one along with I-9 employment verification.

- Keep these forms in a secure employee file.

- If an employee wants to change their withholding, they submit a new W-4.

Compliance Note about INVALID W-4s: Reject any W-4 that's altered or defaced, has unauthorized additions, or contains statements of inability to pay tax. You should request a new form and withhold as a single with no adjustments until received.

Special Case - Independent Contractors: Independent contractors DO NOT fill out a W-4. They are responsible for their own taxes. They will instead fill out a Form W-9 to provide you with their Taxpayer Identification Number (TIN). Make sure you understand the difference between employees and independent contractors – misclassifying workers can lead to significant penalties. I discussed in Section 2 - Worker Classifications.

Learn More >> Reference Guide - W-9

Before You Start - Biggest Misconception

(Hey, don't assume one form covers both!)

Small business owners who handle their own payroll taxes need to be on the lookout for these costly mistakes regarding state withholding requirements.

The biggest misconception is assuming that the federal Form W-4 automatically works for state withholding. It doesn't. Many states require their own specific withholding forms, and state withholding rules often differ from federal requirements. Using the wrong form can result in:

- Under-withholding, leaving your employees with unexpected tax bills. Ouch!

- Over-withholding, unnecessarily reducing employee take-home pay. Double ouch!

- Potential penalties from state tax authorities. No comment from me!

- Additional administrative burden to correct errors. More paperwork for you!

While sixteen states like Alabama, Arkansas, Colorado, Connecticut, Delaware, Hawaii, Idaho, Kansas, Montana, Nebraska, New Hampshire, New Mexico, North Dakota, Oklahoma, South Carolina, and Utah as well as the District of Columbia tax jurisdiction accept the federal W-4, twenty-six require state-specific forms. Additionally, state requirements can change annually. Eight states like Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don't have state income tax, so no state withholding forms are needed.

Make sure to review the form carefully for them; even simple errors can lead to incorrect withholding, which can cause headaches for you and your employees later on.

My Suggestions:

- Contact your state tax authority directly to confirm current requirements and obtain the necessary forms from your state's Department of Revenue website. The IRS has a nice page with links to each state website you might find useful. It's at irs.gov/businesses/small-businesses-self-employed/state-government-websites.

- Consider using professional payroll services - the cost often outweighs the risk of errors.

- At a minimum, consult with a tax professional to set up your withholding system correctly.

I never realized how lucky we are in Canada that our federal, provincial and territorial Finance Ministers work together to reduce duplication of paperwork for small business owners.

When do you need a new W-4?

Key triggers: employee claims exempt status, major life changes like marriage/divorce, or employee requests changes

Let's chat about when you'll need to deal with W-4s. Obviously, you need one when you hire someone new - that's a given. But there are other times too. Your employee might need to submit a new W-4 when:

- They get married or divorced.

- Have a baby or adopt.

- Their spouse starts or stops working.

- They want to adjust their withholding amount.

- They claim exempt status (these need to be renewed annually). An employee might claim exempt if they had no tax liability the previous year and expect none in the current year.

It's important to note that employees can change their W-4 at any time, they don't need to wait for the start of a new tax year.

Remember, the IRS provides tools to help both you and your employees figure this out. I let you know where to find these resources in the Reference Guide. There is a link to it at the end of W-4 section.

Getting It Right - Reviewing W-4s

As a small business owner, you need to check these key items when an employee hands you their W-4. Think of it as your quick checklist:

1. The Basics (Must-Haves):

- Is it signed and dated? No signature = not valid.

- Did they write their full name and Social Security Number (SSN)? Seems obvious, but you'd be surprised!

- Is it the current year's form? The IRS made big changes in 2020.

2. Red Flags to Watch For:

- Did they claim "Exempt" from withholding? They must write "Exempt" in Step 4(c) AND complete Steps 1(a), 1(b), and 5. This expires every February 15th!

- Watch out for any crossed-out or altered text - that's a no-go as in not allowed!

- Watch for inconsistencies like claiming "single" with married credits. Check, then double check.

3. What To Do With Problem Forms:

- What if something's missing? Give it back right away and explain what's needed.

- What if they refuse to complete a W-4? You must withhold as "single" with no adjustments.

- What if the form is a problem for you? Document and keep a copy of any issues or unusual conversations in your records.

- What if you get an IRS Lock-In Letter (LIL)? If an employee provides an LIL, it means no further W-4 changes can be accepted without a new W-4 and a copy of the LIL. (See the Reference Guide for more information.)

Quick Tip: Make a copy of the W-4 and note the date received right on the copy. This simple habit will save you trouble later!

