Petty Cash

by Susan

(Canada)

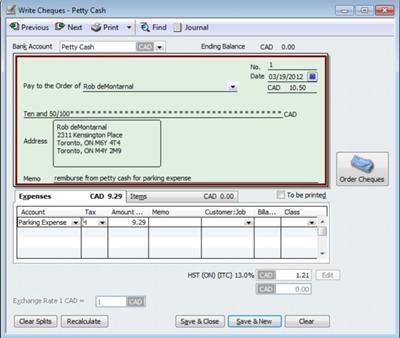

Use Write Cheques to Enter Your Petty Cash Vouchers

Petty cash has been set up.

Let's say I paid Cindy (employee) $10.50 (includes GST only) from Petty Cash for Parking Expense.

In QuickBooks, how do I record this entry? Is the tax backed out and recorded as an ITC.

Susan

Hi Susan,

There are two ways to track Petty Cash. Check out my chat on How to Manage Your Petty Cash Fund.

My bookkeeping entries do not show tax in them (I may have to think about adding that), but you are going to record the petty cash receipt like any other legitimate business expense.

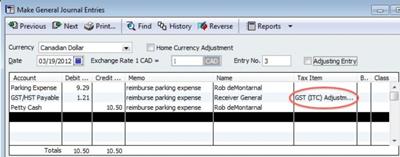

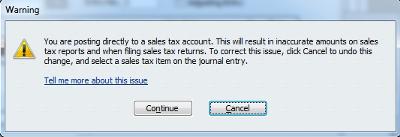

If you are registered for GST/HST, then yes, you would back out the tax and record it separately. This would be your entry would be:

Debit Parking Expense

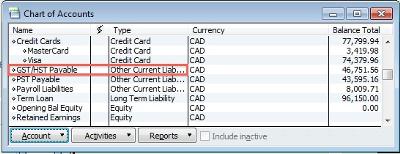

Debit GST/HST Payable

Credit Petty Cash (If you are using my preferred method which I talk about in my chat)

I hope that answers your question adequately.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Member of the QuickBooks ProAdvisor® Program. Screen shots © Intuit Inc. All rights reserved. QuickBooks and QuickBooks ProAdvisor are registered trademarks and/or registered service marks of Intuit Inc.

Comments for Petty Cash

|

||

|

||

|

||

|

||

|

||

|

||

|

||