- Home

- Bookkeeper News

The Bookkeeper News For Home Based Businesses

BOOKKEEPER'S HANDY REFERENCE

by L. Kenway BComm CPB Retired

Quick Links

News and announcements from:

- BC Ministry of Finance

- Department of Finance Canada

- Canada Employment Insurance Commission

- U.S. Department of Labor

- Small Business Accounting Standards Revisions

As well as:

- Newspaper Opinions

- Accounting Newsletter Recommendations

- Market Watch Links

- Tea Breaks

Canadian and U.S. bookkeeper NEWS ... on this page you'll find links and news essential for ... the hard working ... self-employed ... small business owner acting in the role of bookkeeper.

If you want to lift your nose out of the books and get your mind off bookkeeping for a few minutes, you'll also find enjoyable "Teabreaks" scattered throughout the "News".

Here is where I post small business bookkeeper news from governmental agencies other than CRA or IRS like the BC Ministry of Finance, Canadian Department of Finance, the U.S. Department of Labor, etc. as well as market watch links.

For your convenience, you may also enjoy links to other popular Information pages on the site like:

- a cheat table to help you figure out those debits and credits;

Canada

- current Canadian payroll tax rates

- current Canadian Tax Deadlines and CRA tax rates

- the latest small business CRA news (Canada Revenue Agency)

- Canadian mileage rate options

- tax compliance reminders for current month deadlines sneaking up

- tax compliance responsibilities you should know

- what to do when you receive a tax review notice or a PIER report

- a list of zero-rated and exempt GST/HST supplies

U.S.

- current U.S. payroll tax rates

- Current U.S. Tax Deadlines

- the latest small business IRS news (Internal Revenue Service)

- IRS standard mileage rates

- tax compliance reminders for current month deadlines sneaking up

- tax compliance responsibilities you should know

Pour yourself a cup of lavender and honey tea ... good for calming nervousness and alleviating stress ... and spend your tea break skimming this page for items that may be of interest to your business ... or sneak a peek at other bookkeeping pages to book mark to come back to later when you have more time.

Notice to Site Visitor

I initially developed this page as a handy reference for myself. While I do my best to ensure it is accurate and complete, I make it available for your use with the understanding that I cannot be held liable for errors and/or omissions. Please make yourself familiar with my site policies prior to relying on any of the information on this site.

A Reminder To Business Owners Working From A Home Office

This is a reminder to plan for and take a vacation. It will renew your creativity and productivity.

Working from home blurs the line between your personal life and work life ... making a planned vacation even more important.

From the publisher of The Bookkeeper News :0)

Canadian COMPLIANCE* DUE DATES, useful for the bookkeeper, can be found in the "The Compliance" section. Information is categorized federally and provincially (Province of B.C. only for now).

*Compliance in bookkeeping usually refers to government taxes such as:

- GST/HST/PST in Canada

- Sales & Use tax in the U.S.

- WCB

- payroll source deductions

... that sort of thing. And let's not forget income taxes!

CRA NEWS ITEM

Good to Know

Looking for 2023 and 2024 Canadian Mileage Rates from CRA? You'll find ALL your options here.

2024 Automobile Deduction Limits and Taxable Benefit Rates

December 18, 2023

CRA released the automobile deduction limits and taxable benefit rates for 2024 today. I have updated my tables.

See company vehicle rates and employee auto allowance rates.

2023 simplified meal and travel rates are expected to be released the first week of January 2024.

PREVIOUS CRA NEWS RELATED TO THIS TOPIC

2021 Auto Limits and Expense Benefit Rate

Temporary Adjustment to Standby Charge

Dec 21, 2020

The Department of finance announce that most limits that applied in 2020 will continue to apply in 2021 except there will a one cent decrease in taxable benefit of employee's personal portion of auto expenses to $0.27 and $0.24 for selling and leasing employees.

2020 Automobile Deduction Limits and Taxable Benefit Rates

December 20, 2019

The Department of Finance released the automobile deduction limits and taxable benefit rates for 2020 today. I have updated my tables for the one cent increase in rates to the personal portion of automobile operating expenses paid by employers ... and there will be no increase to the tax-exempt allowances paid by employers for employees' personal use of their vehicles for business. All other rates remained unchanged from 2020.

The new CCA class 54 for zero emission vehicles remains at $55,000.

See company vehicle rates and employee auto allowance rates.

2019 simplified meal and travel rates will be released the first week of January 2020.

A Prayer of Thanks for Thanksgiving

October 6, 2023

Monday is Thanksgiving in Canada. Here is a beautiful thought of what I'm thankful for ...

Today may there be peace within.

May you trust that you are exactly where you are meant to be.

May you not forget the infinite possibilities that are born of faith in yourself and others.

May you use the gifts that you have received and pass on the love that has been given to you.

May you be content with yourself just the way you are.