IRS Federal Income Tax Withholding Calculator

The IRS has a federal income tax withholding calculator that employees can use to help fill out the W4. It is important in these situations to use the calculator to avoid under-withholding:

- an employee has more than one job; or

- an employee is a couple where both are employed; or

- the couple have several children.

This useful tool can be found on the IRS website by searching for "withholding calculator" or keep reading for another way.

Using the Withholding Calculator

I know the IRS calculator looks intimidating, but it's actually pretty straightforward. Here's what you do:

- Go to IRS.gov/W4App.

- Have your employee's pay information ready.

- Follow the prompts (it's like TurboTax - just answer the questions).

- Use the results to verify if their W-4 makes sense.

The IRS Lock-In Letter: Extra Withholding Accuracy

The IRS Lock-In Letter is officially called a "Letter 6419." It's for employees who have had issues with inaccurate withholding in the past or want to ensure their current withholding is correct and remains unchanged. The letter verifies (1) the employee's withholding based on their specific circumstances, and (2) restricts any further changes to their withholding without their explicit consent.

Employees can request a Lock-In Letter by contacting the IRS directly. It provides peace of mind and helps prevent future tax surprises. You, as the employer, don't need to do anything with the Lock-In Letter itself other than be aware of its existence.

Making It Easier For Yourself - W-4 Best Practices

Be kind to yourself and consider the following:

1. Where to download official W-4 forms (bookmark this!)

You can find a pdf of the current year W4 Employee's Withholding Certificate to download and print the most current tax year form at irs.gov/pub/irs-pdf/fw4.pdf . This employment tax withholding form underwent major revisions in 2020 including the federal income tax withholding calculation method. It is to be completed by each employee so that you withhold the correct amount of federal income tax.

2. Create a W-4 tracking system. You don't need anything fancy - just reliable. I suggest you create a simple spreadsheet with these columns:

- Employee name

- Date W-4 received

- Effective date

- Status/elections made

- Next review date (if applicable, like for 'exempt' status)

- Notes (like 'exempt' status that needs yearly renewal)

Tip: Set a January calendar reminder to check any 'exempt' W-4s since they expire February 15th each year. This will save you from scrambling at the last minute!

3. Storing W-4s (both paper and digital) - here is what works best for most small businesses:

Paper Storage: Keep W-4s in individual employee folders, store in a locked, fireproof cabinet (yes, really - the IRS wants these safe!), keep them for at least 4 years after the employee's last tax return or termination, label the folders clearly with employee name and hire date.

Digital Storage: The IRS allows electronic W-4s. It is becoming popular.

- Scan W-4s as PDFs (most phones have great scanning apps now).

- Use consistent file naming (like 'W4_LastName_FirstName_YYYY-MM-DD').

- Back up files in at least two places (cloud storage plus local) but honestly these days I prefer the 3-2-2 backup protocols.

- Password protect the folder containing tax documents.

- Keep digital copies as long as paper ones.

Most payroll software systems automatically handle W-4 storage and updates. This is especially helpful for small businesses. I talk more about your options later in the guide.

Pro Tip: When an employee gives you a new W-4, don't toss the old one - keep it with their records. The IRS might ask about historical withholding calculations.

Go To The Reference Guide* >> SSA / IRS Employment Tax Forms - W-4

*The W-4 section of this manual is like me sitting with you saying, "Okay, here's what you need to DO," while the tax forms reference guide is your technical backup. It includes stuff like what to do with undeliverable forms.

6. Form W-9 Request for Taxpayer Identification Number and Certification

What is the purpose of a Form W-9?

The Form W-9 Request for Taxpayer Identification Number and Certification is like the W-4 for employees. It collects the contractor's TIN or SSN and confirms their business details. Ensure this is completed before making any payments.

When you onboard a new independent contractor, it's a bit different than hiring an employee. Check the flowchart to see the two different processes.

Best Practice - Always obtain a signed W-9 before issuing the first check. This form is super important for your records and future tax reporting. You don't want to be chasing after the contractor for this information days before the 1099-NEC are set to go out!

Additional Considerations - It’s highly advisable to have a written contract that spells out payment terms and the nature of the work. This sets clear expectations and protects both parties.

Go To The Reference Guide* >> SSA / IRS Worker and Employment Tax Forms - W9

*The W-9 section of this manual is like me sitting with you saying, "Okay, here's what you need to DO," while the tax forms reference guide is your technical backup. It includes stuff like common mistakes to avoid and other tips.

