Foreign Exchange Transactions

by Terry

(Ontario, Canada)

Income lost to foreign exchange rate changes.

I have received a cheque for payment in US dollars.

The (exchange) rate has changed and I am losing money - how do I record this in Quickbooks® without multiple currencies version?

What type of account?

Thank you so much.

Hi Terry,

I am going to assume you do not have a US dollar bank account ... only a Canadian (CAD) dollar account.

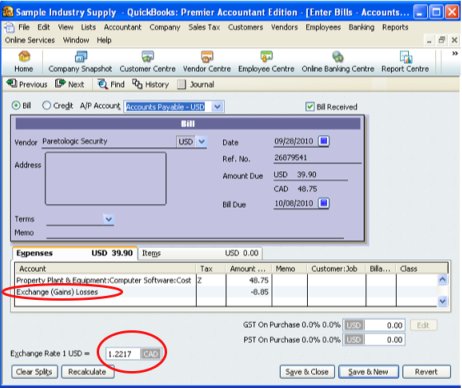

I would setup a QuickBooks® account type other income (on the income statement) so the effect of the currency exchange does not show up in your normal everyday net operating profit (loss) ... but below the line under Other Income and Expense*.

I would call this account Gain (Loss) on Foreign Exchange.

Then I would setup an Other Charge item (on the list menu under items) ... call it something like Foreign Exchange. Set the tax code to be blank and leave the amount at zero. This will allow you to manually enter the amount each time you have a foreign currency transaction.

Setup your accounts receivable in QuickBooks® in CAD. On the second line, use the Foreign Exchange item to record the exchange amount using the Bank of Canada exchange rate for the day if your transaction does not have an exchange rate attached to it. It is always a good idea to make a note in the memo field stating the conversion rate used.

The effect of this transaction should be:

Dr Accounts Receivable for $950

Cr Sales for the CAD amount of $1000

Dr Gain (Loss) on Foreign Exchange for the conversion amount of $50

When you receive your US payment, deposit it to the bank if it is not a direct deposit. This amount will likely be different than the amount you booked above. So let's say you received $940 CAD.

Intuit suggests that you go back and change your original invoice ... but I'm not a fan of this method (especially if you have closed the period) ... it's the accountant in me. I would prefer to do one of two choices.

You could create an adjusting invoice, in this case a credit memo, for the $10 difference. I would select the Foreign Exchange item to record the adjustment. Again, I would make a good note in the memo field.

The effect of this transaction should be:

Dr Gain (Loss) on Foreign Exchange for the conversion difference of $10

Cr Accounts Receivable for $10 which would make the total for this customer $940

Then use Receive Payment to apply the CAD amount received ... followed by Make Deposit selecting the payment you just entered.

Under this option, the effect of the bookkeeping entry should be:

Debit Cash in Bank for the CAD amount received $940

Credit Accounts Receivable for the original amount of the accounts receivable $950

Debit Gain (Loss) on Foreign Exchange for the difference $10

As you can see this is a lot of trouble. So in truth, if you are a small business with little to no debt and no outside investors ... and this transaction was NOT going to be outstanding at year-end, I would just book the original invoice in CAD without taking into account the exchange rate.

Then I would use the second option to record the exchange rate when you receive payment. It simplifies the transaction.

So following through with our example, I would book the following entry using the QuickBooks® invoice form:

Dr A/R $1000

Cr Sales $1000

Then when I received payment, I would receive the $1000 through 'Receive Payment" and book the exchange amount in the 'Make Deposit' window. The effect of the two transactions would be:

Dr Cash in Bank $940

Cr A/R $1000 (through Receive Payments/Undeposited Funds)

Dr Foreign Exchange account $60 (through Make Deposit)

I hope one of these options are suitable for your business circumstances.

*Note - Intuit suggests setting this up as an Expense type of account instead of an Other Income ... but this is not my preference. I like internal financial statements to useful to management and allow / assist them to make informed business decisions.

The great thing about my suggested approach is that a person reading the income statement will able to assess the risk of the foreign currency (which is out of your control) while still being able to assess operations excluding the effect/uncontrollable risk of the foreign currency.

To me, they are two separate issues and this method allows you to separate the issues.

To see how Intuit recommends recording the occasional foreign transaction when you don't have their multi currency version, go to their article title How can I handle the occasional transacton in a foreign currency?. You will find it at: support.intuit.ca/quickbooks/en-ca/iq/Multicurrency/Tips-on-tracking-transactions-in-different-currencies/INF15448.html . This article gets moved around and updated, so you may have to hunt for it.

**Note - To understand the tax treatment, please refer to CRA's bulletin IT-95R Foreign exchange gains and losses.

QuickBooks® is a registered trademark of Intuit, Inc.

Comments for Foreign Exchange Transactions

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||