Let this knowledge settle into your bones, and allow your soul the freedom to sing, dance, praise and love. It is there for each and every one of us.

by Anonymous

THE SMALL eBIZ NEWS

New Standard for Notice to Reader Statements

Effective December 14, 2021

The Auditing and Assurance Standards Board which CPAs in Canada must follow have introduced new compilation standards commonly referred to as "Notice to Reader" statements. The new standard comes into effect December 14, 2021 for all fiscal years.

Costs will now increase for small businesses that must have Notice to Reader statements for your bank, suppliers, or any other third party as only a licensed, practicing CPA can issue compilation statements. The new standards require a new format and signed engagement letters clearly stating the terms of the engagement, the means of accounting used, and that management is responsible for the information provided.

If your business doesn't require official Notice to Reader statements, you can still provide internal financial statements with notes attached to your banker, tax preparer, suppliers, or other third parties.

THE SMALL eBIZ NEWS

2024 EI Insurable Earnings Released

September 15, 2023

The 2024 EI rates including the maximum earnings that premiums can be deducted on were released by the Canada Employment Insurance Commission. The mandated 7 year break even objective has resulted in changes to 2024 rates.

Click here for current EI rates.

CPP rates are normally announced in November.

EI Rates are usually released annually in mid- September by the Employment and Social Development Canada. Prior to 2019, they were released by the Finance Department.

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

EI Premium Rate Freeze Ended

September 2022

The Government announced on August 20, 2021 a two year freeze on the EI premium rate for 2021 and 2022 at the 2020 rate. This ended in 2023.

Small Business Job Credit

September 12, 2014

Yesterday, the Harper government announced a new Small Business Job Credit effective for 2015 and 2016. It will reduce small businesses' EI premiums by about 15%. To ensure there is no additional administrative burden to small business owners, CRA will automatically calculate the credit on your business return.

It was also announced that the 2017 EI rates for employees and employers will see a substantial reduction as the new seven year break-even rate setting mechanism takes effect. Annual rate adjustments will be limited to 5 cents.

The hiring credit for small business has been eliminated for 2014. It was in effect for 2011-2013.

For more information, go to fin.gc.ca> News> Harper Government Introduces Small Business Job Credit.

2014 EI Insurable Earnings Released

September 9, 2013

On September 9, the Harper government announced the 2014 EI rates including the maximum earnings that premiums can be deducted on. The rate is frozen at the 2013 rate for the next 3 years.

For more information, go to fin.gc.ca> News> Harper Government Supports Job Creation with Three-Year Freeze of Employment Insurance Premium Rates.

How EI Rates Are Calculated

November 14, 2011

The CEIFB (Canada Employment Insurance Financing Board) announced the 2012 EI rates including the maximum earnings that premiums can be deducted on.

CEIFB explains that "this amount is indexed annually using the growth in the average weekly earnings as published by Statistics Canada. Thus, an increase in premiums paid by employees is a combination of any change in the EI premium rate, as well as the impact of any change in the MIE (for those at the maximum level of insurable income)."

The Chief Actuary forecasts the break-even rate for 2012 for all provinces except Quebec to be $2.56 per $100 of insurable earnings. 2012 will be the first year the EI Operating Account is expected to break even on an annual basis.

For more information, go to www.ceifb-ofaec.ca> Media Room> CEIFB News Release The Canada Employment Insurance Financing Board Publishes its 2012 Employment Insurance Premium Rate Report

EI Expected to Break Even On An Annual Basis

November 12, 2011

On November 7, 2011, the Finance Minister announced 2012 EI premiums will only rise by 5 cents to 1.83% due to the global economic slowdown. They had been expected to rise by 10 cents as announced on September 30, 2010.

An 16 week extension to the Work-Sharing Program was also announced.

2012 EI maximum insurable earnings have NOT been released yet ... but I am expecting they will be released by the third week in November as they were last year.

2012 CPP Rates were released on November 1.

BACKGROUND

In 2009, EI premiums were frozen as part of Canada's Economic Action Plan. The plan called for the premiums for 2011 and beyond to be set on a break-even basis.

The Finance Minister announced on September 30, 2010 that it still supported the principle that the EI system should break even over time ... but at a slower rate. This means there will need to be modest increases over a number of years to repay the deficit built up in 2009 and 2010.

To continue to support the current economic recovery, 2011 EI premiums only rose by 5 cents (.05%) instead of 15 cents (.15%) ... to 1.78% from the current 1.73%.

Subsequent years were expected to increase by 10 cents (.10%) per year.

For more information, go to Department of Finance>Publications and reports> Backgrounder on EI Rate Increase Limit and Department of Finance>News> Harper Government Takes Action to Support Jobs and Growth.

April 23, 2019

This time of year I watch I have to record the shows I normally watch as I am usually too busy to watch them at their scheduled time. Last night I caught up with The World of Dance.

My favorite dances were the two teams that tied for 1st place in the Upper Team division.

The Kings - https://www.youtube.com/watch?v=q4Kah-grfPw

The Heima - I couldn't find a you-tube clip for them from the cut 2019-04-20 (frownie face) Ne-Yo gave them a score of 100. In this dance they removed their masks.

