- Home

- Financial Statements

- Financial Planning - Your Road Map

Preparing A Financial Plan Is Essential

For The Small Home-Based Business

by L. Kenway BComm CPB Retired

Published March 2009 | Updated June 3, 2024

Cartoon courtesy of Advice ... with Dr. Julia Chicken who says, "Let's face it. You don't know what you're doing."

Cartoon courtesy of Advice ... with Dr. Julia Chicken who says, "Let's face it. You don't know what you're doing.""Reduce your plan to writing. The moment you complete this,

you will have definitely given concrete form to the intangible desire."

-- Napoleon Hill --

Preparing a financial plan is essential to the small home based business. Without a plan, how do you know where you are going … and how will you know when you have "arrived"? Strategic management of your business will keep you focused on your vision and goal.

You should always have a plan B ... and it sure wouldn't hurt to have a C and a D.

"A goal without a plan is only a dream."

-- Brian Tracy --

Planning is all about getting your priorities straight ... as this video shows ... WARNING do not view the video if you don't want to be uplifted, empowered or motivated to get your butt in gear.

Welcome to Bookkeeping Essentials - The Road Map!

Strategic management of your business will keep you focused on your vision and goals for your business.

I am using the term preparing a financial plan here in a broad way to include your business plan and objectives, your budgeting and forecasting.

So where do you start such an overwhelming task? ...

... Start at the beginning - develop your business plan first.

Once you have completed preparing a financial plan, you will need to develop a budget ... so you have a concrete, quantitative method of tracking your progress towards ... your overall financial plan for your business.

This section is entitled “The Road Map” because it is going to discuss :

- financial planning from a strategic management point of view,

- how to create your business plan,

- how to develop your first budget (it’s not as hard as it sounds) and then

- finally how to monitor your financial plan.

There may be some side topics discussed that I think of as being more about managing the numbers side of your business.

- If it's doing the actual bookkeeping, it will be handled under "The Bookkeeping Practices".

- If it’s a skill I think you need to learn to run your business more effectively, I will post that under “The Financials Training”.

- If it relates to setting up your bookkeeping system, I will post that under "The Accounting System”.

More for Canadians >> Tax Compliance Resources

More For Americans >> Small Business Tax Compliance

One point I’d like you to keep in mind as you work your way through this section ... I will try to tie any topic covered in this section back to good bookkeeping practices and how your bookkeeping system can help you run and manage your business. This site is all about bookkeeping after all! ;-)

You may have noticed I've been throwing a bunch of motivational quotes. I hope you come to this page on the days you are discouraged or frustrated, and there will be many, to catch your breath and find some motivation to keep going, to remember why you are doing this?

Purpose of Preparing a Financial Planning

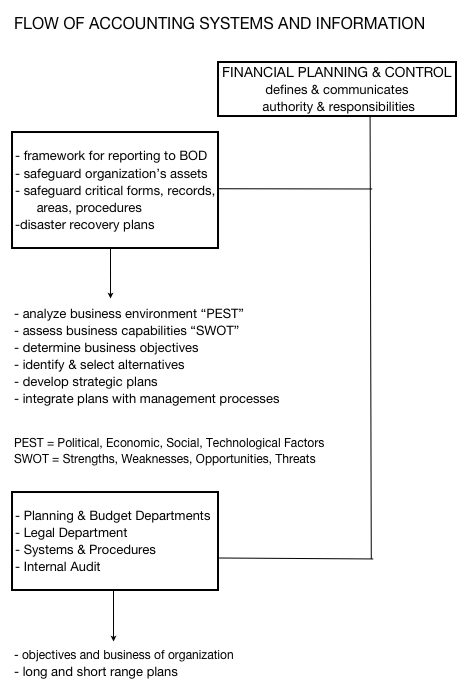

Sometimes a picture can say more than words. I've put together a flowchart that depicts the purpose and objective of having a financial plan for your business. As your business grows, you will want to refer to this flowchart to make sure you haven't missed anything while developing and conceptualizing your plans.

The flowchart shows how your accounting systems and accounting information flows and pertains to financial planning.

In a small unincorporated business, your Board of Directors (BOD) will likely be your trusted advisors / mentors. Your "departments" will likely be outsourced to various professionals.

The big thing to notice is you are trying to define and communicate authority and responsibilities.

