- Home

- Financial Statements

- Financial Reports Overview

Advertisement

Free Online Accounting Training

Free Online Accounting TrainingLearn How To Read Your Internal Financial Reports

For The Business Owner Working From Home

by L. Kenway BComm CPB Retired

Published March 2009 | Edited August 30, 2024

No previous accounting training or bookkeeping training? No problem! This section (the whole website actually) is strictly for the non-accountants. It was designed for small business owners working from home with no financial background.

Whether or not you are doing your own bookkeeping or have hired a bookkeeper, you need to learn how to read, interpret and use the information you’ve painstakingly compiled to help you run your business.

This free bookkeeping training helps YOU with the numbers side of your business … not the data entry … but the real numbers that drive your business. We'll will focus on financial statement reporting which is different from income tax return reporting.

Highlights Of This Post

In addition to basic bookkeeping concepts, you'll find a series of chats on how to read your internal financial statements:

- Introduction to your financial statements

- Balance sheet

- Income statement

- Cash flow statement

- Sample financial statements

- How to review your financial statements - an important business skill

There's also short accounting training overviews ... things I think you should become familiar with such as

- Basic cash management

- Basic ratio analysis - Some Quick Accounting Training

- Are you profitable? - More Quick Accounting Training

- What to do now to prepare for yearend

- Yearend bookkeeping Q&A

And for those looking for looking for more formal online bookkeeping courses, I've put together information on online accounting training and tutorials.

Each article is written in an easy to understand manner intended to help you run your business efficiently and effectively ... because the numbers do matter.

Executive summaries of all the free bookkeeping and accounting training articles follows.

Welcome to Bookkeeping Essentials - The Financials Training!

Advertisement

As a self-employed business owner, working from home can be an isolating experience at times. I sometimes go for days without interacting with another human on a face-to-face basis (lots of phone and internet conversation though.) ... just me and my animals conversing with each other and with nature! I talk a lot to myself some days.

I work from home. Even though I have accounting training, I was faced with the problem, "Where do I turn now for resources and guidance because I no longer have co-workers down the hall?" It was one of the challenges I faced when my commute to work went from 60 minutes to 60 seconds. ;-)

It's why I started this website ... a resource of practical information and basic accounting training for home based businesses.

Due Diligence Defense

In Canada and the United States, the taxing authorities should not impose a penalty if the taxpayer exercised due diligence or reasonable cause (care) in their reporting of tax. Often a taxpayer must go to court and demonstrate that he/she took steps to not make an error.

-- Cyndee Todgham Cherniak --

Lawyer and Publisher of The HST Blog

Executive Summaries

|

Basic Accounting Concepts and Principles

The best place to begin is by understanding the basic accounting concepts and conceptual framework around which Canadian GAAP (Generally Accepted Accounting Principles) was developed ... the foundation for all bookkeeping and accounting training. Canadian GAAP has undergone some changes in recent years. Accounting Standards for Private Enterprise (ASPE) came into effect January 1, 2011. You will find information about some of the changes that may affect how you keep your books. Two current topics are:

For my U.S. visitors, you will find a link to U.S. GAAP resources. For small business purposes, Canadian GAAP is very similar to U.S. GAAP. Most of the differences between the two standards arise when dealing with the more advanced reporting required of publicly traded companies. |

|

An Introduction to ...

|

Sample Financial Reports From QuickBooks®

|

Sample financial reports because sometimes a picture is better than words ... for those who learn by seeing. These bookkeeping forms are a reference point for producing your own financial statements. This page is meant to be used as you work your way through the articles mentioned on this page. |

|

How to Read Your Balance Sheet

Learn why it matters that you understand your balance sheet. Then discover what it reveals about your business finances. The mystery is about to unfold! You'll find accounting training chats on:

Here are links to individual items on the balance sheet: Assets Accounts Receivable Inventory Count Inventory |

|

How to Read Your Income Statement

Learn why it matters that you understand your income statement. Learn how profit and loss is different than cash flow. Discover how you use this financial statement to improve your bottom line. The mystery unfolds! ... You'll also find four sidebar chats:

Here are links to individual items on the income statement: Revenue COGS and COGS formula Gross Profit Operating Expense |

|

The Monthly Financial Review

|

Business coach Susan Martin from Business Sanity.com explains a quick method of calculating your profitability manually in "Computing Business Profitability".