I also liked Kayla Mar the ballet dancer from the Junior division. Her cut performance was breath taking ... her grace and elegance when she dances is ethereal ... https://www.youtube.com/watch?v=qwClC7IX878

This was good too: https://www.youtube.com/watch?v=IpINGfSUjns

THE SMALL eBIZ NEWS

Proposed New Rules for Voluntary Disclosure Program

June, 2017

CRA has released their proposed new rules for the Voluntary Tax Program effective January 2018.

They are proposing different tracks dependent on specific criteria for income tax, payroll sources deductions and GST/HST. Read about the proposed changes here ...

Wise Words

Fours things you can't recover:

The stone ... after the throw.

The word ... after it's said.

The occasion ... after it's missed.

The time ... after it's gone.

-- Author Unknown --

Do Something Different This Year

December 31, 2015

"We" all know if you aren't getting the results you want in any area of your life, the only way to get a different result is to do something different to change it up ... and hopefully you'll get different results ... the ones you were hoping for.

Austin Netzley's excellent article in Business Insider titled "15 money tips to make you rich in 2015" lists 15 action items to help you do things a bit differently in 2015 ... or this year. I've summarized them here but follow the link above to read the entire article. It's worth your time.

- Become you own CFO - Become aware of where your money is going.

- Go on a diet - Cut out one expense for 30 days that isn't helping you achieve your goals.

- Be selfish - Take care of yourself financially so you have move flexibility to help others.

- Be selfless - Nurture an attitude of selflessness that focuses on helping others.

- Improve your credit score - get your free credit report and address any items hurting your score.

- Define what true wealth means for you - It is more than just a certain amount money. For many, it includes freedom, family, health, purpose, experiences, etc. Knowing your definition will help you stay on track and arrive at your dream life sooner. (Editor - anything written by Brian Tracy will help you figure out your definition of wealth.)

- Automate your money - When the money comes in, automatically send it to other accounts so you won't be tempted to waste it. (Editor - Profit First is a great read explaining how to put this system in play. It will also help with item 3 above.)

- Add another income stream - Never put all your eggs in one basket.

- Focus on passive and residual income - Build wealth by putting your business or money to work for you instead of trading your time for money.

- Get a library card - Invest in yourself by reading to increase your knowledge and inspire you. (P.S. the library card thing doesn't work for me ... They rarely have the books I want want when I want them (so I get like five all at once) which means I never get the books back on time so it costs me a frick'en fortune in late fees! Amazon eBooks work much better for me.)

- Make your investments boring - Investing should be more like watching paint dry. Learn to take the emotion out of it. Running your own business is high risk. Your other investments should be low risk for a "balanced" portfolio.

- Track your progress - Think big picture and monitor your net worth I.E. track how much of your money / wealth you keep.

- Cut 10% - And invest it ... in yourself ... or pay down debt ... or invest it in items 8, 9 or 11 above).

- Hang out with rich people - You become the average of the five people you spend the most time with.

- Reduce your goals - Create a single challenge at any given time. (How about working on this list?)

So that takes care of the finances for 2016 but how about your health?

"We" also know that bookkeepers spend much of their day sitting in front of a computer ... which isn't the best for your health if you aren't doing regular exercise and eating properly. For those who are thinking about their New Year's resolutions and want to achieve different results than in the past in this area ... here's one to consider that could make a difference in your personal life and your business.

Yoga International is having a FREE 30 day yoga challenge. They send you an email each day with your 30 minute "class". If you are interested, here is where you sign up ...

https://yogainternational.com/guide/2016-30-for-30-challenge

Their free library is amazing. It has Office Yoga routines that are as short as 5 minutes, Chair Yoga routines to get you moving, your blood flowing and give you a boost of energy ... which we can all use at some point through the day.

After giving it some thought, my yoga mantra for 2016 is going to be "Make a different choice today."

My choice of tea - Olive Leaf Tea by Suede Hills Organic Farm

My choice of tea - Olive Leaf Tea by Suede Hills Organic FarmAs bookkeepers, it is up to us to keep ourselves healthy so that we can be available for our families and to serve our customers / clients. I don't know about you but I started my own business so I could have a life on my terms.

I've decided to work on improving my diet in 2016 as well as create a home yoga practice for the days I can't make it to the gym or get out for a walk. Too many of my friends are having serious health issues which comes with my age I guess ...

With this in mind, last year (2015) I switched the tea I'll drank during my tea breaks. Suede Hills Organic Farm*, located in Savona, BC, has this amazing Olive Leaf tea that helps alkalize your body. The more alkaline your body, the more vitality you'll have.

I hope 2016 proves to be kind to all my visitors. Wishing you much prosperity in your businesses accompanied by health and wellness to enjoy your successes ...

Remember do something different in 2016 to get different results!

*Please note that I do not receive a commission from Suede Hills Farm. I just like their products and wanted to share it with you.

THE SMALL eBIZ NEWS

QuickBooks Payroll Tax Tables Updated For 2016

December 18, 2015

QuickBooks 2016 payroll table updates will be released on January 11, 2016 due to CRA's delay in releasing the 2016 tax tables.

