- Home

- US Small Business Tax Compliance

- Employee Payroll Taxes

- Payroll for a Small Business Owner

- Reference Guide: Employment Tax Forms

SSA / IRS Worker and Employment Tax Forms

Reference Guide To The Payroll Manual

Published August 2011 | Revised January 29, 2025

by L. Kenway BComm CPB Retired

WHAT'S IN THIS ARTICLE

Introduction | SSA / IRS Tax Information Slips and Returns | Form I-9 | Form W-4 | IC Form W-9 | Form W-2 | Form W-3 | Form 1099-NEC | Form 1096 | Yearend Payroll Checklist

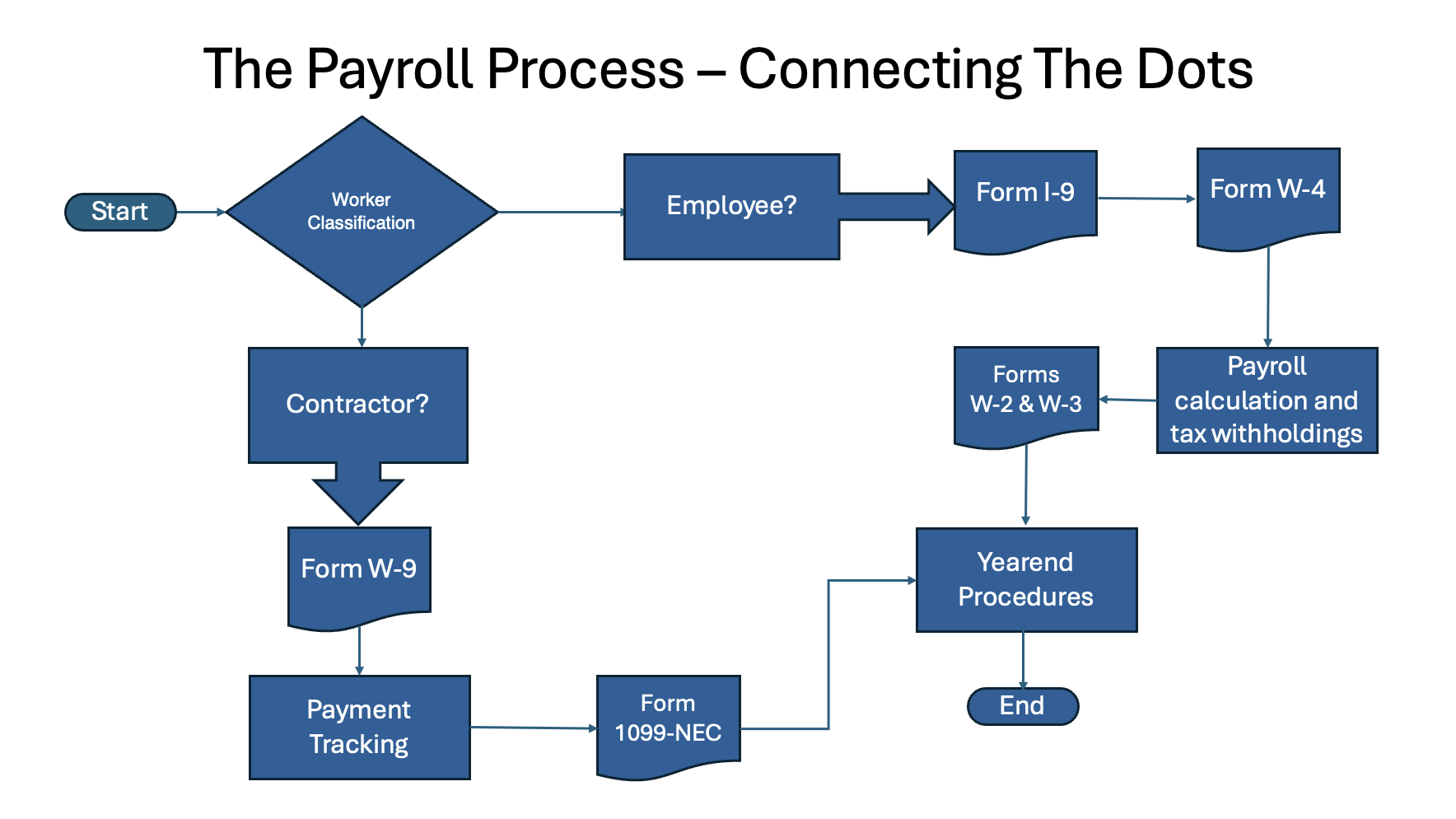

This chart shows you how the various employment tax forms connect. It's lets you see the flow.

This chart shows you how the various employment tax forms connect. It's lets you see the flow.There is usually a lot of stress and confusion that comes with year-end payroll processing. While December brings lots of holiday cheer, it also brings payroll responsibilities that can't be overlooked. In this chat, I've broken down what you need to do throughout the year as well as what you need to know about the various SSA / IRS employment tax forms to close out your payroll year successfully.

This chat is written for small businesses with less than 10 employees. So pour yourself a cup a tea, settle in ... relax ... and let's get started.

Table of Contents

U.S. Worker and Employment Tax Forms

1. SSA / IRS Tax Information Slips and Returns - Definition

2. The Starting Point - Forms I-9, W-4, and W-9

3. Tax Reporting and Compliance - Forms W-2, W-3, 1099-NEC, 1096

Small Business Year-End Payroll Checklist

1. Verify Employee Information and Classification

2. Reconcile Payroll Records

3. Tax Compliance and Reconciliation

4. Benefits Review

5. Year-end Tax Forms

6. System Updates for New Year

7. Record Keeping

Supporting Articles for Federal Payroll Taxes

U.S. Worker and Employment Tax Forms

1. SSA / IRS Tax Information Slips and Returns

Wondering what an information return is?

According to the law dictionary at law.yourdictionary.com, it is "a tax return intended to communicate information about the taxpayer’s activities or status to the Internal Revenue Service, but upon which no tax is due".

It's a fancy way of saying it provides tax information but does not compute tax due (both to the IRS and the taxpayer). An example of an information return is a W-2 or any 1099.

A W-3 is a summary form associated with W-2s, while a W-4 and W-9 are more about gathering and providing necessary tax information for proper reporting. The I-9 is classified as a verification form rather than a tax slip or information return.

2. The Starting Point

Section TOC - Worker and Employment Tax Forms

2.1 Form I-9 - New Hire Documentation and Reporting

- What is the purpose of the I-9 Form?

- 5 Things you need to know about federal and state requirements

- Section resources and references

2.2 Form W-4 - Processing and Compliance

- What is the purpose of the W-4 form?

- Technical overview of W-4

- Legal requirements and references

- What to do with undeliverable forms

- Resources and links

2.3 Form W-9 - Request for TIN

- What is the purpose of the W-9 Form?

- Common errors to avoid

- Filling out a W-9 for sole proprietors

- Filling out a W-9 for corporate entities

- Additional tips

- Section resources

2.1 Form I-9 - New Hire Documentation and Reporting

Section TOC Employment Tax Forms

- What is the purpose of the I-9 Form?

- 5 Things you need to know about federal and state requirements

- Section resources and references

What is the purpose of the I-9 form?

A visual for you of the header of an I-9 form

A visual for you of the header of an I-9 formForm I-9 Employment Eligibility Verification verifies that your newly hired employees are legally authorized to work in the United States. Proper completion and storage of the Form I-9 should be a priority at the start of your on-boarding process.

Background Updates

1. The "first day of work" law went into effect on June 11, 2011. Employers are required to report the date an employee first performs services for pay on federal tax form I-9, in addition to the other I-9 information requirements, which are:

- the employee's name, address, and SSN

- the employer's name, address, and federal EIN

2. Homeland Security announced that "starting November 1, 2023, all employers must use the revised Form I-9, Employment Eligibility Verification, with the edition date 08/01/23, when completing the employment eligibility verification process. This updated Form I-9 reflects the option for eligible employers to verify employment eligibility remotely [using the new online I-9 system]" .

