Interest Received in a Deposit

(Canada)

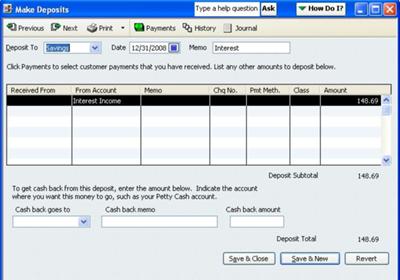

Make Deposit window found in the Banking drop down menu

How do you show interest received in a deposit using QuickBooks?

I'm not sure exactly what you are asking ... so I'll answer in two parts.

Part One - Interest paid by bank

Let's say the bank pays you interest on a savings account. To record the interest, go to the Make Deposits window.

Next, change the memo from Deposit to Interest (see the picture above that I inserted).

Enter the account as Interest Income (which is in the 7000 series of accounts on your chart of accounts (COA)) ... because it is passive income ... not active business income.

Enter the interest paid in the Amount field.

Save the entry.

The Bookkeepers Tip

As a general rule, you use the Make Deposits window to directly enter deposits as long as they are NOT customer payments you have received.

Customer payments are entered through Receive Payments if it is for an outstanding accounts receivable invoice ... or through Sales Receipts is it is a "cash" sale.

Part Two - Interest received on a customer payment

I normally run into this situation when having to book tax refunds received from the Receiver General of Canada.

This is how I record interest received with the cheque but not included on the accounts receivable invoice (or in the case of taxes ... the general

I go to Receive Payment and pull up the customer ... in this instance the Receiver General-Receivable.

I enter the amount of the receivable (not the total cheque value) and match it to the correct invoice / journal entry. Then I complete the rest of the window including a cheque reference number and a quick memo note.

Next, I go to Make Deposits and select the customer payment I just input.

After selecting okay, I arrive at the deposit window where I enter the interest on the line following the account receivable deposit ... coding it to Interest Income.

This time (unlike the bank interest) I enter the received from field.

I take the time to make a memo on the time period or return the interest pertains to ... I don't know about you, but I tend to forget these things after a time ... and taking the extra minute to write a good note saves me looking up paper/scans references later. (The memo note at the very is left as Deposit.)

The total amount of your deposit should now equal the total value of the direct deposit or the cheque to be deposited.

I make sure the deposit is dated the same day as the actual bank deposit.

I hope this answers your question.

Let's chat again soon ... Your tutor lake

Comments for Interest Received in a Deposit

|

||

|

||