7. Payroll Software and Technology

Section TOC

- Spreadsheets vs Software

- Free vs. Paid Software

- Specific Software Suggestions

- Cloud-Based vs. On-Premise

- Integration with Other Systems

- Demo or Trial Period

- Security Considerations

Here's some suggestions on selecting and implementing payroll software, timekeeping systems, and other relevant technologies. I'm not an expert by any means. I just want to put this stuff on your radar for consideration. As a small business owner, you are continually having to learn new stuff. This is one area you need to pay attention to.

Spreadsheets vs Software

I get why spreadsheets might seem appealing – they're familiar, often already on your computer, and don't cost anything extra. Kind of like driving a trusty old pickup truck – you know how it works, and it gets the job done.

However, payroll involves a lot of moving parts, more like a F-150® Tremor® pickup . I suppose you COULD maybe service the truck yourself, but it's tough without all the new specialized tools that make the job much easier and more accurate. Payroll software is a specialized tool.

The point I'm trying to make is that servicing the modern truck without specialized tools illustrates the challenges of managing payroll with spreadsheets alone. Payroll software, like those tools, is designed to tackle complex tasks efficiently and accurately. The complexity and advanced capabilities required for payroll is just like the specialized tools needed for maintaining a modern vehicle.

Payroll software automatically calculates tax updates (which is always a huge pain point when doing payroll), creates audit trails and backup, and reduces errors in tax calculations (saving you a ton by avoiding expensive mistakes).

Free vs. Paid Software

Free payroll software usually has hidden costs and limitations. The free versions typically handle basic calculations but miss helpful features like tax filing, direct deposit, or year-end W-2 processing. You'll will find yourself doing these tasks manually, which eats up your valuable time and increases the risk of errors.

While free software might work if you have just one or two employees and are comfortable handling tax filings yourself, most small business owners find that paying $30-50 per month for full-service payroll software is worth every penny. Paid versions usually include time-saving features like employee self-service portals and automatic tax updates that can save you hours each month. Think about this when deciding which way to go - one tax filing mistake could cost you more in penalties than a whole year of paid software.

Specific Software Suggestions*

Popular options for small businesses include QuickBooks Payroll - good for businesses already using QuickBooks; Gusto - known for its user-friendly interface and HR features; Square Payroll - works well for retail and restaurant businesses; ADP Run - a comprehensive solution with strong compliance features

*Disclaimer: This list represents common choices but isn't an endorsement. Research thoroughly to find what fits your needs.

Cloud-Based vs. On-Premise

Cloud-based solutions can be accessed anywhere if you have an internet connection. Other nice features are they have automatic updates and backups and require no server maintenance. They usually use a monthly subscription payment model.

On-premise solutions require a one-time purchase up front. It's usually good for about three years before you have to upgrade for security purposes. The data is stored locally, you control the updates, and may require IT maintenance from time to time.

For small businesses, cloud-based solutions typically offer better value and convenience.

Integration with Other Systems

We have touched on this earlier in the manual. Look for software that connects with your accounting system, has time tracking tools, connects with your banking system and tax filing systems. Some will also integrate with HR platforms.

Good integration reduces double-entry and errors.

Demo or Trial Period

Before committing, take it for a 'test drive' so you can kick the tires to see if it's a good fit for your business. Test it with real data. Try some payroll calculations then check the tax calculations. Determine if customer support was actually supportive. Review the available reporting features.

Use this time to verify the software meets your specific needs. Don't be afraid to walk away and try something else if it doesn't meet your needs.

Security Considerations

Choose software that prioritizes security to protect sensitive payroll data. Some security features that are a must have these days are data encryption, multi-factor authentication, automatic regular backups, access controls, and audit trails.

8. Payroll Processing and Recordkeeping

Section TOC

- Setting Up Your System

- The Data Entry Process

- Record Retention Requirements

- Data Security and Privacy

- Wage and Hour Law Compliance

- Practical Tips for Small Business Owners

- Common Mistakes to Avoid

- What To Do When You Make A Mistake?

This section will be presented in bullet point format making it short and sweet. Its main purpose is to put these items on your radar. My expectation is that you will make your own detailed notes on each bullet point. If I've written an article on the item, I will provide the 'Learn More' link.

Setting Up Your System - Simple is Best

Before you even start entering data, you have a few decisions to make. Establishing a standardized process will save you time and headaches down the road.