3. COVID-19 remote verification flexibilities ended July 31, 2023. Employers are now required to inspect documents in person for employees whose documents were previously examined remotely.

New Hire - Important Points for Small Business Owners

(5 things you need to know about federal and state requirements)

- I-9 reporting is a federal requirement. New hire reporting is a state requirement and different from I-9 reporting. It is not state-specific, but all employers must comply with federal guidelines. Verify your state's specific reporting window requirements. While federal law allows up to 20 days, many states have shorter time frames. Best practice: Report new hires as soon as possible.

While federal law mandates new hire reporting to detect child support fraud, each state implements this with its own timeframe and method. It's important to verify specific state requirements, as they can vary significantly. - Use the new I-9 form (edition date 08/01/23) starting November 1, 2023 is a federal requirement. The old form became invalid after October 31, 2023 and is no longer compliant with federal regulations.

- Federal law mandates that all new hires must use the revised W-4 form issued after 2020. Follow W-4 requirements correctly. Pre-2020 employees can remain on their existing W-4 forms (grandfather provision) until they want a change, while all new hires must use the revised form.

- Check your state's specific E-Verify requirements. This is a federal requirement with state-specific mandates. This means requirements vary by state location, industry type, and federal contractor status. Employers should review their specific state requirements to ensure compliance.

- I-9 forms must be kept for 3 years after the hire date or 1 year after termination, whichever is later. This is a federal requirement. Store records securely, preferably with digital backup. Implement a system to track retention periods.

Section Resources and References

- Federal new hire steps reference: US Code reference: 42 USC 653a(b)(1)(A) The Public Health and Welfare - State Directory of New Hires "(b) Employer information (1) Reporting requirement (A) In general Except as provided in subparagraphs (B) and (C), each employer shall furnish to the Directory of New Hires of the State in which a newly hired employee works, a report that contains the name, address, and social security number of the employee, and the name and address of, and identifying number assigned under section 6109 of the Internal Revenue Code of 1986 to, the employer."

- I-9 and new hire reporting deadlines: Here are four resources:

1. The official United States Citizenship and Immigration Services (USCIS) website is uscis.gov. Their site covers BOTH I-9 and E-Verify. It is a great resource where you can find the most up-to-date information including information about non-compliance penalties.

2. You could also visit the Department of Homeland Security (DHS) website at dhs.gov for official and current information.

3. The National Association of Statework Agencies (NASWA) at naswa.org is a good resource for finding state-specific information.

4. Your state's labor department. Search for terms like New Hire Reporting (40 sites use this term), New Hire (10 states use this term), New Hire Directory (Kansas, New Mexico, & North Carolina), or New Employee Registry (California). This search should take you to your state's specific new hire reporting programs.

Return to Manual >> Part 1 Payroll Setup and Management - Form I-9

2.2 Form W-4 - Processing and Compliance

Section TOC Employment Tax Forms

- What is the purpose of the W-4 form?

- Technical overview of W-4

- When you need a W-4?

- What is the handling process for a W-4?

- Does it matter what version of the W-4 is used?

- What are some common issues to watch to for?

- Pro Tip

- Heads Up - Legal requirements you need to know

- 6 legal obligations

- The IRS Lock-In Letter (Letter 6419)

- What is the relevance of a LIL to a small business owner?

- LIL From The Employee's Perspective - What to do with undeliverable forms

- Section resources and references

What is the purpose of the W-4 form?

A visual for you of the W-4 header

A visual for you of the W-4 headerImagine it is your new hire’s first day. They are eager to get started, and you want all their paychecks to reflect the right tax deductions. That’s where the W-4 comes in.

Form W-4 Employee's Withholding Certificate helps you determine the correct amount of federal income tax to withhold from your employees' wages. Deducting the correct withholding from an employee's paycheck helps avoid issues for both you and your employees when tax season arrives.

Form W-4 - Technical Reference

Let's break down the technical aspects of the W-4 that will help with the onboarding process.

Why it matters? Getting this right is important because it tells you how much federal income tax to withhold from each employee's paycheck. Under-withholding can lead to penalties for both you and your employee come tax time. Over-withholding means your employees are giving the government an interest-free loan! Think of the W-4 as your employee's instructions to you about their tax situation.

When you need a W-4?

- New Hires: It's a requirement before their first paycheck. Make it part of your onboarding process.

- Life Changes: Employees should submit a new W-4 when their personal situation changes. This includes marriage, divorce, birth or adoption of a child, a spouse starting or stopping work, or simply wanting to adjust their withholding. Proactively reminding employees of this annually can save from trouble later.

- Exempt Status (no federal income tax withheld): Employees claiming exempt status must submit a new W-4 EVERY YEAR. You need to set a reminder to follow up with these employees in January.

What the handling process for a W-4?

- Day One: Timing is everything! Have the employee complete the W-4 along with their I-9 employment verification.

- Review for Validity: Reject any W-4 that looks altered, defaced, has unauthorized additions, or includes statements about inability to pay tax. Ask the employee for a new, correctly completed form. Until you receive a valid W-4, withhold at the highest rate – single with no adjustments. This protects you from liability.

Recap On What To Watch Out For: (1) Don't accept a W-4 if your employee has crossed out or written in unauthorized statements. (2) If something looks off, have them complete a new one. - Secure Storage: Keep all W-4s in secure employee files, either physical or electronic.

- Changes: When an employee submits a new W-4, update your payroll system IMMEDIATELY to reflect the changes.

- Important Deadlines: You need to implement the W-4 changes by the first payroll period that ends 30 days after you receive it. For example, if an employee gives you a new W-4 on March 1, and you run payroll bi-weekly, you need to apply it no later than the March 30 payroll.

- Record Keeping: Keep all W-4 forms for at least four years after the date the last tax was due or paid. It's best to keep them in a secure file, either physical or digital.

Does it matter what version of the W-4 is used? In short, yes it does. The current form is Format (2020 and later versions). It has five main steps:

- Step 1: This is the basics - your employee's name, address, SSN, and filing status (single, married, etc.).

- Step 2: They'll complete this if they have multiple jobs or if their spouse works.

- Step 3: Here they list dependents to claim tax credits.

- Step 4: Optional adjustments like other income, deductions, or extra withholding.

- Step 5: Your employee signs here - it's not valid without their signature!

What are some common issues to watch to for?

- Employee doesn't turn one in? You must withhold at the highest rate (single, no adjustments). No exceptions.

- Got a W-4 that looks altered or has extra notes about not paying taxes? Reject it and ask for a new one. Meanwhile, withhold at the highest rate.

PRO TIP: Create a simple new-hire packet with both the W-4 and I-9. Have employees complete both forms while you're checking their I-9 documents. Two birds, one stone!

HEADS UP: If you're hiring independent contractors, they need a W-9 instead. Don't mix these up - it's a different process entirely.

Legal Requirements You Need to Know

There is a difference between legal requirements and resources. This legal requirements section is about what you MUST do to stay compliant, while resources section below are the tools to help you do it.

Some of this has already been said but I brought your legal obligations together in one place so there is no confusion.

- You must have a valid W-4 on file for each employee (no exceptions!).

- Keep W-4s for at least 4 years after the last tax return is filed.

- You can't accept invalid forms. (I'll tell you what makes them invalid in a minute.)

- You must implement new W-4s by the start of the first payroll period ending 30 days after receiving it.

- If an employee refuses to complete a W-4, withhold at the higher single rate.

- You can't tell employees what to claim. (That's a big no-no!)

The IRS Lock-In Letter (Letter 6419)

An employee may present you with an IRS Lock-In Letter (Letter 6419). This letter protects the employee from unauthorized changes to their W-4 withholding. If an employee provides a Lock-In Letter:

- You cannot accept any other W-4 from them UNLESS it's accompanied by a new, signed W-4 AND a copy of the Lock-In Letter.

- The Lock-In Letter (aka LIL) confirms their current withholding instructions.

What is the relevance of a LIL to a small business owner? While not a common occurrence, small business owners should be aware of the LIL in case an employee presents one. It means the employer CANNOT accept any other W-4 from that employee unless it's accompanied by a copy of the LIL.