The support notes say if you are currently using QuickBooks 2014 or an earlier version, "you must upgrade to the latest version of QuickBooks in order to use the new Tax Table Update for Payroll."

If you ever want to check that you have the latest release ... go to the Employee menu and select My Payroll Service>Tax Table Information. It should tell you the date the tax table calculations are updated to and when the tax table expires. The first two digits of the tax table version are supposed to inform you the date your tax tables are good to.

This is always good news for me because I don't like to update to the latest version until they've had a chance to work out the bugs.

If you have Automatic Updates turned on, you would have received the update automatically.

You can find product update information at:

http://support.intuit.ca/quickbooks/en-ca/iq/Update-QuickBooks/Update-tax-tables-for-QuickBooks-Payroll/HOW15192.html

It's easier to just search for "How to update QuickBooks".

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

Quebec HST Setup in QuickBooks

December 22, 2012 (Updated August 28, 2016)

Quebec transitions to HST on January 1, 2013. Intuit has HST setup instructions in QuickBooks. The original link at support.intuit.ca is no longer available but the title of the article classified under Taxes was 'How to setup QuickBooks to track the new QST in 2013'.

THE SMALL eBIZ NEWS

Ernst & Young's 2015 Annual Tax Guide

|

December 12, 2015

The guide Managing Your Personal Taxes 2015-16 A Canadian Perspective has been available on their website since October under Services> Tax or through this link: www.ey.com/CA/en/Services/Tax/Managing-Your-Personal-Taxes Ernst & Young's annual income tax guide is a downloadable PDF or as an eBook for your |

smartphone, eReader or tablet. There is a section for professionals and business owners, incorporating your business, incorporated employees as well as employees and US tax for Canadians. |

THE SMALL eBIZ NEWS

BDO's Year-End Tax Planning Checklist

November 19, 2014

The Bookkeeper News likes to search out articles that may be useful to small business owners.

BDO Canada has released their year-end tax planning checklist. It includes business income and owner-manager considerations ideas that would be of interest to small business owners and bookkeepers. You can download it at:

bdo.ca> Library> Services> Tax> Tax Bulletin> Year-End Tax Planning Checklist

One of the goals of The Bookkeeper News is to help you relax and take the odd teabreak. I like watching some of the singing and dancing reality shows. I share my favorites with you.

Click here to skip your tea break and go directly to more news.

November 4, 2014

One of the things I like about living in Radium is that I can walk everywhere in town. The other is the wildlife that comes to visit. Today the wild turkeys dropped in for a visit!

Wild turkeys visit Radium Wild turkeys visit Radium |

Now if someone can tell me why iPhone pictures sometimes turn on their side ... because it only shows like this once I downloaded it. :( |

Heads Up POS Users

October 28, 2014

An POS malware alert from the Department of Homeland Security has been issued. The malware is called Backoff. It recommends you use two factor authentication as remote access was gained through poor/weak passwords. Steps to mitigate risks are outlined.

Compilation Engagement Standards Revised

October 26, 2014

The Journal of Accountancy (JOA) has an excellent article on the revised standards for compilation engagements to prepare financial statements (https://www.journalofaccountancy.com/news/2014/oct/201411156.html) issued by AICPA ARSC. The article discusses SSARS No. 21 revisions to non-audit standards.

A compilation engagement is also referred to as a "Notice To Reader" (NTR) statement. These financial statements are usually compiled from information provided by the management of the business. No attempt is made to assure readers that the information contained in the financials is in accordance to GAAP.

NTRs differ from a review engagement where limited assurance is provided by having the accountant perform inquiries and analytical procedures on the information provided.

"The new standard eliminates a requirement from previous standards dating to 1978 that required accountants in public practice who prepared financial statements to, at a minimum, perform a compilation engagement with respect to any financial statements they presented to management or to third parties.

In recent years, the question of who has prepared financial statements has become more difficult to answer due to the expanded use of technology such as cloud computing. By eliminating the submission requirement, SSARS No. 21 eliminates the need for accountants to use professional judgment to determine whether they have prepared financial statements. The potential for diversity in practice also is eliminated."

You can download AICPA's fact sheet on their website. SSARS No. 21 used ISA's ISRE 2410 and ISRS 4410 as a base when drafting the standards.

THE SMALL eBIZ NEWS

Financial Advisor Act of Ontario

August 20, 2014

Back in February 2014, an Ontario MPP tabled a private member's bill to regulate financial advisors.

Don Cayo also has an interesting article on this topic with regards to B.C. Bing/Google "B.C. should stiffen regulation of financial advisers" published by the Vancouver Sun.

THE SMALL eBIZ NEWS

New Online Copyright Infringement Rules

June 27, 2014

As early as January 2015, new online copyright infringement comes into effect. Unlike the U.S. Notice and Take Down system, Canada will have a Notice and Notice system. You can read more in an article titled "Made in Canada” online copyright infringement regime coming into force by Brian P. Isaac and Daniel M. Anthony from Smart & Biggar/Fetherstonhaugh.

