Sales Receipt Requirements

by Mom

(Canada)

Sales Receipt Requirements

Hi,

My son is just starting his very own small-business. (He is 13). I am setting him up to use QuickBooks in its most simple form (sole proprietorship) but one question comes to mind.

Since his business is small (very small indeed), he meets the requirements for not having to collect/submit HST (i.e. less that $30,000 in sales over 4 rolling quarters). However, I am at a loss to find out what are the minimum requirements for the information that needs to be included in Sales Receipts.

I have searched high and low and the only requirements I can find is for the business that does collect HST, which, for my son is overkill.

Any help would be immensely appreciated.

Hey,

Check out this link for CRA legitimate business receipt requirements.

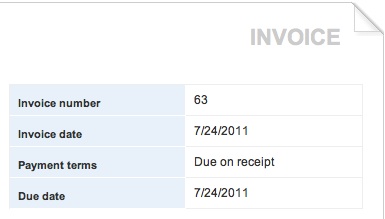

The only adjustment you need to make is to ignore the GST/HST registration number requirements. I personally also like the sales receipts to be pre-numbered if they are hand written. If you will be using accounting software like QuickBooks, then each invoice / sales receipt will automatically be assigned a number. Save voided slips so you can account for each numerical receipt during an audit. If you are using QuickBooks, use void instead of delete if you need to cancel a receipt for some reason.

Remember, you need to have enough information to allow a business to deduct their expense. They need to prove to the tax auditor proof of purchase AND proof of payment.

You didn't say what your son's business was going to be. If he will have a lot of deductions / expenses that attract GST/HST, then he may want to consider registering for GST/HST voluntarily, so he can recover his input tax credits.

Comments for Sales Receipt Requirements

|

||

|

||

|

||

|

||

|

||