LIL From The Employee's Perspective: LIL is a tool for taxpayers to protect themselves from having their withholding settings changed without their consent. It's particularly useful for those who have complex tax situations or have experienced identity theft related to their tax information. Let's break it down:

- LIL Purpose: The LIL prevents any changes to an employee's W-4, ensuring their chosen withholding remains in effect. This protects against unauthorized changes, whether due to identity theft, errors, or other issues.

- How LIL works: An employee requests an LIL from the IRS. Once approved, the LIL prevents any further W-4 changes unless the employee initiates them with a new, signed W-4 and a copy of the LIL.

What do you do with undeliverable forms?

The IRS requires employers to keep all employment tax records for at least 4 years after the due date of the employee's personal income tax return OR after the tax is paid, whichever is later. This includes:

- Employee's W-4 forms

- Forms 941 (Quarterly Tax Returns)

- Forms 943, 944, 945 (if applicable)

- Form W-3 (Transmittal of Wage Statements)

- Copy A of Forms W-2

- Undeliverable W-2s*

*If you can electronically reproduce the undeliverable W-2s, you may shred the originals.

However, I would add two important points:

- It's often wise to keep records longer than 4 years, especially if you have concerns about potential audits or employment issues.

- Some states may have different retention requirements, so you should also check your state's specific rules.

I generally recommend keeping these records for 7 years to be on the safe side, unless you're tight on storage space.

Section Resources and References

Resources are different than legal requirements. They are the tools to help you do meet your requirements.

1. IRS Website and Instructions

- Form W-4 Instructions - Helps in understanding how employees should fill out the form accurately. The instructions provide explanations on each section of the form however sometimes I have trouble understanding what IRS instructions say. That's when Google becomes my best friend.

- Form W-4 - Download and print the most current tax year form at irs.gov/pub/irs-pdf/fw4.pdf.

- IRS Tax Withholding Estimator - This online tool can help both you and your employees simulate their tax situation to determine appropriate withholding amounts. You'll find it at IRS.gov/W4App.

- Publication 15-T - The bible for calculating withholding.

- State websites - The IRS has a nice page with links to each state website you might find useful. It's at irs.gov/businesses/small-businesses-self-employed/state-government-websites.

2. Payroll Software Provider Guidance - Many payroll systems offer tutorials, webinars, and customer support tailored to walk you through W-4 processing within their platform. This can help automate calculations and ensure compliance.

3. Local Small Business Development Centers (SBDCs) - Often offer workshops and one-on-one counseling that can provide additional clarity on W-4 management and other tax-related requirements.

4. U.S. Small Business Administration (SBA) - The SBA occasionally provides resources and guidance for small business owners, including tax and compliance advice that can be useful for understanding W-4 implications.

5. Professional Organizations - Organizations such as PayrollOrg [American Payroll Association (APA) and Global Payroll Management Institute (GPMI) merged in May 2023] often have valuable resources, including webinars, compliance updates, and networking opportunities with payroll professionals. I may be wrong but I think you have to be a member to access them.

6. Certified Public Accountant (CPA) Consultation - Engaging with a CPA can provide personalized advice on how to manage W-4s and integrate them effectively into your payroll system while considering your business’s specific needs.

Return to Manual* >> Part 1 Payroll Setup and Management - Form W-4

* The manual explains the 'what and why'. This reference guide explains the 'how'.

2.3 Form W-9: Request for TIN

Section TOC - Nonemployee Tax Forms

- What is the purpose of the W-9 Form?

- Common errors to avoid

- Filling out a W-9 for sole proprietors

- Filling out a W-9 for corporate entities

- Additional tips

- Section resources

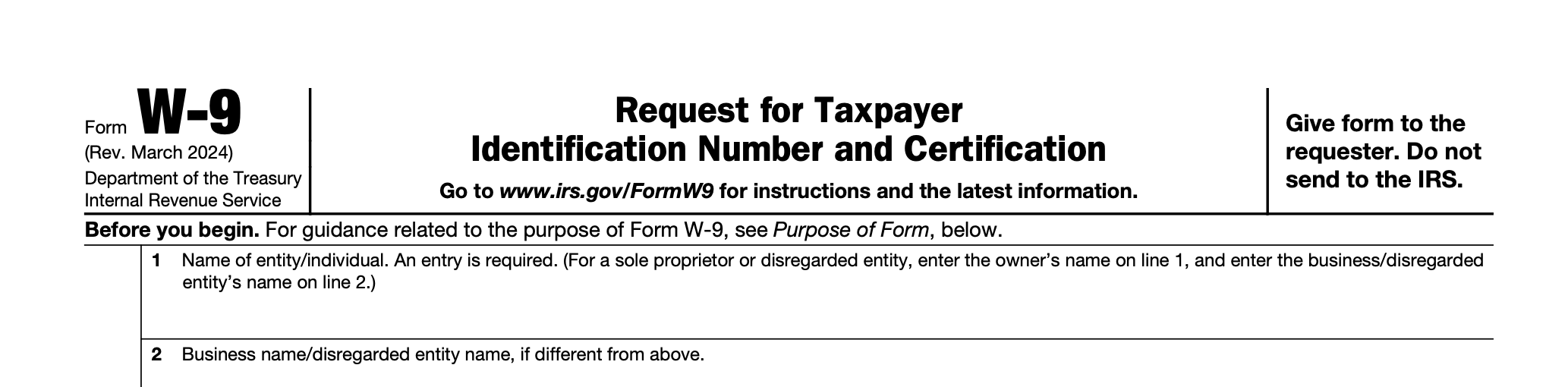

A visual for you of the W-9 header

A visual for you of the W-9 headerWhat is the purpose of the W-9 form?

Form W-9 Request for Taxpayer Identification Number and Certification is used to solicit a contractor's TIN. You'll use this information to file a 1099-NEC at the end of the year if you pay them $600 or more. (This form is also used for other types of 1099 income.)

When you're working with independent contractors, the distinction between employee and contractor tax reporting is super important. Think of Form W-9 as the contractor counterpart to Form W-4 for employees.

The W-9 is used to collect tax information from contractors, such as their Taxpayer Identification Number (TIN) or Social Security Number (SSN). This form ensures that you're ready to report payments properly at year-end.

It's important to note that, unlike employees, nonemployee workers are responsible for their own tax withholdings.

Common Mistakes to Avoid

Get the whole picture to avoid any headaches down the road. Catch these issues before you submit the request:

- Ensure all sections of the W-9 form are completed. Incomplete forms can lead to delays or require you to contact the requester again.

- Verify that the TIN provided is correct and matches the legal name of the entity or individual. For individuals or sole proprietors, this is usually a Social Security Number (SSN), and for corporate entities, it is typically an Employer Identification Number (EIN).

- Ensure that the correct business entity is checked off. This includes differentiating between sole proprietors, LLCs, corporations, partnerships, etc.

- The form must be signed and dated. The form's no good without them. The contractor’s signature is their way of saying everything's accurate, particularly the TIN.

- Be cautious with how you send these forms. Do not send W-9 forms over unsecured email or other non-secure methods. Use secure transmission methods to protect sensitive information.

Filling Out a W-9 for Sole Proprietors

- Line 1: Enter your name as shown on your tax return.

- Line 2: Business name or "Doing Business As (DBA)" if applicable.

- Line 3: Check "Individual/sole proprietor or single-member LLC."

- Line 5: Enter your address.

- Line 6: Enter your city, state, and ZIP code.

- Part I: Enter your SSN or EIN. Note that sole proprietors can use either, but if you have an EIN, it's typically preferred.

- Part II: Sign and date the form. By signing, you confirm the accuracy of the information provided.

Filling Out a W-9 for Corporate Entities

- Line 1: Enter the legal name of the entity.

- Line 2: Enter the business name or "Doing Business As (DBA)" if it differs from the legal name.

- Line 3: Check the appropriate box for the entity type (e.g., "C Corporation," "S Corporation," "Partnership," "Limited liability company," etc.). Make sure the type of entity matches the classification used on your tax returns.

- Line 4: If applicable, enter any exemption codes for FATCA reporting.