Take time before you start on preparing a financial plan to read Steve Pavlina's article 10 Stupid Mistakes Made By the Newly Self-Employed at:

www.stevepavlina.com/blog/2006/04/10-stupid-mistakes-made-by-the-newly-self-employed

Following are executive summaries of the chats I've together that provide instructions on the practical side of making and monitoring your business plans.

Just click on any link of your choice and you'll go right to the page.

Bookkeeping Facilitates ... Informed Business Decisions

Capture your progress of the goals you have identified and set. Let your accounting system help YOU make informed business decisions.

Building Your Business Plan

Originally, I had planned to have you join me while I took you through the process I used to create a business plan for my small home based business.

But there is just so much information out there on how to do it ... and sites that have tools to help in preparing a financial plan ... so instead of following my original plan, I'm going to refer you to a great site ... or two.

Keith Anderson CPA-CA's wrote a good article on and shared his expertise on Why Prepare a Business Plan. His website is now defunct but here are my notes which may be an actual excerpt from his website.

- The business plan identifies the amount and the type of financing or outside investment required.

- A plan makes it easier for a lender or investor to assess you and your proposal.

- It encourages realism.

- It helps you to better identify your customers, your market, your pricing strategies and thecompetitive conditions under which you must operate to succeed.

- It improves your ability to manage your business.

- A business plan provides an outline of your short term and long term business goals.

If you are overwhelmed with the thought of preparing a Business Plan, CPA CA's are trained to assist you in developing one.

Canada Business.ca has a free interactive business planner that you might consider using to get started. This site is hosted by the Government of Canada. I talk more about it here along with other government sites sponsored by the Australian and UK governments.

I'll share that in preparing my financial plan was developing multiple sources of active and passive income (not putting all my eggs in one basket ... so to speak). You see, I don't have a company pension. My long term goal was financial independence even without the luxury of a company pension. I started working on it in my thirties. So it's never to early to start planning because life happened while I was making plans and the foundation I laid in my thirties literally carried me through the next twenty five years at various points in time.

More For Canadians >> As a small business owner, do you have an exit strategy from your business?

Four Secrets to Customizing Your Bookkeeping Reports ... to Meet Your Needs

Plan ahead to customize your financial reporting package to meet your specific information needs.

Financial reporting is an essential planning tool that helps YOU mine your valuable small business information records.

Your accounting reports can help you make better business decisions ... if you spend some time planning your information needs properly.

You'll find four secrets to help you on your way.

Creating Your First Budget

Budgeting is one component of preparing a financial planning. It is easy to create a budget if you are systematic, logical, and thoughtful. For example, tie your budget into your business plan by putting numbers to your plans for the coming year.

To create your budget, follow these general guidelines.

- Work on one account / category at a time from your income statement.

- Keep notes on your assumptions. It will help when you have to try to figure out why you are out from your budget.

- Budget at the level of detail you want to track and monitor. It may be different for each account / category.

- Make sure you account for one time items as well as the ongoing items.

- There is usually a lot of consistency from year to year, so look at last year's actual results to help you build this year's budget.

Once I've drawn up a budget, I like to review it and classify all the items as a way to set my priorities ... because I want and like to meet my financial planning goals. I reorganize expenses into discretionary (need to have) and non-discretionary (want or nice to have).

If you use QuickBooks and have at least one year's worth of data, QuickBooks can create a budget for you based on last year's actual results. You can then edit the information to reflect your goals for the coming year ... and adjust it for one time versus ongoing expenditures.

Budgeting gets easier the longer you do it ... so your first budget may take some time as you begin to quantify your vision into actual financial results, but each year you will get better at it and it won't take as long to develop.

Forecasting, How is it Different from Budgeting?

Budgeting is creating amounts for each category of revenue and expense ... and then tracking your progress at meeting your budgeted amounts.

It is your short term plan on what you expect your financial results to be. On a regular basis, you review the differences to determine why you over or under spent within each category.

Forecasting is projecting into the future ... like running a "what if" scenario.

While my budget for the year remains static once I have finalized it , my forecasting is always changing.

I like to use the forecast so I can see the effect of changes I know are going to happen that are different from what I anticipated when I drew up my budget.

The more you budget, the easier it becomes each year to create a new budget ... especially if you have been forecasting on a regular basis.