QuickBooks Receive Payment

by Mark

(U.S.)

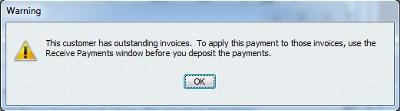

This is the message you ignored when making your bank deposit for the customer payment received.

Hi,

I have a bad habit of just depositing funds and recording it in QuickBooks 2009 without going through the "Receive Payments" process.

Therefore, later, I need to make an adjusting entry to make sure that A/R is accurate and shows receipt of payment, but without increasing my bank balance by the same amount a second time.

Could you please help me with this?

Thx,

Mark

Hi Mark,

QuickBooks is a great program but if you don't use it the way the program is designed, you create all kinds of trouble for yourself ... and get inaccurate reporting. Who is going to rely on inaccurate information to run their business?

I'm curious ... you haven't told me if you have been booking your income twice ... once when you create the invoice or sales receipt ... and again when you booked your deposit. If you haven't been booking your income twice, where have you been booking your deposits?

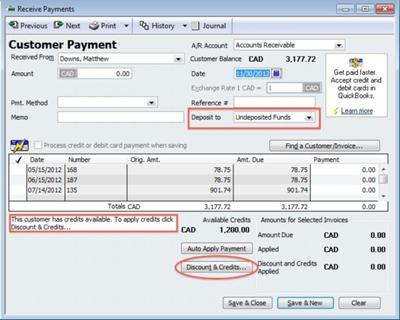

I'm going to walk you through an example using a customer named Matthew Downs. He made a $1200 payment on November 30, 2012.

I want you to run your Customer Balance Detail report. My guess is under "Type" you will see Invoice or Deposit but not Payment.

When you receive a payment through accounts receivable, "payment" type would show up here. "Deposit" type shows up here when you use Make Deposits for a customer payment.

If you are using QuickBooks properly, there should be no "deposit" types here. If there is, you need to fix it.

Now I want you to open up your Customer Center and go to one of your customers. I'm guessing that when you look at the customer's account, the payment you deposited does not show. This is the big downfall for you. If a customer calls, you can't just look in the account and see how much is owing anymore. Your sub-ledger does not match your general ledger control total.

You could run the Accounts Receivable Aging Summary and get a balance ... but you need to tidy it up. I'm going to run through two ways to correct your problem. I suggest you take a backup before you start. That way if you muck up, you get a do-over.

The first way does a quick fix ... meaning you will apply the payment to the customer's balance ... but it won't show up in the customer sub-ledger (Customer Center).

Find your Make Deposit entry. Change the "from account" field to "Accounts Receivable". The customer's name must be correct in the "received from" field. Save your entry. See picture two above for an illustration.

By the way, if

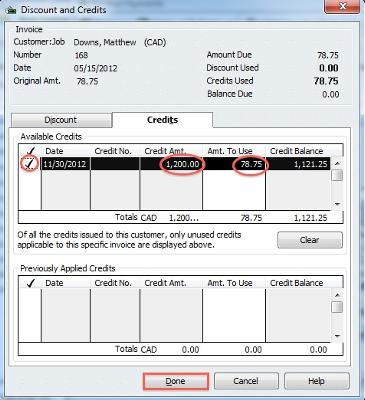

Next, go to Receive Payment and select your customer name. You should see a message on the left hand side that says, "This customer has credits available. to apply credits click Discounts & Credits...". Go ahead and click the "Discounts & Credits" button. Picture three above shows this screen for you and what it should look like.

Now, click on one of the unpaid invoice lines (see picture four). The credit amount available shows, along with the amount you are going to apply. If this payment is for numerous outstanding invoices, you will have to repeat this step until your credit is used up.

Again this method is a quick fix but is not a long term solution because it doesn't correct your customer sub-ledger.

The second option is to fix your error and do the entry properly, the way it should have done. You can see that using this method means you didn't save any time taking a short cut. In fact, you created more work for yourself.

First, void the deposit (do not delete it - voiding keeps the audit trail) but record the information you need BEFORE you void it.

Next record the payment through the customer payment screen ... I told you there was no time savings using this method. (Oops I didn't mean to say "I told you so!" :0))

What makes this the better option of the two methods ... it fixes your customer sub-ledger.

Mark, a smarter shortcut would be to use "receive payment" and change the "Deposit to" field to chequing from undeposited funds. I've outlined the field in picture three above.

However, the downside to this shortcut is you will make your bank reconciliation tougher if you deposit multiple payments in a bank deposit ... and you reduce your internal controls.

So I'm sorry to say that no matter what option you choose, you are going to have to roll up your sleeves because it is going to take work to fix this error.

Maybe this will make you feel a bit better ... you are not alone in trying to take this shortcut.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Comments for QuickBooks Receive Payment

|

||

|

||

|

||

|

||