Help - GST and Gross Sales

by Dave

(Alberta)

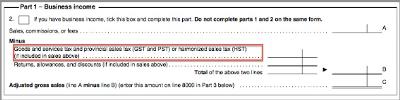

T2125 Part 1 - Business Income - 2 reporting options

Hello all,

I am trying to get my 2010 taxes filed and am running into some confusion.

I am a computer consultant providing computer services strictly in Alberta.

I am using the Quick Method for GST and understand that line 101 needs to reflect the total amount of income INCLUDING the GST I charged.

So for simplicity lets say that is $100,000 in service + $5000 in GST.

So that goes on Line 101 of the GST return.

And then the amount I pay is calculated @ $105,000 * .036 = $3780 - $300 (1% of first $30,000)= $3480

The question I have is what amount do I put on my T2125 in the Gross Sales, Commissions or Fees box?

$100,000 or $105,000

Thanks.

Dave

Hey Dave,

If you look closely at Part 1 - Business Income on the T2125 schedule, you get a choice of how to report it.

If line A includes GST, then you back it out on line B. If line A doesn't include GST, then Line B would be zero.

As you are reporting your sales figures including GST on your GST return, I would report your income including GST on line A ... so the amount clearly ties to the amount reported on your GST Return.

But hey that's just the bookkeeper in me. I like to clearly see where a number comes from or goes to ... and I think auditors do too!

I've included a snap shot for you (see above) of Part 1 - Business Income. You can see I've highlighted in red the section where you back out your GST.

Hope this helps.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Return to GST/HST Quick Method.