- Choose your tools

For a small business, a simple spreadsheet might be all you need. If you're comfortable with spreadsheets, create one with columns for employee name, hours worked, pay rate, deductions, and net pay. Alternatively, consider basic payroll software. There are affordable options designed specifically for small businesses. Don't overcomplicate things. Start simple and upgrade as you grow. Why buy a Ford 150 when a Honda Civic gets the job done! - Employee Information – One Place for Everything

Create a central location (physical or digital) for each employee's vital payroll info collected during onboarding and while they are employed. This keeps everything organized and readily accessible. See the discussion about employment tax forms about what gets kept in each file. - Consistent Schedule – Set it and (Almost) Forget it

Choose a regular payroll schedule (weekly, bi-weekly, monthly) and stick to it. This creates predictability for both you and your employees.

PRO TIP: Choose a schedule that aligns best with your business's cash flow.

The Data Entry Process

Handling payroll is a necessary administrative duty that every business owner with employees needs to carry out. With a clear process and attention to detail, you can manage payroll efficiently and accurately, even with limited resources. Keep these things in mind:

- Create a standardized process for entering employee information

- Double-check all entries, especially tax rates and wage rates

- Maintain a consistent schedule for processing payroll

- Keep detailed notes of any special situations (garnishments, advances, etc.)

- Use a simple spreadsheet or basic payroll software for calculations

- Document all overtime, paid time off, and leave taken

Let's take a look at what the steps in a good payroll processing actually looks like:

- Collect the time data - Decide on your preferred method: paper timesheets, a shared online spreadsheet, or a time clock app. Clearly communicate deadlines to your employees and have a backup plan for late submissions (maybe a quick phone call or email reminder). Having employees sign off on their timesheets adds an extra layer of accuracy.

- Validate the data - This is where you put on your detective hat! Compare timesheets against employee schedules. Look for anything unusual: missing breaks, excessive overtime, or duplicate entries. A little detective work upfront can prevent bigger problems later. Sometimes the errors are simple human error. You don't want to pay an employee for 80 hours instead of 8 hours due to an employee data entry error!

- Run calculations - How are your math skills? Calculate regular hours, overtime (remember that 1.5x rate!), and any pay differentials. Apply the correct pay rates and factor in any adjustments like advances, garnishments, or benefits deductions. Next, calculate federal, state, and local tax withholdings. Don't forget about any reimbursements owed to employees. If you're using a spreadsheet, double-check your formulas! Learn more about FLSA.

- Review for accuracy - Before you finalize anything, take a deep breath and review everything. Compare this payroll to previous ones – are there any significant variations? Verify your tax calculations. Make sure deductions don't drop anyone's pay below minimum wage. This is your last chance to catch any errors. You will get better every time you perform a review. Make a review checklist (why recreate the wheel at every payroll review?) and update it the more you learn.

If you use payroll software, it will handle the automated calculations and have compliance built into it. Payroll programs usually have real-time verification to flag potential errors as you enter the data. They also have reporting and auditing tools and may have 'comparison' features to previous periods. However, you will still need review the payroll run for accuracy. Look for input validation (programs can't correct data entry errors) and unusual variations (investigate software 'flags'). Are the tax liabilities reasonable? Review the payroll reports regularly to catch issues early. Take a final look and use your common sense to see if the you think the payroll is accurate. You do have a spidey sense on if it is right, whether you know it or not. It's your business, trust your instincts. - Process the payments - Whether by check or direct deposit, be sure sufficient funds are in your bank account. Include pay stubs showing gross pay, deductions, and net pay. Keep copies for your records. Follow a consistent payment schedule (weekly, bi-weekly, etc.).

Remember, you need employee consent for direct deposit. - Create and store records - File copies of timesheets, pay stubs, and tax calculations. Document any special situations or adjustments. Store records securely (physical or electronic) for at least 4 years. Back up electronic files regularly. We'll discuss this further in the next segment.

PRO TIPS:

- Consider using a checklist for each payroll run so you don't miss any steps. I don't know how your days go, but some days I had a lot of interruptions and a check list was a life saver!

- Think of payroll software as your assistant, not your replacement. It handles the heavy lifting, but you're still the boss, responsible for oversight and accuracy. By combining software with a diligent review process, you will have accurate and compliant payroll runs while saving time and reducing your stress.

Record Retention Requirements

Think of keeping detailed payroll records as a housekeeping task—dreaded but necessary—not only for audits or employee queries, but also to comply with federal laws like the Fair Labor Standards Act (FLSA), which require you to maintain these records for at least three years. Here are your obligations:

- W-2 & W-3 forms: Keep for 4 years

- W-4 forms: Keep for 4 years after filing fourth quarter for the year

- I-9 forms: Retain for 3 years after hire date or 1 year after termination

- W-9 form: Keep as long as valid, plus 3 years

- 1099-NEC form: Keep for 4 years

- Payroll records: Keep for at least 3 years

- Time cards/sheets: Maintain for 2 years

- Tax records: Store for at least 4 years

- Store records in both physical and electronic formats when possible. Follow the 3-2-2 backup protocol.