The official news release was issued on June 24, 2014. The World Intellectual Property Organization (WIPO) Copyright Treaty and the Performances and Phonograms Treaty is effective in Canada on August 13, 2014.

THE SMALL eBIZ NEWS

Revenue Recognition Standard

June 9, 2014

On May 28, 2014, IASB and FASB released the converged revenue recognition standard. PwC has a good article on how it will change how you do business. E&Y stated that IFRS15 is a "significant change from current IFRS ... will need to use more judgement ... because the use of estimates is more extensive".

Public companies start applying the new guidance in 2017, non public companies in 2018. Heres are some of the effects:

- The new standard ends industry specific rules; consistent principles will apply to all.

- New disclosure requirements for contracts with customers; revenue is recognized as each performance obligation is fulfilled.

- Contingent fees may be recorded earlier.

- A new approach to reporting fees from licensing of intellectual property.

- A new approach to capitalizing contract related costs.

- The amount of revenue recorded for longer term contracts.

- Bonus plans, commissions and debt covenants may need to be renovated to maintain their original intent.

You can find the new standard in two places:

- FASB website (good overview) - fasb.org/jsp/FASB/Page/BridgePage&cid=1351027207987

- IASB website (need a subscription to view)- ifrs.org/Features/Pages/IASB-and-FASB-issue-converged-Standard-on-revenue-recognition-May-2014.aspx

May 7, 2014

This time of year I watch the live shows and record series I like to watch. Tonight on American idol, Jena Irene's (can you believe she is only 17 years old?) performance of "Can't Help Falling in Love With You" and Caleb's "Maybe I'm Amazed" were my two favourite performances ... and there were so many other performances that were excellent too. I guess my picks really show my age!

Here's my picks for the night .... enjoy

http://rickey.org/video-jena-irene-sings-cant-help-falling-love-american-idol-2014/260445/

http://www.rickey.org/video-caleb-johnson-sings-maybe-im-amazed-american-idol-2014/260439/

I've also been throughly engaged with Meryl and Maks dancing these last few weeks on Dancing with the Stars. When both dances came to an end, I was so engrossed I was surprised they stopped dancing. It felt like they just got started. Meryl is the kind of dancer I love to watch ... so much grace and elegance.

Week 6 tango - https://www.youtube.com/watch?v=I3U5mKlQ86I

Week 7 salsa - https://www.youtube.com/watch?v=hkkA3-0IpU4

Week 8 Rumba - https://www.youtube.com/watch?v=os6HieJDzzg

... and Derek Hough's choreography in this number was ingenious in this argentine tango with Amy:

https://www.youtube.com/watch?v=SqxNdEcu8hc

And lastly there have so so so many great performances on The Voice these past three weeks ...

THE SMALL eBIZ NEWS

Heartbleed Bug

April 15, 2014

An excellent article to check out on Mashable:

The Heartbleed Hit List: The Passwords You Need To Change Right Now

THE SMALL eBIZ NEWS

B.C. MSP Rates are Increasing

February 19, 2014

British Columbia's MSP (medical services premiums) rates are set to rise in 2015. If you are paying the premiums for your employees, don't forget the premiums are considered a taxable benefit and must be included on the employee's T4 slip.

Here is a summary of the B.C. MSP rates from 2011 to 2015:

MSP Coverage

|

2015 |

2014 |

2013 |

2012 |

2011 | |

|

Single |

$72 |

$69.25 |

$66.50 |

$64 |

$60.50 | |

|

Family of Two |

$130.50 |

$125.50 |

$120.50 |

$116 |

$109 | |

|

Family of 3 or more |

$144 |

$138.50 |

$133 |

$128 |

$121 |

This piece of bookkeeper news should help low income small business owners. How? If you earn under $30,000, you may be able to apply for premium assistance that can reduce your premiums due.

Click here for premium assistance (subsidy) rates. Currently a 100% subsidy is available for those who earn $22,000 or less. Premium assistance is to be enhanced so those receiving it will be unaffected by the rate increase.

THE SMALL eBIZ NEWS

NOva Scotia planned HST rate reduction dropped

February 7, 2014

Nova Scotia announced in 2012 an intention to reduce the HST in 2014 to 14% and again in 2015 to 13%. However the Nova Scotia Finance Department announced it cannot afford to lose the revenue and will not be proceeding with the previous government's HST rate reductions.

THE SMALL eBIZ NEWS

Review of the Conceptual Framework - Series of Free Webinars

September 10, 2013

The International Accounting Standards Board (IASB) is holding a series of free webinars that run through to November discussing issues raised in the discussion paper on the conceptual framework for financial reporting.

The first presentation was held on September 3 on the definition of assets and liabilities. The webinar was recorded; you can see the slides and listen to an MP3 recording. Each webinar includes a Q&A session.

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

Get Your Copy of the U.S. ASPE Framework For SMEs

June 17, 2013

There is a battle brewing over the recent release of the Financial Reporting Framework for Small and Medium-Sized Entities by AICPA

National Association of State Boards of Accountancy) apparently has issues with it ... although the issues stated sound more like territorial fights to me. Remember, initially they were in favor of the complementary work. (See previous post for more details.)