I like it because it teaches you how the numbers from your financial statements work (it's painless and relevant accounting training) ... instead of just relying on your computer to spit the numbers out for you. Think of it as a way to proof your financial reports.

For those of you keeping manual books or who don't have regular financial statements, it's a great way to determine if you are making money ... instead of waiting for your accountant to give you the big surprise at year-end.

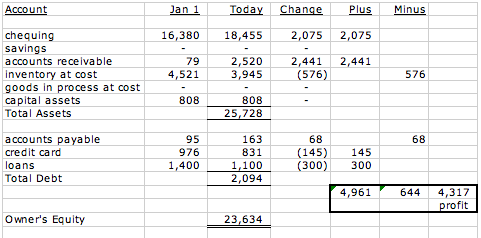

Here is Susan's method ... I've modified it slightly so that you have more of a template that you can setup and use all the time ... plus I snuck in one more calculation so you also have your owner's equity.

On a clean sheet of paper ... or create your own bookkeeping worksheet template in an Excel spreadsheet ... with your accounting ledger at hand (you do need fairly up-to-date record keeping to use this method):

- Make six columns across the top and call them Account, Jan 1, Today, Change, Plus, Minus.

- Under the Account column, write down:checking, savings, accounts receivable, inventory (at cost), goods in process (at cost), capital assets. These are your assets (what your business owns) so mark the next line with Total Assets.

- Continue under the Account column, skip two lines ... then write down:accounts payable (include tax payable accounts like GST), credit card loans. These are your liabilities (what your business owes) ... so mark the next line with Total Debt.

- Under the Account column again, skip two lines and write Owner's Equity.

- Under the Jan 1 column, write down the opening balance on Jaunary 1 for each of the accounts you listed above. Your opening balance should be the same as your December 31 closing balance.

- Under the Today column, write down today's balance for each of the accounts you listed above.

- Subtract column three from column two ... show the change as a positive or negative number in the Change column.

Your (rough) income statement:

- For your asset accounts (cash, accounts receivable, inventory and goods in process, capital assets) do this:

- If the account balance is larger now than at the beginning of the year, put the calculated change in the Plus column.

- If the account balance is smaller now than at the beginning of the year, put the calculated change in the Minus column.

- For your liability accounts (accounts payable, credit card or loans) do this:

- If the account balance is smaller now than at the beginning of the year, put the calculated change in the Plus column.If the account balance is larger now than at the beginning of the year, put the calculated change in the Minus column.

- Total the Plus and Minus columns.

- Subtract the Minus Column from the Plus Column ...

- A positive balance means you are profitable .. Whoo hoo!

- A negative balance means you are losing money. :0(

Accounting training made easy! Now for the extra calculation I snuck in ...

Your (rough) balance sheet:

- Under the Today column, add up your assets and write the number down on the line I had you mark as Total Assets.

- Under the Today column, add up your liabilities and write the number down on the line I had you mark as Total Debt.

- Under the Today column, if you subtract your Total Assets from your Total Liabilities, you have your Owner's Equity (how much you have invested in the business ... not to be confused with the value of your business).

Example of bookkeeping worksheet you can create in Excel to calculate your profitability.

Example of bookkeeping worksheet you can create in Excel to calculate your profitability.I'm not sure if you figured it out ... but the Plus column is Debits and the Minus column is Credits. You can find a "cheat table" on Debits and Credits that will help you keep them sorted out.

Now this mini accounting training lesson wasn't too bad, was it?

Susan Martin offers financial management coaching services (relevant accounting training) for small business. You can contact her through her website. I have not used her services, but I like her blog and management articles.

P.S. The more you practice doing this mini accounting training lesson, the more likely it will be that you will begin to intuitively understand the numbers that drive your business.

P.P.S. If you liked this sidebar, you might also like this quick method of estimating your cash flow.

Wrap-Up

There are so many business skills to learn about when running your own business. You may not need formal accounting training but developing financial skills will help you beat the odds of still being in business five years from now.

I have spent some time scouring the internet looking for sites that are designed for business people without an accounting background … non-accountants.

Two sites that provide excellent basic accounting training for small business owners that do not have a financial background are:

- reallifeaccounting.com - no longer available John retired. I will be looking for a replacement

- dwmbeancounter.com

To your ongoing business success!