Remember: If there's any litigation or audit, you must retain all related records until the matter is resolved, even if it extends beyond the normal retention period.

Recordkeeping Tips:

1. Create a simple filing system (both physical and digital) organized by year

2. Set calendar reminders for destruction dates

3. Keep a log of what records you have and when they can be destroyed

4. Store records in a secure, fire-resistant location or encrypted digital storage

5. Back up digital records regularly

6. Consider scanning physical documents as backup

Learn More >> Record Retention Guidelines

Data Security and Privacy

Protecting data security and privacy in the payroll process is needed to keep sensitive employee information safe from breaches and misuse. As an employer, you need to install strong security measures to maintain your employees’ trust and integrity in your business. Consider these guidelines for maintaining payroll security and confidentiality:

- Keep all payroll files in a locked cabinet or password-protected folder.

- Limit access to payroll information to essential personnel only.

- Use strong passwords for electronic systems.

- Back up electronic records regularly using the 3-2-2 standard.

- Never email sensitive employee information without encryption.

- Properly dispose of outdated records through shredding.

- I know you are busy, but come up with a very loose plan on how to respond to a breach so you aren't scrambling if it does happen.

TECH TIP: Reliable payroll software should have built-in security features such as end-to-end encryption (keeps data secure), user access controls (restricts access by setting permissions), and secure data storage (safeguard against breaches). These tools can significantly reduce the risk of data breaches and give you peace of mind. Think of it as having a digital fortress where your data is both safe and ready when you need it.

Wage and Hour Law Compliance

The Fair Labor Standards Act (FLSA) governs minimum wage, overtime, and recordkeeping requirements. The Internal Revenue Service (IRS) rules are primarily used for tax purposes, determining how a worker should be classified for federal tax obligations. The following should be on your radar:

- Display required federal labor law posters

- Track hours worked accurately

- Calculate overtime at 1.5x regular rate for hours over 40 per week

- Maintain clear records of meal breaks and rest periods

- Document any salary deductions

- Keep records of minimum wage compliance

Learn More >> FLSA vs IRS Independent Contractor Rules

Practical Tips for Small Business Owners

To establish a smooth and consistent payroll process, consider implementing these key procedures into your payroll compliance routine:

- Process payroll on a fixed schedule (weekly, bi-weekly, or monthly)

- Create a payroll calendar marking important dates and deadlines

- Use a checklist for each payroll run

- Keep copies of all pay stubs and tax payments

- Reconcile payroll accounts monthly

- Document all procedures for backup purposes

Common Mistakes to Avoid

I know payroll is a daunting task, at least it always was for me because there are so many rules and deadlines. When handling payroll, watch out for these common mistakes that can lead to errors and compliance issues:

Compliance Mistakes - Let me share some compliance mistakes that small business owners often fall into:

- Worker misclassification: Listen, I know it's tempting to classify workers as independent contractors to save on taxes, but this is a huge red flag for the IRS. If you control when, where, and how they work, they're probably employees. Get this wrong, and you could face unwanted penalties and back taxes.

- Overtime errors: Here's a common one - not paying overtime when employees work through lunch or answer emails from home. Remember, if they're working, they need to be paid, even if you didn't authorize it.

- Forgetting to update tax rates - Make it a habit to regularly check for updates.

- Not keeping up to date with changing laws such as minimum wage regulations - Labor laws can and do change frequently. Develop a process to keep on top of this.

- Missing poster requirements: This seems minor, but it's actually required by law. You need those labor law posters displayed where employees can see them. Get them free from the DOL website.

Calculation Mistakes - These are the math headaches that can really mess up your payroll:

- Incorrect overtime calculations: Don't just multiply the hourly rate by 1.5. You need to include non-discretionary bonuses in the regular rate first.

- Incorrect handling of retroactive pay - Know your FSLA obligations.

- Not reporting all forms of taxable income and benefits.

- Wrong tax withholding: Double-check those W-4s and tax tables. Pro tip: Use the IRS withholding calculator to verify your calculations.

- Vacation/Paid time off (PTO) accrual errors: Keep a running spreadsheet of PTO earned and used. Trust me, employees notice when this is wrong!

Administrative Mistakes - Here's where the paperwork beast can bite you:

- Late deposits: Set two calendar reminders for tax deposits - one week before and day of. Better yet, enroll in EFTPS.gov. It's free and much easier to track.