We do know the framework is not GAAP ... that was the point in releasing ... to give small business a reporting framework that met their needs and the needs of their private investors.

I have discussed why small businesses might not want to use GAAP reporting before. In this chat I discuss how important it is to not use GAAP finanacial statement titles ... on of NASBA's issues ... like Balance Sheet or Income Statement.

For the Balance Sheet, I use Statement of Financial Position - Tax Basis (Unaudited).

For the Income Statement, I use Statement of Operations - Tax Basis (Unaudited).

During the year, when interim monthly reports are issued, I use the term "Unajduted" rather than "Unaudited" to reflect that month-end / year-end adjusting entries have not been prepared.

June 9, 2013

You can download a copy of the Financial Reporting Framework for Small and Medium-Sized Entities for free at AICPA.

It is interesting to note that the guide says, "The Financial Reporting Framework for Small- and Medium-Sized Entities re- produces substantial portions of the CICA Handbook © 2012, published by The Canadian Institute of Chartered Accountants, Toronto, Canada (CICA), used under licence from CICA."

The CPA letter daily says "the framework is complementary to the Financial Accounting Foundation's Private Company Council, which is considering potential GAAP exceptions and modifications for private companies".

US Draft ASPE Released for SMEs - US GAAP is in Transition

December 3, 2012

This is bookkeeping news for my US readers.

In the December 15, 2012 newsletter there is an article on Accounting Standards for Private Enterprises (ASPE).

It contains information on the American Institute of Certified Professional Accountants' (AICPA) draft of a Financial Reporting Framework for Small and Medium Enterprises released early in December.

When the draft is finalized in 2013, it will provide guidance and optional reporting choice over GAAP for privately owned businesses in the U.S.

Deloitte Webinar on ASPE Update

October 31, 2012

While catching up on my reading for The Bookkeeper News, I came across a webinar that will be useful to bookkeepers who want to learn more about the Accounting Standards for Private Enterprise (ASPE). ASPE is the one of the new GAAPs that went into effect on January 1, 2011 in Canada.

Deloitte's is holding an interactive webcast to improve your understanding of the changes to ASPE and better prepare for the year-end financial reporting cycle. Some important topics that will be covered include the 2012 annual improvements process and Employee Future Benefits.

November 5, 2010

The Bookkeeper News

ASPE Webinar

Deloitte's is offering a webinar on Tuesday November 9 at 2 pm EST on Thinking strategically about Accounting Standards for Private Enterprise.

"This webcast is intended to help private enterprises start thinking strategically about all of the choices and decisions that need to be made when transitioning to Accounting Standards for Private Enterprises (ASPE). It is important to remember that the choices made can have a significant impact on users, financial statements, work effort and transition costs – among other things.

Combining technical knowledge with practical experience, our Deloitte presenters will discuss:

- Early adoption: Factors to consider when making the early adoption decision

- Section 1500 Exemptions and Accounting Policy Choices: Points to consider when determining which Section 1500 exemptions should be taken in the entity’s opening balance sheet and which accounting policies to adopt from within the available choices

- Tax implications: Key tax implications and issues to consider when converting to ASPE

- Disclosures: The importance of exercising professional judgment when preparing disclosures to meet user needs and fair presentation requirements

- Reporting: Key ASPE reporting considerations in the year of adoption"

Bookkeepers and small business owners can register at www.deloitte.ca> Insights> Webcasts >Deloitte Update webcasts> Thinking strategically about Accounting Standards for Private Enterprise.

THE SMALL eBIZ NEWS

Payroll Year-End Best Practices Webinar

September 7, 2013

Ceridian is offering a free webinar on year-end best practices for payroll. It will assist you in being compliant with CRA and having successful year-end reporting.

THE SMALL eBIZ NEWS

eSignature Technology

June 28, 2013

If you are on the paperless road and want to learn more about eSignatures and how to use them ... or you want your bookkeeper to use them when dealing with your account / paperwork ... then Accounting Today's June 24, 2013 article by Steve Dusablon titled Using E-Signatures in the Tax and Accounting Profession is worth a read.

I've started grouping the tea breaks together in a few spots. If you aren't interested in this post ... just click here to view more bookkeeper news items.

June 19, 2013

I first posted this on January 8, 2012. I think it's time to brush it off and read it again as summer approaches. As a small business owner it is easy to forget what is really important.

The Mayonnaise Jar and The Coffee

(I've also seen this called The Empty Pickle Jar)

When things in your life seem almost too much to handle, when 24 hours in a day is not enough, remember the mayonnaise jar and two cups of coffee.

A professor stood before his philosophy class and had some items in front of him.

When the class began, wordlessly, he picked up a very large and empty mayonnaise jar and fills it with golf balls.

He then asked the students if the jar was full. They agreed that it was.

The professor then picked up a box of pebbles and poured it into the jar. He shook the jar lightly. The pebbles rolled into the open areas between the golf balls.

He then asked the students again if the jar was full. They agreed it was.