- Line 5: Enter the address for your business.

- Line 6: Enter the city, state, and ZIP code.

- Part I: Enter the company’s EIN.

- Part II: An authorized person should sign and date the form.

Additional Tips

- If any information changes (like your name, business name, or TIN), submit a new W-9 to the requester as soon as possible.

- Check if backup withholding is required. If you're subject to it, ensure you're correctly acknowledging this on the form.

Backup withholding is a process where the payer withholds a certain percentage of payments to a contractor if the contractor hasn't provided the correct TIN or has had backup withholding ordered by the IRS.

If a contractor mentions 'backup withholding', don't panic! It might means they might have had some tax issues in the past. The IRS might require you to withhold a portion of their pay and send it directly to them. It's the contractor's responsibility to fix it with the IRS, but you need to make sure you're following the rules. Try to find out more of the back story so you can decide if you still want to hire them.

Section Resources

Official Sources:

- IRS.gov - The official IRS website is the ultimate authority.

- Form W-9 and Instructions - The official form and its instructions are updated regularly. You'll find the web page at irs.gov/forms-pubs/about-form-w-9.

- Publication 15 (Circular E, Employer's Tax Guide) - This publication covers various employer tax obligations, including information reporting. You'll find it at www.irs.gov/publications/p15.

- Publication 1779 (Independent Contractor or Employee) - This publication helps businesses determine the proper classification of workers, a crucial distinction for tax purposes. You'll find it at irs.gov/pub/irs-pdf/p1779.pdf.

- IRS Small Business and Self-Employed One-Stop Resource - A central hub for small business tax information. You'll find it at irs.gov/businesses/small-businesses-self-employed.

Reputable Third-Party Resources:

- SBA.gov - The SBA (Small Business Administration) offers numerous resources and guidance for small businesses, including tax-related topics.

- score.org - SCORE (Service Corps of Retired Executives) provides free mentoring and resources to small businesses, including tax advice.

- Of course consulting with your accountant is always wise. This is especially important for complex situations or if you are unsure about any tax-related matters.

Return to Manual* >> Part 1 Payroll Setup and Management - Form W-9

* The manual explains the 'what and why'. This reference guide explains the 'how'.

Section TOC - Worker and Employment Tax Forms

3.1 Form W-2 The Annual Employee Wage Statement

- What is the purpose of the W-2 form?

- Timing Rules for W-2

- Supplemental Wages

- Yearend Reconciliation W-2

- 5 Additional Important Points

- FAQ About W-2 Reporting

3.2 Form W-3 Transmittal of Wage and Tax Statement

- What is the purpose of the W-3 form?

- Common Errors to Avoid

- Red Flags To Watch For

- Yearend Reconciliation W-3

- Reconciliation Tips For W2 and W3

3.3 Form 1099-NEC Nonemployee Compensation

3.4 Form 1096 Annual Summary and Transmittal of U.S. Information Returns

3.5 Small Business Year-End Payroll Checklist For 10 or Fewer Employees

3.1 Form W-2 The Annual Employee Wage Statement

Section TOC - Employment Tax Forms

- What is the purpose of the I-9 Form?

- 5 Things you need to know about federal and state requirements

- Section resources and references

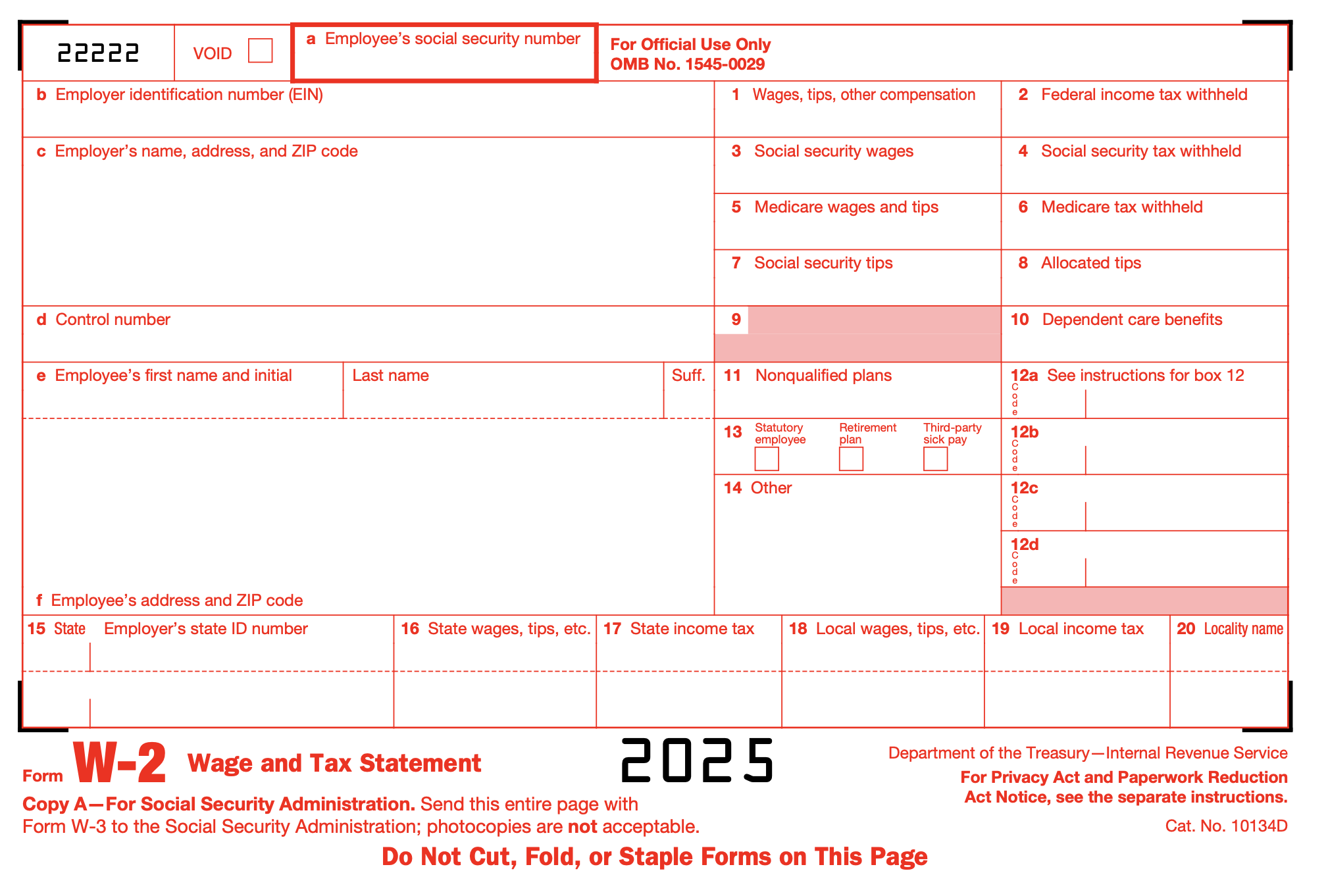

What is the purpose of the W-2 form?

A W2 Wage and Tax Statement is a summary of the wages and withholdings taken for each employee employed during the year. Employees must receive their W2 employment tax form by January 31st each year.

Timing Rules for W-2 Employment Tax Form

Please Read BEFORE You Prepare Your W-2 Slips

Remember: W-2s follow when you paid employees, not when they earned the money. This is true for both wages and payroll taxes.

Example: Pay someone on January 2, 2025, for December 2024 work? That goes on their 2025 W-2, not 2024. Same rule applies to bonuses!

This might seem odd if you're used to GAAP accounting (which uses earned dates), but for W-2s, payment date is king.

Pro Tips:

(i) Enter actual payment dates in your payroll system

(ii) Process payroll in the correct period

(iii) Double-check those year-end dates, especially December's last payroll

Using QuickBooks Online? Good news - it handles this automatically when you enter payroll correctly.

