Reimbursed Expenses

Hello,

I am trying to figure out whether or not I should include recoverable expenses in line 101 of the HST report.

I work for a patent agency. We pay official fees on behalf of our customers and then we add this fee as reimbursements to the invoice we issue to our customer.

Should I add this recoverable expense to line 101 ?

Thank you

Hi,

I have never dealt with patents specifically, but when I have reimbursable expenses, this is how I deal with it in QuickBooks ... as pictures are worth a thousand words, I am including screen shots of QuickBooks windows.

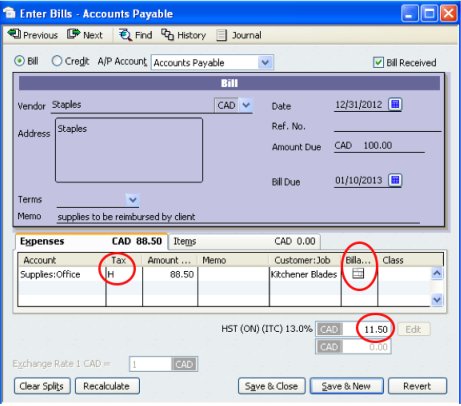

This first screen shot shows the entry of the vendor billing pertaining to reimbursable expenses. Notice that I have indicated that the expense is to be reimbursed.

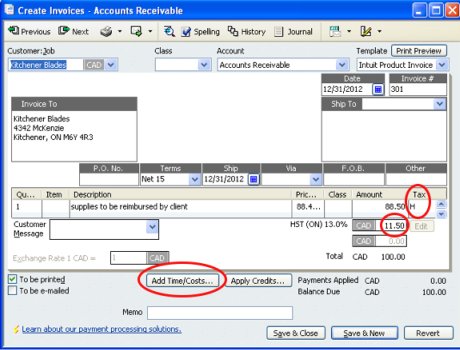

The second screen shot shows the client invoice charging the reimbursable expense. I have assumed that you are not marking up the reimbursable expense ... which is treated a bit differently.

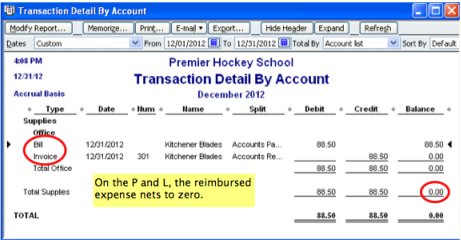

In this third screen shot, you get to see the effect on the income statement. You can see the expense account reflects a nil effect.

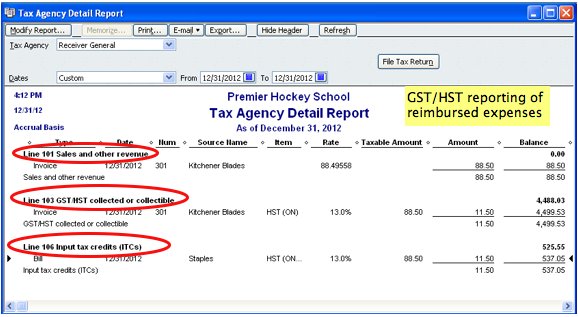

And finally, this fourth screen shot shows how it is reported on the GST HST report. You can see that the customer amount invoiced shows on line 101 excluding the GST HST collected. The GST HST collected shows on line 103 and the GST HST associated with the original expense (the input tax credit) shows on line 106.

I handle reimbursed expenses this way because of my understanding of how reimbursed expenses are to be reported for tax purposes.

QuickBooks® is a registered trademark of Intuit, Inc. ... Member of the QuickBooks ProAdvisor® Program ... Screen shots © Intuit Inc. All rights reserved.

Comments for Reimbursed Expenses

|

||

|

||

|

||

|

||

|

||

|

||