Share Capital

by Stanley

(Toronto)

Capital Structure

My clients (3 owners together, 50%,30%,20%) just setup a new small corporation to buy a franchise business. They are going to use their own fund $150,000 and borrow $100,000 from bank.

How much capital shares should I record in their equity account? I see some small corporations with only one owner just put $100 in capital share, and the balance is recorded to "Due to shareholders" in libility.

Should I do the simlar thing? $50,$30,$20 is recorded for capital shares for these three owners and 149,900 is recorded to "Due to shareholders"?

What results would be in taxation or accounting if I record capital share amount with different amount(for example $500,300 and $200 for the three owners)?

Stanley,

It is my understanding that the share capital is determined when the company is setup. They really need to see a tax accountant or tax lawyer to ensure they setup the share capital in a way that best facilitates their uniques circumstances. This is particularly important as they aren't all contributing the same amount of capital. I would not "cheap out" here as it could cost them in the long run.

If you have the lawyers documents from the incorporation, you should find it there I think. You should also be able to find it in their minute binder under share certificates. These would have been issued when they incorporated.

A Simon Fraser University article by Simon Volker (http://www.sfu.ca/~mvolker/biz/incorp.htm)

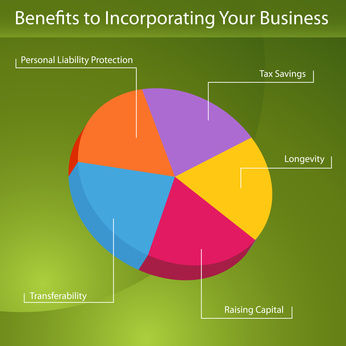

"One of the details of incorporation, covered in the afore-mentioned articles, relates to classes of shares. A company has the right to define its "capital structure" in many different ways, i.e. it can define various classes and types of shares which it will issue. For example, companies usually issue one class of shares, namely "common" shares. These shares are precisely that: "shares" of ownership. Each share entitles shareholders to one vote at shareholder meetings and each share entitles its holder to one share (i.e. 1 divided by the number of shares issued in total) of the corporate profits. You may have heard of "Preferred" shares. Such shares have certain "preferred" rights. For example, they might entitle the holder to a fixed dividend rate. They may also entitle the holder to a conversion into common shares (at a given ratio or formula). They can be used to give investors special rights or additional security in order to attract their investment dollars. Sometimes different types of shares, common or preferred as described as Class A or Class B (or Class C...etc) shares. There are no universal definitions relating to Class A vs Class B. For example, one company's Class A shares might be quite different from another company's Class A shares. The different classes permit companies to assign different rights to the shareholders of these securities, e.g. different classes may have different voting or liquidation rights." ... my emphasis

Comments for Share Capital

|

||

|

||