Supplemental Wages

Good To Know

Supplemental wages (like bonuses, commissions, overtime) are included on a W-2 employment tax form in:

- Box 1 (Wages, tips, other compensation)

- Box 2 (Federal income tax withheld - including the 22% supplemental wage withholding)

- Box 3 (Social Security wages, up to the annual limit)

- Box 5 (Medicare wages)

Important note: While supplemental wages are withheld at different rates during the year, on the W-2 employment tax form, they're combined with regular wages. There's no separate reporting required for supplemental wages; they're simply part of the total wages reported.

For your small business, you'll want to ensure your payroll system properly tracks these supplemental payments throughout the year for accurate W-2 employment tax form reporting in January.

There are 3 procedures used to determine the amount of withholding on supplemental wages:

- Manadatory flat rate withholding (37%) applies to supplemental wages over $1 million in a calendar year. It must be used for amounts exceeding $1 million.

- Optional flat rate withholding (22%) can be used for supplemental wages under $1 million. This is the most common and simplest method for small businesses. Examples: bonuses, commissions, overtime pay.

- The aggregrate procedure combines supplemental wages with regular wages. It calculates withholding as if total amount was a single payment. It is more complex but can be more accurate. It must be used if an employee has no regular wages to base withholding on.

For a small business with less than 10 employees, the Optional Flat Rate (22%) is typically the most practical method for handling supplemental wage withholding, unless you have a specific reason to use the aggregate procedure.

See The Department of Treasury's INFO 2012-0063 for more information. While the reference is somewhat dated, the basic procedures remain unchanged. Current guidance is regularly updated and can be found in these sources on supplemental wage withholding:

- IRS Publication 15 (Circular E), Employer's Tax Guide (irs.gov/pub/irs-pdf/p15.pdf)

- Internal Revenue Code Section 3402(h)(2)

- Treasury Regulations 31.3402(g)-1

The Bookkeeper's Tip

A Good Bookkeeping Practice

Yearend Reconciliation W-2

Due Date: January 31st whether you file electronically or by paper

As part of your year-end employee payroll tax procedures, reconcile your Form 941 to your Form W-2. The IRS looks for the following discrepancies:

- Bonuses are reported as wages and as social security and Medicare wages on Forms W-2 and on Form 941;

- Social security and medicare wages and taxes are reported separately on Forms W-2 and on Form 941 ... social security taxes W-2 Box 4; medicare taxes W-2 Box 6 ... do not include taxes in wages information W-2 Box 3 and 5;

- Social security wages should not exceed the annual wage base amount;

- Do not report tax free noncash wages as social security and medicare wages;

- Take the time to check that all W-2s total to the amounts reported on Form W-3.

Additional Important Points

- Quarterly Reconciliation: The best practice is to reconcile quarterly 941s with payroll records throughout the year. Don't wait until year-end to catch discrepancies.

- Common Areas to Check: Check third-party sick pay, group term life insurance over $50,000, personal use of company vehicle, tips, health insurance for 2% S-corporation shareholders

- State Requirements: Don't forget state unemployment wage bases. State W-2 filing requirements may differ.

- Record Retention: Keep W-2 records for at least 4 years. Maintain backup documentation for all adjustments.

- Electronic Filing Requirements: E-filing is mandatory if you have 10+ W-2s. Consider e-filing even if not required - it's more efficient.

FAQ About W-2 Reporting

Whether you're hiring your first employee or managing multiple contractors, understanding which forms you need and when to use them is knowledge you need to have to be tax compliant. Here are answers to some common questions about reporting annual income on W-2s and 1099-NECs.

I'm hoping these FAQs will help you avoid common mistakes while meeting your obligations as an employer. So as to keep it short and sweet, I have, for the most part, answered them in bullet format.

This information is current as of January 2025.

When must I provide W-2s to employees and file with SSA?

When must I provide W-2s to employees and file with SSA?

W-2s must be provided to employees by January 31. The same deadline applies for filing with the Social Security Administration, whether filing electronically or by paper.

What should and should not be included on a W-2?

What should and should not be included on a W-2?

What SHOULD be reported on a W-2:

- All wages, salaries, bonuses, and tips

- Taxable fringe benefits (Be sure to properly identify the taxable portion.)

- Group term life insurance over $50,000

- Employer contributions to a 401(k)

- Relocation expense reimbursements

- Taxable mileage reimbursements above IRS limits

- Sick pay (including taxable portion of third-party sick pay)

- All federal, state, and local income tax withholdings

- Social Security and Medicare taxes withheld

What should NOT be reported on a W-2 as they are generally non-taxable:

- Payments to independent contractors (use 1099-NEC instead)

- Business expense reimbursements under an accountable plan

- Health insurance premiums for S-corporation 2% shareholders (reported on Schedule K-1)

- Non-taxable benefits like:

- Vendor payments

- Rent payments

- Partnership distributions (These are reported on Schedule K-1.)

- Health insurance premiums (unless required by state law)

- Qualified transportation benefits under IRS limits

- De minimis fringe benefits

- Qualified retirement plan contributions

Tip: When in doubt about a specific payment or benefit, refer to IRS Publication 15-B Employer's Supplemental Tax Guide.

Just to make things clear as mud: Some items may be reportable but not taxable. Some benefits are reportable in specific boxes on W-2 but aren't included in taxable wages. When in doubt, check the IRS Publication 15 (Circular E). Keep detailed records of all wage calculations and classifications.

How do I handle various types of compensation on W-2s?

How do I handle various types of compensation on W-2s?

- Box 1: Regular wages, bonuses, overtime, tips, other compensation

- Box 2: Federal income tax withheld

- Box 3: Social Security wages are subject to a maximum wage base. This limit changes annually.

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips are not subject to any maximum wage base.

- Box 6: Medicare tax withheld

- Taxable portion of third-party sick pay: Include in Boxes 1,3, and 5.

- Taxable fringe benefits (personal use of company car, cell phone): Include in Boxes 1, 3, and 5

- Box 12: Use specific codes for various items. DO NOT use Code DD for employer-paid health insurance premiums (unless it's an HSA contribution). Common codes include:

- Code D: Elective deferrals to a 401(k) plan*

- Code E: Elective deferrals to a 403(b) plan (tax-sheltered annuity)*

- Code J: Non-taxable sick pay (exclude taxable third party sick pay wages)

- Code DD: Employer paid contributions to an HSA

- Code W: Employer paid contributions to a health FSA

* These contributions are not taxable at the time they are made, but they must still be reported. - Box 13: Check the "Third-party sick pay" box if applicable. Do not report TAXABLE third-party sick pay in Box 12. It's included in Boxes 1, 3, and 5.

- Box 14: Other information, as needed, like employee-paid insurance premiums if applicable.

- Business expense reimbursements under accountable plan: Do not report

- Relocation expenses: Generally reportable as wages since 2018. Following the Tax Cuts and Jobs Act of 2017, most employer-paid moving expenses are subject to taxation and should be reported as wages.

- State and Local Taxes: If applicable, these must be calculated and reported separately on the W-2.

Tip: Ensure third-party sick pay has correct reporting by coordinating with the third-party payer.

What are common W-2 filing mistakes to avoid?

What are common W-2 filing mistakes to avoid?

- Using incorrect employer EIN

- Mismatching employee name/SSN with SSA records

- Wrong state/local tax amounts

- Missing required box codes

- Incorrect Medicare wages

What are W-2 and 1099 electronic filing requirements?

What are W-2 and 1099 electronic filing requirements?

- As of 2023, you must file W-2s electronically if submitting at 10 or more forms*.

- Use SSA Business Services Online (BSO) for W-2s electronic filing. Other options are approved commercial payroll software or third-party payroll providers.

- As of 2023, 1099s require electronic filing at 10 or more forms*.

- Use FIRE / IRIS system for 1099s**.

- State requirements may differ. Check your state's department of revenue website.

- For more details, see IRS Publication 1220 which is updated annually.

* This change was implemented as part of the Taxpayer First Act, which gradually lowered the threshold:

- Tax year 2021: 250 forms

- Tax year 2022: 100 forms

- Tax year 2023 and beyond: 10 forms

If you have fewer than 10 forms, you can still file paper forms, though electronic filing is recommended. This applies to all information returns, including Forms 1099-NEC, 1099-MISC, and other 1099 variants.

