HST From Purchases

by Denise

(Ottawa, ON, Canada)

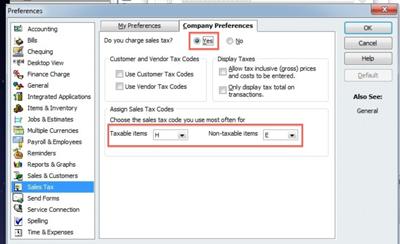

1. Turn on Sales Tax

Hello,

I have a question regarding entering the HST paid from purchases into QuickBooks software.

The corporation is registered for the GST/HST (although it doesn't make close to the $30,000 threshold I thought it was best to register)

I purchased office supplies (in Ottawa, Ontario) so I paid HST (13%). I want to record the HST in the journal entry like this ...

Debit office supplies (expense account)

Debit HST taxes (expense account)

Credit bank (asset)

Thank you so much.

I will definitely donate once I get the books up and running ! Your site has helped me more then QB help or their forum :)

Hi Denise,

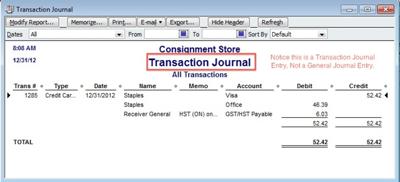

You don't want to be making general journal entries in QuickBooks. The program is designed so you use the proper form for data entry. The transaction journal entry booked works behind the scenes.

You have three choices to enter your purchases:

- Write Cheques (from the Banking menu)

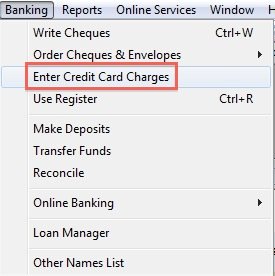

- Enter Credit Card Charges (from the Banking menu)

- Enter Bills (from the Vendors menu)

You may want to read my Internal Controls article to determine the best method to use.

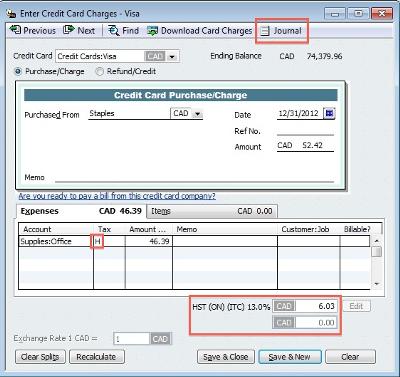

In this example I am going to assume you used your company credit card (not your personal credit card) to make the purchase.

- Make sure the sales tax feature is turned on. (See first picture above.)

To check this, go to Edit> Preferences. Highlight "Sales Tax", then select the "Company Preferences" tab. Make sure "Yes" is selected. Also assign your default tax codes while you are here. - Next, from the Banking menu, select "Enter Credit Card Charges". (See second picture above.)

- Complete the QuickBooks form. (See third picture above.)

If you select the correct sales tax code, QuickBooks automatically calculates the correct tax associated with your purchase. Click on "Save & New" or Save & Close". You are done. - If you want to see the actual journal entry booked by QuickBooks (see fourth picture above), reopen the transaction. Click on the "Journal" icon found on the top right hand side. (See third picture above.)

QuickBooks® is a registered trademark of Intuit, Inc. ... Member of the QuickBooks ProAdvisor® Program ... Screen shots © Intuit Inc. All rights reserved.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Comments for HST From Purchases

|

||

|

||