- Missing deadlines: Create a payroll calendar marking ALL due dates - tax deposits, quarterly returns, W-2s, everything. Use the free IRS Online Tax Calendar at irs.gov/businesses/small-businesses-self-employed/online-tax-calendar to create it.

- Incomplete new hire paperwork: Keep a checklist and use it. I-9, W-4, state withholding forms, direct deposit forms. Get these done day one. I've started one for you.

- Not reporting garnishments or new hires - both must be processed correctly and reported with a set timeframe. Don't risk the penalties by not complying.

Record-keeping Mistakes - Good records are your best defense in an audit:

- Not keeping adequate records: Keep everything for at least 4 years: timesheets, pay stubs, tax forms, leave requests, the works. Be kind to yourself and help future audits go well by adhering to at least the minimum periods required by law.

- Unsecured data: Password protect those payroll files! You have a legal obligation to safeguard your payroll information. Invest wisely here.

- Failing to backup electronic data - Technical system failures happen all the time. Don't make yourself a victim by sidestepping this protocol.

- Missing audit trail: Document everything when correcting mistakes - what happened, why it happened, how you fixed it, and what steps you've put in place to prevent it. Trust me, if you're ever audited, this documentation will be invaluable.

What To Do When You Make A Mistake?

We all make mistakes. The important thing is to learn from them. Here's how to handle payroll mistakes:

- If you discover any payroll mistakes, don't panic.

- Document what happened.

- Calculate the impact of the payroll mistake.

- Fix the error(s) immediately.

- Tell the affected employee(s) quickly to maintain trust.

- Take it as a learning opportunity and adjust your payroll process to prevent the mistake from happening again.

Need help? Don't hesitate to call your accountant or payroll service. Sometimes paying for an hour of professional help can save you days of headaches.

9. Payroll Accounting and Reconciliation

Section TOC

- Basic Payroll Accounting Setup

- Payroll Journal Entries

- Integrating with Accounting Systems

- Monthly Reconciliation Checklist

- Common Discrepancies and Solutions

- Necessary Reports to Maintain

- Best Practices for Small Business

This section will be presented in bullet point format making it short and sweet. Its main purpose is to put these items on your radar. My expectation is that you will make your own detailed notes on each bullet point. If I've written an article on the item, I will provide the 'Learn More' link.

Basic Payroll Accounting Setup

It is recommended that you create a dedicated payroll bank account. Here's why:

- Keeps payroll funds separate from operating expenses

- Easier to track payroll-related transactions

- Simplifies reconciliation process

Payroll Journal Entries

In payroll accounting, you must create accurate journal entries so you can properly recording all transactions related to employee compensation, tax withholdings, and benefits. You need financial records that accurately reflect your payroll activities. Let's look at a breakdown of what a payroll journal contains:

1. Recording Payroll - oversimplified

- Gross wages (debit)

- Employee tax withholdings (credit)

- Net pay (credit)

2. Recording Employer Tax Obligations - oversimplified

- Payroll tax expense (debit)

- Employer portion of FICA (credit)

- Federal/State unemployment taxes (credit)

Example for a $1,000 gross paycheck:

1. Recording Payroll:

Debit: Wage Expense $1,000

Credit: Federal Income Tax Payable $150

Credit: Employee FICA Payable $76.50

Credit: Net Payroll Payable $773.50

2. Recording Employer Tax Obligations:

Debit: Payroll Tax Expense $76.50

Credit: Employer FICA Payable $76.50

Learn More >> Detailed Payroll Journal Entry Example

Integrating with Accounting Systems

When you integrate your payroll system with your accounting system, it makes managing your business finances a lot easier by keeping data consistent, cutting down on errors, and giving you a clear picture of your business's financial health. Consider the following:

1. A Sample of Small Business Options*:

- QuickBooks Payroll

- ADP Run

- Gusto

- Paychex Flex

*Disclaimer - This is not an endorsement.

2. Key Integration Points:

- Automatic journal entries

- Tax payment scheduling

- Direct deposit processing

- Report generation

When using a program like QuickBooks Online, if you subscribe to their payroll module, the integration with your accounting system is built into the process, making it seamless and efficient to manage payroll alongside your other financial tasks. Just don't mistake ease with lack of importance.

ADP Run, Gusto, and Paychex Flex offer integrations with popular accounting software. As I use QBO, I'm not 100% sure but Google said:

- ADP Run can integrate with platforms like QuickBooks Online and Xero.

- Gusto offers integration with QuickBooks Online, Xero, and FreshBooks.

- Paychex Flex supports connections with accounting software such as QuickBooks and Sage.