The professor next picked up a box of sand and poured it into the jar. Of course, the sand filled up everything else.

He asked once more if the jar was full. The students responded with a unanimous “YES”.

The professor then produced two cups of coffee from under the table and poured the entire contents into the jar, effectively filling the empty space between the sand. The students laughed.

“Now,” said the professor, as the laughter subsided, “I want you to recognize that this jar represents your life. The golf balls are the important things - God, family,children, health, friends, and favorite passions. Things, that if everything else was lost and only they remained, your life would still be full. The pebbles are the things that matter like your job, house, and car. The sand is everything else -- the small stuff.” he said.

“If you put the sand into the jar first,” he continued, “There is no room for the pebbles or the golf balls. The same goes for life. If you spend all your time and energy on the small stuff, you will never have room for the things that areimportant to you...” he told them.

“So... pay attention to the things that are critical to your happiness. Worship with your family. Play with your children. Take your partner out to dinner. Spend time with good friends. There will always be time to clean the house and fix the dripping tap. Take care of the golf balls first -- the things that really matter. Set your priorities. The rest is just sand.”

One of the students raised her hand and inquired what the coffee represented.

The professor smiled and said, “I'm glad you asked. It just goes to show you that no matter how full your life may seem, there's always room for a couple of cups of coffee with a friend.”

Author Unknown

P.S. Feel free to substitute tea or beer for coffee! :0)

June 18, 2013

While bookkeeping, I was listening to Ralph Vaughn William's Fantasia on a Theme by Thomas Tallis performed by Eugene Omandy and the Philadelphia Orchestra ... on YouTube (https://www.youtube.com/watch?v=IbzxhZT6akk) ... excellent music to do bookkeeping by.

Anyway, one ad that came on before the video starts was by itabc.ca/employers. The employer showcased in this ad was Middleton Petroleum ... they sponsor apprentices. Oh my gosh!!! What an excellent ad. If I was younger and looking for employment, this company is one I would investigate to see if there was a good fit. Honestly, I've never wanted to save an ad to watch again ...

And of course, just because I would like to see the ad again ... it has never shown up again. :(

May 21, 2013

My favorite couple won Dancing with the Stars tonight ... Kellie Pickler & Derek Hough. Their freestyle dance received a standing ovation from Len.

https://www.youtube.com/watch?v=jU1_OssfgR4

Last week their Argentine Tango was incredible as well:

https://www.youtube.com/watch?v=Xj5M5iHlxVk

I also loved his choreography for Kellie's Pasodoble Trio Dance ... even if Len didn't. I just love Derek's choreography ... period!

https://www.youtube.com/watch?v=ZD8XM0dDzWw

I am so glad Derek decided to dance this season ... and Kellie was perfection!

IF you have been following this site over the past 4 years, you know I like dance. The Shadow Theatre Dancers from Hungary that performed in Britain's Got Talent 2013 is A-M-A-Z-I-N-G.

https://www.youtube.com/watch?v=H8s97NiC2Ys

Dance at it's best!!! So Bookkeepers ... Lift your noses out of the books for a moment and enjoy your teabreak. Not all news is about bookkeeping ... sometimes it just about taking time to enjoy life ... which is why you work, isn't it?:0)

To enjoy more teabreaks, click here.

THE SMALL eBIZ NEWS

ATTENTION ... Retailers From Outside The Province Who Sell to British Columbians

May 25, 2013

BC has now transitioned to PST + GST. If you live outside BC, you probably think this doesn't affect you. Well, you'd be wrong. If you are a retailer (Canadian or foreign) that sells to BC businesses or residents ... you too need to register for a PST number!!!

Bookkeepers can also register for third party access to their clients' accounts.

eTaxBC has been open since January. Any business that has taxable goods and/or services with more than $10,000 in gross annual revenue needs to register. My PST Rates page has various tables summarizing data such as:

- A summary of all PST rates. They now range from 7% to 12%.

- A summary of the transitional rules.

- Link to a nice summary sheet of what's taxable and what's not.

- A summary of all the announcements.

- A writeup on travel and transportation rules.

2013 TD1 Forms et al ...

Last item ... if you have employees in B.C., remember you are required to ask each of them to complete a new tax exemption form. This should have been done before April 1, 2013 (when PST came into effect).

THE SMALL eBIZ NEWS

U.S. Online-Sales Tax

May 11, 2013 (Updated February 13, 2014)

The Senate quickly approved The Marketplace Fairness Act (MFA) this week, bypassing the Finance Committee. It is now in the House.

The Judiciary Committee has said they will take more time to review the bill and attempt to make it simpler, according to the Hillicon Valley Technology blog. They want to see uniformity on definitions and tax rates.

The bill exempts small businesses with annual sales under $1 million. This bill is aimed at large online retailers like Amazon so small business online retailers don't have to worry at this point.

As of February 2014, this is still just proposed legislation. A report was issued in September 2013 by the House Judiciary Committee to frame MFA discussion. It is called "7 Principles fo Remote Sales Tax."

In Wikipedia, there is a nice two paragraph summary of current law and the problem which is behind The Marketplace Fairness Act.

