Entering Invoices from a Supplier

by Christine

(Whistler, BC)

How to enter a bank charge using

This may be a silly question, however; I'm very new to bookkeeping and Quickbooks and see a potential problem with how our accounts were set up.

Initially when Quickbooks was set up, my husband transferred over bank related transactions, including payment for an invoice that was not yet listed in our payables but had been paid through a bank transfer.

Do all Payable Invoices we receive need to be added before payment is applied through either the cheque writing tool or through an automated bank transfer payment?

As it stands, it would seem to me that on paper, we paid something that wasn't owing (although it was, but not yet recorded). I hope that makes sense?

Now, if I add the actual invoice, it shows a payable is due, but that has been paid through the transfer. How does one correct that? Since I do not know the terminology to search Quick Books, I'm at a loss on how to research this at any length.

Additionally; the total of the amount paid through the bank transfer includes a bank service fee; whereby the actual invoice is $25 less. I have tentatively "split" the transfer payment to show a bank fee, but this still doesn't clear up the initial problem.

I have to say I love this site, for someone who has no formal training I have applied what I have learned in the workforce with your information and already have "reconciled" so much. Thanks and God Bless;

Christine

Hi Christine,

There are two ways to pay a bill in QuickBooks.

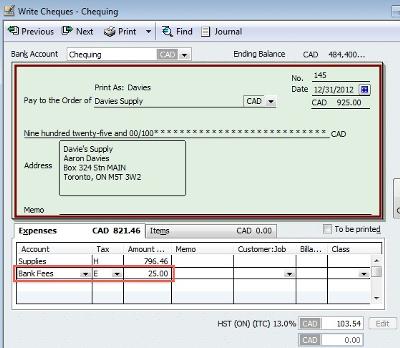

One method is to use Write Cheques coding the expense directly the appropriate expense account on the income statement or capital account on the balance sheet.

The second method is to enter your

From an internal control perspective, my preference is the second method. It reduces the likelihood of paying an invoice twice.

To correct your current problem, the quickest method (assuming you haven't entered the invoice in accounts payable) is to edit the bank transfer transaction so that the cheque is coded to the appropriate expense account and not accounts payable.

Your other alternative is to enter the invoice into accounts payable then to edit the bank transfer transaction so that the cheque is coded to accounts payable. Once you've done that, you would go into Pay Bills and apply the credit to the invoice. Once the credit is applied, the invoice will be marked "paid" and will no longer show on your accounts payable report.

To address the bank service fee, if it is not a separate charge, open the cheque in the register so you can edit the transaction. In the coding area, add a line for the bank charge and recalculate the cheque. The amount should now match the bank withdrawal as well as show your vendor invoice paid.

It's great that you understood the potential problem.

I hope I understood your question. If not, please post back for clarification Christine.

P.S. I would like to remind you there is a difference between information and advice. The general information provided in this post or on my site should not be construed as advice. You should not act or rely on this information without engaging professional advice specific to your situation prior to using this site content for any reason whatsoever.

Comments for Entering Invoices from a Supplier

|

||

|

||