** Businesses can currently file information returns electronically using either the legacy FIRE system or the new IRIS system. The IRS recommends transitioning to IRIS, as it will eventually replace FIRE.

FIRE (Filing Information Returns Electronically) is a legacy system that eventually be replaced by the new system IRIS. In May 2024, the IRS stated, "Eventually IRIS will replace FIRE. There is no date for when FIRE will be retired. We can say it will not be anytime soon. Businesses will need to decide when to switch from FIRE to IRIS. We do recommend you start to familiarize yourself with IRIS before FIRE shuts down."

IRIS (Information Returns Intake System) is the new system the IRS is launching to replace FIRE. The system is available for 2024 1099s filing as well as other information returns. It is completely free to use. You do not need any special software as you directly access it through the IRS portal. Since enrollment takes about 45 days to process, I strongly recommend signing up now rather than waiting until tax season. This is especially important if you file 10 or more information returns, as electronic filing is mandatory in these cases.

Here are some of the features of IRIS:

- Files over 21 types of 1099s without Form 1096

- Handles multiple information return types

- Built-in error detection and validation

- Maintains filing records

- Allows corrections and extension requests

- Supports .csv file uploads or manual data entry

- Works with 30 states through Combined Federal/State Filing Program

- Can file with up to 2 participating states simultaneously

For more details about IRIS, you can reference IRS Publication 5717.

How do I determine if someone should get a W-2 or 1099-NEC?

How do I determine if someone should get a W-2 or 1099-NEC?

Consider these factors:

- Behavioral control: Do you control how work is done?

- Financial control: Does worker have unreimbursed expenses? Own tools?

- Relationship type: Written contracts, benefits, permanent relationship?

If you control the work method, they're likely an employee (W-2). If they control their work method, likely contractor (1099-NEC).

More >> When to use the Form 1099-NEC

Return to the Manual* >> Part 2 Tax Reporting and Compliance - W-2

* This checklist is the 'how'. The manual will give you the 'what and why'.

3.2 Form W-3 Transmittal of Wage and Tax Statement

Section TOC - Employment Tax Forms

- What is the purpose of the W-3 form?

- Common Errors to Avoid

- Red Flags To Watch For

- Yearend Reconciliation W-3

- Reconciliation Tips For W2 and W3

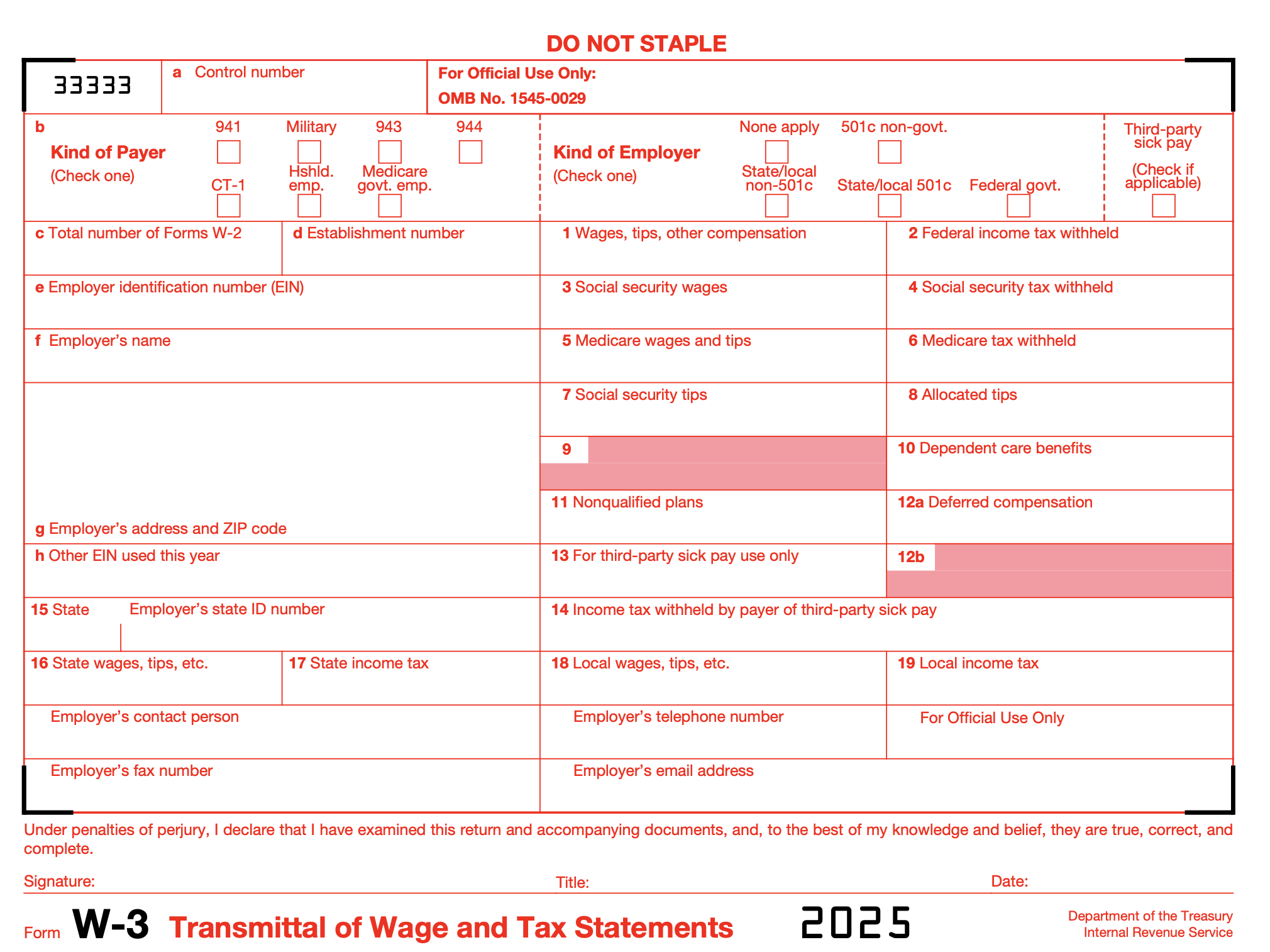

What is the purpose of the W-3 form?

A W3 Transmittal of Wage and Tax Statement is a summary of all the W2s submitted to Social Security Administration (SSA).

Back History: Prior to 2017, SSA ... not IRS ... used to require they receive their copies of all the W2s along with the W3 summary by February 28th each year. However, in 2017, the due date moved to January 31 to combat tax refund fraud and identity theft. Previously, the IRS would often issue refunds before they could verify the wage information on taxpayers' returns against the W-2s and W-3s from employers (since those weren't due until February 28th). Identity thieves took advantage of this gap by filing fraudulent tax returns early in the season, claiming refunds before the IRS could match the information with employer forms.

Now you really need to have all your ducks in a row to meet the January 31st deadline. Start your year-end payroll reconciliation process early so you can meet this deadline comfortably.

Common Errors to Avoid

- Mismatched totals between W-2s and W-3

- Incorrect employer identification numbers

- Missing or incorrect SSA registration number

- Mathematical errors in totaling fields

Red Flags To Watch For

Try to avoid these common errors:

- Missing or incorrect SSA registration number

- Incorrect employer identification numbers

- Missing or incomplete employee forms

- Mathematical errors in totaling fields

- Mismatched totals between W-2s and W-3

- W-2 totals don't match 941s

- Tax deposits don't match liabilities

The Bookkeeper's Tip

A Good Bookkeeping Practice

Yearend Reconciliation W-3

Due Date: January 31st whether you file electronically or by paper

Take the time to check that all W-2s total to the amounts reported on Form W-3.