Monthly Reconciliation Checklist

A monthly payroll reconciliation checklist is a handy way to double-check that all your payroll records match up with your accounting data, keeping everything accurate and consistent. Here's my suggestions to start but feel free to add on to it as you perfect your process:

- Compare payroll reports to bank statements.

- Verify tax payments cleared.

- Match canceled checks/direct deposits.

- Review outstanding items.

- Compare quarterly 941 totals to payroll records.

Common Discrepancies and Solutions

Let's look at some common payroll discrepancies you might run into. I suggest simple solutions to help you get started on tackling them. Feel free to add to the list as you get better at finding out where the problem is.

1. Payment Discrepancies

- Try comparing pay stubs to bank withdrawals.

- Check if the tax withholding amounts are correct.

2. Tax Payment Issues

- See if your IRS/State payments match your internal records. Start with your payroll register then follow the trail.

- Make sure you are using the correct tax ID numbers.

3. Benefits Deduction Errors

- Look over employee authorization forms.

- Verify that the deduction amounts are accurate.

Necessary Reports to Maintain

Establishing a consistent schedule for payroll reporting is really important. Payroll reports help catch errors early, show you've met your tax compliance obligations, maintained accurate financial records, and of course they reduce year-end stress because you dealt with issues throughout the year.

Regular review of these reports can help you spot trends, manage cash flow, and avoid costly mistakes. I like to think of these reports like checking in with your doctor for stuff that needs regular monitoring. They are a reality check that everything is in sync. You can keep an eye on your business's vital signs by keeping on a schedule like the one I suggest here:

1. Monthly Reports

- Payroll register

This is your master record of all payroll transactions for each pay period within the month. It tracks wage payments, deductions, and taxes while details are fresh and easier to correct. Monthly review is essential for verifying the accuracy of payments, catching irregularities early. It also meets your obligation to maintain detailed records for tax purposes.

In QuickBooks Online (QBO), you would run the 'Payroll Details Report' or 'Payroll Summary Report'. - Tax liability report

This report helps track deposit requirements and due dates, absolutely a must have for compliance. It shows all your tax liabilities incurred (federal, state, local) and your payments made. Conducting a monthly review helps you keep a close eye on your cash flow and makes sure you're setting aside enough for tax payments. This way, you’re making tax deposits on time, helping you avoid any penalties.

In QBO, you would run the 'Payroll Tax Liability Report'. - Deduction summary

The purpose of this report is to detail all employee deductions (health insurance, 401(k), garnishments, etc.). It will help you verify correct benefit payments and employee contributions. You will find this report valuable as it will help you handle employee benefits and deductions properly.

In QBO, you would run the 'Deductions/Contributions Report'.

2. Quarterly Reports

- 941 reconciliation

Reconciling your Form 941 is key to avoiding costly amendments and those stressful IRS notices. Before you file, take a moment to compare your quarterly payroll data with the entries on Form 941. Making sure everything matches up helps you catch any discrepancies early, before they turn into bigger issues.

In QBO, you will find these forms under taxes > forms. Don't forget to archive them before you file them. - State unemployment reports

Keep an eye on your state unemployment insurance payments and taxable wages to stay in line with state regulations and making accurate tax payments. Doing this every quarter helps you manage your unemployment tax rates without any surprises.

In QBO, you would run the 'State Tax Wage Report'.

3. Annual Reports

- W-2/W-3 reconciliation

The goal here is to make sure that all the W-2s you hand out to your employees at the end of each year match up with what you've reported on the W-3 form to the IRS. Think of this task as making sure no loose ends are left hanging before closing the books for the year. The bonus for me is it prevents employee tax issues and IRS penalties.

In QBO, you will find these forms under taxes > annual forms. Don't forget to archive them before you file them. - Year-end tax summaries

Think of year-end tax summaries as a snapshot of all your tax ducks in a row. They’re a necessity for tax return preparation and helpful for planning ahead. Use your year-end payroll tax summaries to tackle your tax returns and setup a payroll budget for your upcoming business year.

In QBO, you would run the 'Payroll Tax and Wage Summary' report.

Maintaining the reports above is about staying on the good side of federal and state regulations and making sure your tax payments are spot on! Don't skip this payroll processing procedure. Your future self will thank you for it!

Best Practices for Small Business

When handling payroll reconciliations, consider implementing these best practices into your payroll reconciliation routine:

1. Schedule regular reconciliation times. I recommend monthly so you don't let the task slide.

2. Keep digital copies of all payroll records.

3. Use integrated payroll/accounting software if it's in your budget to do so.

4. Maintain an audit trail for changes.

5. Document your reconciliation procedures so you have them for next time. I've said it before. There's no point in recreating the wheel every time. This is not the time to fly by the seat of your pants!

