Self Assessing PST

by Suzi

(British Columbia)

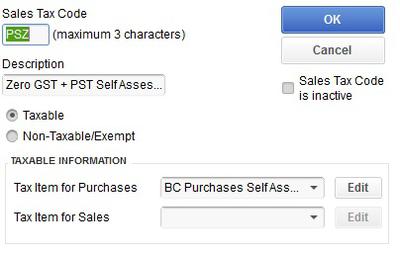

Picture 1 PSA Tax Item Setup

Hi,

I live in BC and setting up bookkeeping file for my first client and I have to self asses PST on couple of purchases out of country. It is equipment that will become company asset. I am having trouble correctly posting the self assessed PST into QuickBooks.

I have tried to do an online search and found numerous advice about creating a self assessed PST expense account and also creating a new tax item, however now I am getting a bit confused. I just want to make sure that the self assessed PST will show up on the correct line in the tax report. Can you walk me step by step what is the correct way to do it?

Thank you very much.

Hi Suzi,

This is how I setup self assessing PST in QuickBooks desktop. I'm sure there are other ways to do it but I found this works for me.

Go to the menu bar and select Sales Tax > Manage Sales Tax. Click on the "Change Tax Setup" button on the right hand side and follow the wizard (or manually setup your tax codes, items and groups which I prefer but that's just me):

1. Choose add another rate for an existing tax.

2. Select "Ministry of Finance (BC)" for the sales tax agency.

3. Enter a name for the tax rate you are creating. Basically you are creating a new sales tax item for self assessed PST. See Picture one above for how I set it up. You can see I selected 7% as the sales tax rate and Box F for the Return Line. I kept QuickBooks's default for the Tax Return

4. Create two new sales tax codes. If you are using the wizard, you will have to walk through the next steps twice, one for each code.

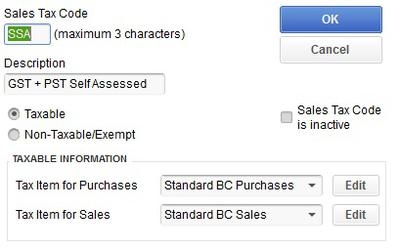

- One for zero rated GST + self assessed PST. I call it PSZ. See Picture two above.

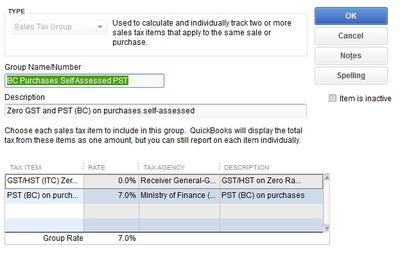

- Another one for GST + self assessed PST. I call it SSA. See Picture three above.

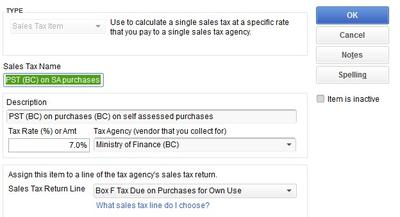

3. Create a new sales tax group. You can see that I choose "This tax code is for the new tax rate PLUS other taxes, which I'll select in the table below."

- See Picture four above. From the table list, I chose Z for GST Zero Rated. Your tax group will be GST at 0% and PST at 7%.

- Another one for GST + self assessed PST. I call it SSA. It will be similar to Picture 4 but for this group. From the table list, I chose G for GST Only. Your tax group will be GST at 5% and PST at 7%.

The problem I had using the wizard is I inadvertently setup sales tax items when self assessing PST only requires purchase tax items. If this happens just edit the code because I've never had to self assess PST on sales. See the difference between Picture 2 and Picture 3 for what I mean.

When you are done, your sales tax code list should include something like this:

Code PSZ Description Zero GST + PST Self Assessed

Code SSA Description GST + PST Self Assessed

I've done this up quickly as I'm pressed for time and have not really tested it so you may have modify the instructions somewhat. Hope it helps.

Return to Learning QuickBooks.