As part of your year-end employee payroll tax procedures, reconcile your Form 941 to your Form W-3. The IRS and/or SSA cross check the following amounts:

- W-3 Box 1 Wages, tips and other compensation = line 2 on sum of quarterly Form 941s;

- W-3 Box 2 Federal income tax withholding = line 3 on sum of quarterly Form 941s;

- W-3 Box 3 Social security wages = line 5a on sum of quarterly Form 941s ... do not report prior year Form 941 adjustments on the current year Form W-3;

- W-3 Box 5 Medicare wages and tips = line 5c on sum of quarterly Form 941s ... do not report prior year Form 941 adjustments on the current year Form W-3;

- W-3 Box 7 Social security tips = of line 5b on sum of quarterly Form 941s ... do not report prior year Form 941 adjustments on the current year Form W-3;

This reconciliation process is essential because discrepancies between these forms often trigger IRS notices and potential penalties. Let's look at a few key points:

- Start the reconciliation process early - don't wait until January to begin.

- Double-check that your payroll software or service has properly categorized all compensation types.

- If any mid-year adjustments to Form 941s were made, ensure these are properly reflected.

- Remember that some items, like third-party sick pay, might need special attention in the reconciliation process.

Source: section 12 of Pub. 15 (Circular E), General Instructions for Forms W-2 and W-3

Reconciliation Tips For W2 and W3

1. Monthly:

- Compare payroll reports to bank statements

- Verify tax deposits match payroll tax liabilities

2. Quarterly:

- Match Form 941 totals to payroll reports

- Verify state unemployment reports match payroll

3. Annually:

- W-2 Box 1 wages should match 941 line 2

- W-3 totals must match sum of all W-2s

- W-3 must reconcile with all four quarterly 941s

Return to the Manual* >> Part 2 Tax Reporting and Compliance - W-3

* This checklist is the 'how'. The manual will give you the 'what and why'.

3.3 Form 1099-NEC Nonemployee Compensation

What is the purpose of the 1099-NEC form?

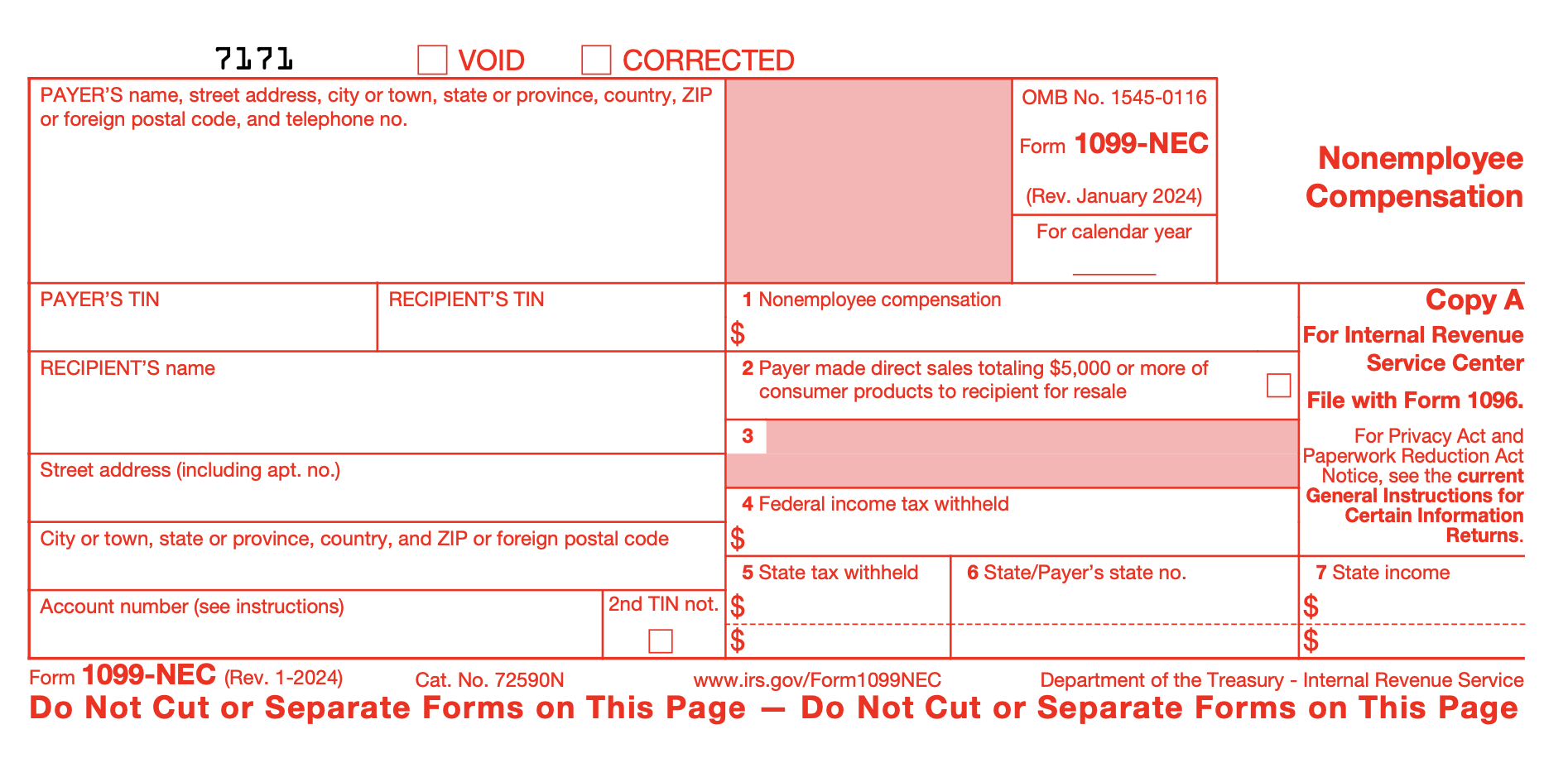

This is a visual for you of the 1099-NEC form

This is a visual for you of the 1099-NEC formThe Form 1099-NEC Nonemployee Compensation is used to report annual payments made to contractors totaling $600 or more.

When you're working with independent contractors, the distinction between employee and contractor tax reporting is super important. Think of Form 1099-NEC as the contractor counterpart to Form W-2 for employees. Both forms report income earned but in a slightly different way.

The 1099-NEC is used to report payments made to independent contractors (nonemployees) for services rendered. If you paid an independent contractor $600 or more during the tax year, you are generally required to file a 1099-NEC. This form reports the total amount paid to the contractor. It's important to remember that this form is for payments for SERVICES rendered. Other types of payments to independent contractors (such as rent, prizes, or awards) require different 1099 forms.

It's important to note that, unlike employees, nonemployee workers are responsible for their paying their own income tax deposits. This responsibility does not fall on you.

Key information reported on Form 1099-NEC

- Payer's information (your business information)

- Recipient's information (the independent contractor's information)

- Total amount paid for services (if $600 or more)

Learn More >> IRS Form 1099-NEC vs 1099-MISC vs 1099-K: What's The Difference

3.4 Form 1096 Annual Summary and Transmittal of U.S. Information Returns

What is the purpose of the 1096 form?

