Sales Tax Return Already Filed

by Lynne

(BC)

Cannot File Prior Period GST/HST Tax Return

I am using my newly purchased QB and filed my current quarterly Sales Tax Return.

Now I am entering data retrospectively for the last fiscal year. I want to File Return and Receive Refund from Agency, but QB says I cannot file - return already filed. I did not do this for any period last year, but have done it for in current year.

Do I have to manually create an invoice for Sales Tax Agency?

Many thanks.

Hi Lynne,

Sorry I took so long to get back to you. I needed time to experiment a bit.

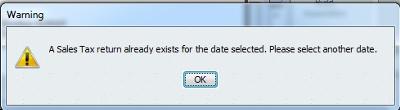

I recreated your error message ... you can see it in the first picture.

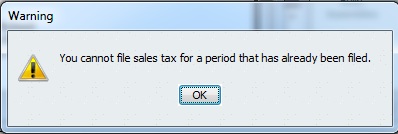

Next I tried to re-file the last return so that I could clear prior periods. That created the error message in the second picture above.

I think you are going to have to manually prepare each payment and/or refund. Make sure your GST/HST Payable account is balanced prior to filing your next GST/HST return.

Take a backup before you file your return ... which you should do anyway in case something goes wrong.

What is going to happen is that when you file your next legitimate tax return in QuickBooks, it is going to clear all your prior periods ... which is why I said to take a backup BEFORE you begin and make sure you are balanced.

You are going to have to manually create your GST/HST return that you actually file with CRA as your QuickBooks report will have carry forward balances from your prior periods.

I am wondering how you got your opening balances for QuickBooks setup if you are retroactively going back and entering data. Usually, you enter your opening balances for the time period where you want to begin and go forward ... not backward ... in time.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Comments for Sales Tax Return Already Filed

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||