10. Important Considerations When Reaching 10 Employees: Compliance Changes at the 10-Employee Threshold.

Section TOC

- Benefits Administration

- OSHA Recordkeeping

- Increasing Complexity

- Key Takeaway

Here's a heads-up about what's coming if you grow your business to 10 employees. It is an exciting milestone! I want to let you know that this growth will come with new responsibilities.

While this might not be an immediate concern with your current team size, it's good to keep in mind as your business grows. Think of it as planning ahead - like checking the weather forecast before a road trip! Let me walk you through what changes you'll need to be aware of.

The jump from 9 to 10 employees can trigger some significant changes in compliance requirements for a small business in the US. Here's what you need to be aware for now:

- Benefits Administration: It's one of those things that gets more complex as your business grows. When you're managing benefits for just a few employees, you can probably keep track of everything in a simple spreadsheet. But once you hit that 10-employee mark, you might find yourself juggling quite a bit!

Think about it: You're tracking health insurance enrollments, 401(k) contributions, and maybe some voluntary benefits like dental or vision coverage. Each employee might choose different options, have different deduction amounts, and make changes during life events. That's a lot to keep straight!

Here's my suggestion; when your benefits tracking starts feeling overwhelming, it's probably time to look into a more robust system. This doesn't mean you need to buy expensive software right away - but you'll want something more sophisticated than just spreadsheets to help you stay organized and avoid mistakes. Your future self will thank you for making this switch before things get too complicated! - OSHA Recordkeeping: It's actually good news for small businesses like yours! Since you have fewer than 10 employees, you can scratch this off your worry list. OSHA gives U.S. small business owners a break here and doesn't require you to keep those detailed injury and illness records.

However, you MUST report any workplace fatality or the hospitalization of one or more employees to OSHA immediately. This is mandatory, regardless of your business size. Also keep in mind that if your business is in a higher-risk industry (like construction or manufacturing), you might still need to keep these records regardless of size.

Although your recordkeeping requirements are simplified for now, creating a safe work environment is always essential. Resources like OSHA's website (osha.gov) offer valuable guidance.

And here's a heads-up for your future growth plans; once you hit that 11-employee mark, you'll need to start maintaining these OSHA records. - Increasing Complexity: It is not that there is some magic legal switch that flips - it's more like your business is entering its 'teenage years.'

You'll find yourself juggling more paperwork, spending more time on HR stuff, and thinking 'Wow, I could really use some help here!' That's totally normal. Most business owners start feeling this way around this time.

Just remember; feeling a bit overwhelmed at this stage is completely natural. The good news is, there are plenty of ways to manage it. Once you feel overwhelmed, you might want to pause and ask yourself, 'Do I want to handle all this myself, bring someone in to help, or maybe partner with a payroll service?' There's no right or wrong answer - it's just about finding what works best for you and your growing business.

Key Takeaway

While the jump from 9 to 10 employees doesn't create a massive cliff in compliance requirements, it does bring a few new responsibilities to your table. The biggest one you'll need to think about is OSHA recordkeeping - basically, documenting workplace safety stuff.

Here's a tip; start preparing a bit before you actually hit that number. It's kind of like getting your ducks in a row before you need them lined up, right? Don't feel like you have to figure all this out by yourself. This is actually a really good time to touch base with an HR pro or maybe chat with a legal advisor. They can help make sure you are not missing anything important.

Remember, just take it one step at a time - you've got this!

Wrapping Up Part 1: Setting Up and Managing Payroll

In Part 1, I covered the essential building blocks of payroll management for your small business:

- Meeting current compliance requirements

- Understanding worker classification and new hire documentation

- Processing key forms like I-9s and W-4s

- How hiring a contractor is a different process than hiring an employee

- Choosing appropriate technology solutions

- Managing payroll processing and recordkeeping

- Implementing basic accounting and reconciliation practices

- Planning ahead for employee growth

Remember, good payroll management is about creating consistent processes that work for your business size. Start with the basics, document your procedures, and build from there. Don't feel pressured to implement complex systems if simpler solutions meet your needs.

As I move into Part 2: Payroll Tax Reporting and Compliance, I will build on these fundamentals to help you understand your tax obligations and reporting requirements. Having these solid payroll management practices in place will make tax compliance much easier to handle.

Go To Part 2 >> Payroll Tax Reporting and Compliance

Payroll for a Small Business Owner (A manual for less than 10 employees)