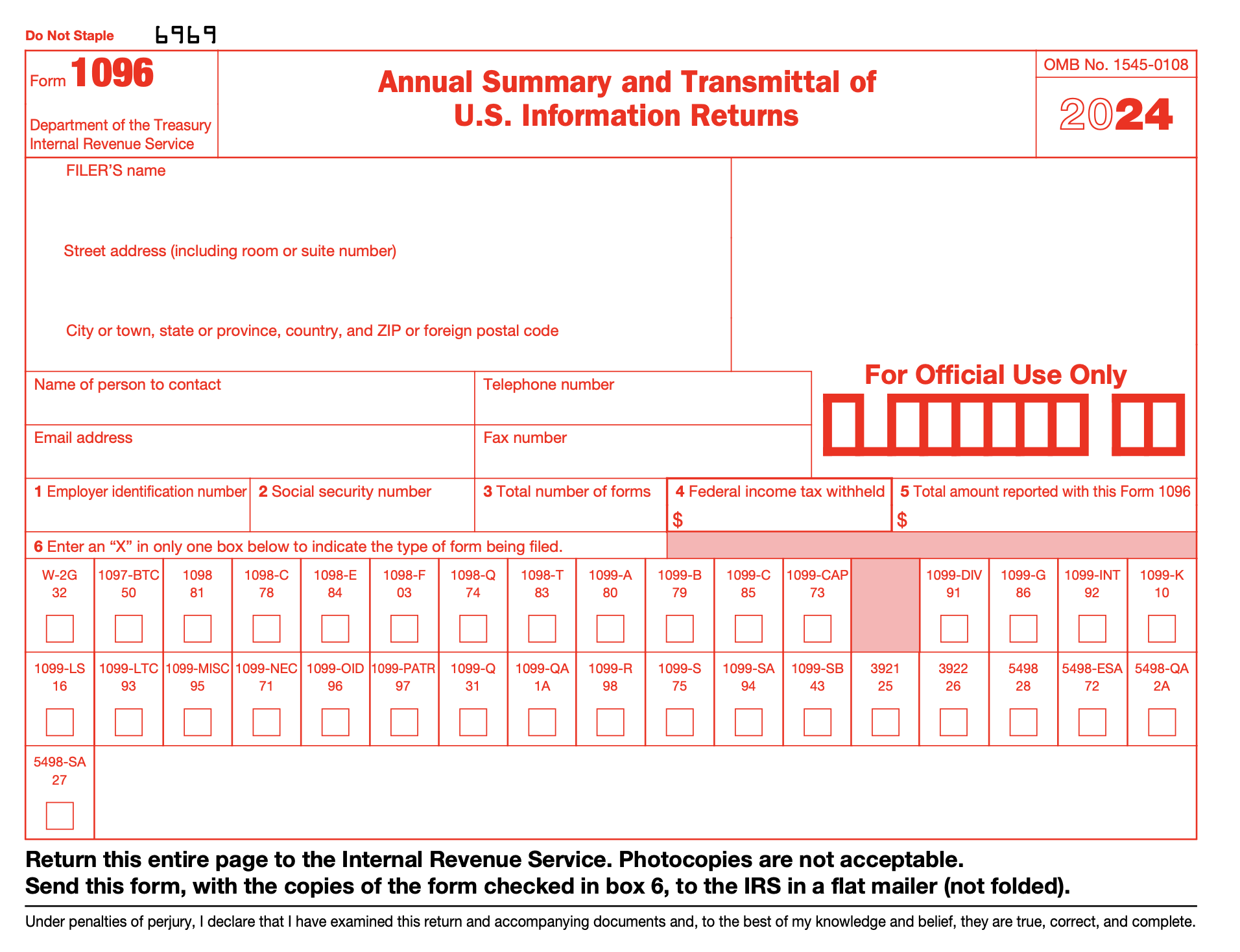

This is a visual for you of the Form 1096

This is a visual for you of the Form 1096The Form 1096 Annual Summary and Transmittal of U.S. Information Returns acts as a summary of all 1099 forms you submit to the IRS. Just so you connect the dots between the employee and nonemployee process, the Form 1096 is analogous to the Form W-3 for employee earnings.

Form 1096 is a summary and transmittal form used to send paper copies of information returns (like the 1099-NEC, 1099-MISC, etc.) to the IRS. Think of it as a cover sheet that summarizes all the 1099s you're filing. You'll need a separate Form 1096 for each type of information return you're submitting. If you're filing electronically, you generally don't need to file Form 1096.

Key information reported on Form 1096

- Type of information return being filed (e.g., 1099-NEC)

- Total number of information returns being filed

- Total amounts reported on the information returns

- Payer's information

Return to the Manual* >> Part 2 Tax Reporting and Compliance - Form 1096

** This reference guide is the 'how'. The manual will give you the 'what and why'.

Small Business Year-End Payroll Checklist

For 10 or Fewer Employees

As a small business owner in the U.S., ensuring you have all your payroll tasks completed by year-end is very, very, very important. It's always best to refer to specific resources like ADP's Annual Payroll Year-End Checklist or consult with a CPA for tailored guidance.

That said, here's a general checklist for year-end payroll for a business with 10 or fewer employees, valid for either the 2023 or 2024 tax year.

1. Verify Employee Information and Classification:

- ⎕ Verify accuracy of names, addresses, and SSNs

- ⎕ Confirm employee classifications (full-time/part-time)

- ⎕ Review contractor vs. employee status

- ⎕ Review exempt vs. non-exempt status*

- ⎕ Update outdated W-4 forms

- ⎕ Confirm employee benefit elections for new year

*Paylocity.com explains that "exempt employees usually hold administrative, professional, or executive positions. They're “exempt” from the Fair Labor Standards Act's (FLSA) overtime regulations and, therefore, not entitled to overtime pay. Nonexempt employees are typically paid hourly and perform more manual or technical duties.".

2. Reconcile Payroll Records:

- ⎕ Check point - do your payroll records match your quarterly 941 forms; discrepancies can indicate errors that need to be rectified.

- ⎕ Verify the taxable wages for each employee, double-checking for any mistakes that could affect both tax reporting and employee take-home pay.

- ⎕ Go through overtime payments to ensure they are not only processed correctly but also accurately reflect hours worked and rates. Check they comply with labor laws.

- ⎕ Ensure that any manual checks issued outside the regular payroll system have been accurately recorded in your payroll system and your general ledger. Make sure the correct withholdings were taken and W-2 reporting was not affected incorrectly. It's generally okay to issue manual checks occasionally for special circumstances, such as bonuses, corrections, or other off-cycle payments. However, relying on manual checks regularly can complicate your payroll records and increase the risk of errors.

- ⎕ Confirm that all fringe benefits are reported correctly. The IRS in Publication 15-B define fringe benefits as "a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work." Some fringe benefits are deductible to the employer; some are taxable income for the employee. Check the IRS guidance on which benefits are taxable and how to calculate their fair market value. See task 3.4 above for more information.

- ⎕ If applicable, review any special wage payments such as tips or 401(k) contributions to ensure they comply with regulations and have supporting documentation.

3. Tax Compliance and Reconciliation:

- ⎕ Double check your federal, state, and local tax deposits for accuracy and completeness.

- ⎕ Make sure that all payments made to the IRS on a quarterly or monthly basis have been properly entered in your accounting program.

- ⎕ Take time to reconcile Social Security and Medicare withholdings with your IRS account to avoid any potential issues.

- ⎕ Confirm the state unemployment insurance rates that will apply in the coming year; you may need to make adjustments to your upcoming budget.

- ⎕ To make sure you avoid penalties and are 'audit ready', review your local tax obligations so there are no surprises.

- ⎕ Address any outstanding tax notices or discrepancies you may have received, as resolving issues in a timely manner is extremely important when dealing with payroll.

4. Year-end Review of Benefits:

- ⎕ Take a look at your records for paid time off to ensure it aligns with employee usage policies.

- ⎕ If applicable, confirm the amounts contributed to health insurance plans to maintain accurate financial tracking.

- ⎕ Validate the details of contributions made to retirement plans; accuracy is important for both taxation and employee satisfaction.

5. Year-end Tax Forms:

- ⎕ Prepare W-2s for employees

- ⎕ Prepare 1099s for contractors - in a larger company, Form 1099 tasks would be performed by Accounts Payable staff and not Payroll staff.

- ⎕ Collect W-9s from contractors

- ⎕ Plan for January 31 distribution deadline

6. System Updates for New Year:

- ⎕ Update your payroll system for the new tax tables

- ⎕ Review minimum wage changes and update manually if your system doesn't handle this for you

- ⎕ Set up new vacation and paid time off (PTO) accruals

- ⎕ Verify software updates

7. Record Keeping:

- ⎕ Back up all payroll data

- ⎕ Store copies of tax filings

- ⎕ Maintain records of paid leave

- ⎕ Address any garnishments or levies

- ⎕ Keep records for at least 4 years

Return to the Manual* >> Part 2 Tax Reporting and Compliance - Yearend Tasks

* This checklist is the 'how'. The manual will give you the 'what and why'.

My sincere gratitude to all my readers ... without you I'd have no website. Blessings to you all. My suggestion to you ... enjoy a tall cool glass of lemon water while you click and poke and peek and snoop this site ... perhaps start with the blog which lists the most recent updated articles.