"Each state in the United States may impose a sales tax on products or services sold in that state. Most states impose a sales tax, some states do not; and each state may set the rate and scope (products taxed) of the sales tax. Within each state, counties and cities may have different sales tax rates and scope, resulting in many different rates based on the location of the point of sale. Generally, the states allow (or require) the seller to itemize and collect the tax from their customers at the time of purchase. Most jurisdictions hold sellers responsible for the tax even when it is not collected at the time of purchase.

Residents of the 45 states with sales and use tax must pay tax on their online purchases.[5][6] However, according to the Supreme Court rulings [...], retailers, including catalog and online sellers, only need to collect sales and use tax for states where they have a physical presence.[7][8] If an online retailer does not collect sales tax at the time of purchase, the consumer must pay the use tax due directly to the state. While business compliance with use tax filing is quite high, consumer compliance is rather low. The Marketplace Fairness Act seeks to increase compliance and tax collections by shifting the responsibility for payment from consumers to retailers."

The Calfornia State Board of Equalization discussed electronic order sales in their Economic Newsletter Volume XVII, Number 1 February 2011 stating "remote sales are very important to tax administrators and policy makers. If remote sales are made to California residents from vendors located outside of California, with no physical presence in this state, federal law prevents California from requiring the vendor to collect use tax from the consumer. [my emphasis] The responsibility to remit taxes due falls upon individual California consumers rather than out-of-state vendors."

Avalara.com has an excellent blog on sales tax changes scheduled for 2014. In another blog post on 2014 online sales tax, Gail quotes Ohio Governor John Kasich saying* :

“Similar items enacted in other states have resulted in extensive litigation without necessarily producing an increase in state revenue. The federal government retains the right to regulate interstate commerce. Without the collection authority being clearly extended to the states for the purpose of out-of-state interstate retailers, the legality of this item is uncertain and problematic.”

* when vetoing sales tax collection on internet sales with nexus to Ohio.

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

February 18, 2013

A February 13, 2013 Reuters news article announced that collection of online sales tax by online-only merchants was re-introduced in the Senate as The Marketplace Fairness Act.

Think ... Amazon.com.

It was proposed "to exempt from sales tax collection any merchant with $1 million in annual sales or less."

Businesses who do business online but have a physical store already collect online sales tax.

December 29, 2012

U.S. Online-Sales Tax

Robert Wood is a U.S. lawyer ... and I enjoy his blogging. On Boxing Day (December 26) he aptly wrote a blog titled, "7 Key Rules Govern Tax Online".

As I chatted about in my October newsletter, sales tax seems more complicated in the States than in Canada. Mr. Wood's blog does a great job outlining the key factors.

While there are some self assessment requirements, for the most part, it is the merchant that collects sales tax in Canada ... based on place of supply rules.

In the U.S., Americans are supposed to report their use tax on their income tax returns ... really ... really ... if the merchant did not collect it. The State governments want the average citizen to have a bookkeeping system in place to determine how much use tax they owe the government ... really ... really! It seems to me it is the government's responsibility to have a system ... whose foundation is not self-assessment ... in place to collect these taxes.

Current law is such that out-of-state merchants cannot be forced to collect sales or use tax unless they have nexus (have a connection) to the state. For the most part, nexus seems to mean "have a physical presence" ...

But that is changing with many states looking to expand/change the laws to include online shopping.

In Canada, our place of supply rules are based on the location of the customer. It makes it simple with rules in place to help determine the location of the customer when customers have multiple locations or business crosses provincial/territorial/country borders.

Since having this website, I have come to a real appreciation of how well the federal, provincial, and territorial governments in Canada work together to reduce paperwork and eliminate trade barriers between the provinces/territories. Sales taxes must also show on the invoice and not be hidden or embedded in the cost ... making it easy to see what you are paying.

You can read Mr. Wood's blog at forbes.com ... he is a regular contributor.

December 26, 2012

Online-Sales Tax Bill

THE HILL's Technology Blog reported on December 25 that time has run out to gee a vote on the online-sales tax bill. It will have to re-introduce the measure in the next session of Congress.

"The Marketplace Fairness Act, authored by Sens. Durbin, Mike Enzi (R-Wyo.) and Lamar Alexander (R-Tenn.), would empower states to tax their residents' online purchases. The bill exempts small businesses that earn less than $500,000 annually from out-of-state sales".

Currently, states "can only collect sales tax from retailers who have a physical presence in the state".

When a purchase is made online, the purchaser is supposed to self assess the tax by declaring their purchases on their tax forms.

Read Brendan Sasso's entire article at thehill.com.

November 6, 2012

Market Based State Sales Tax - A Review of Sourcing Rules

In my last bookkeeper news ezine (October 2012), I briefly reviewed sales tax in Canada and the U.S. Today while catching up on my reading, I came across a new article on U.S. sales tax.

Michael S. Schadewald, CPA, Ph.D. reviews the 13 states that have adopted source based sales tax in a Tax Advisor article Apportionment Using Market-Based Sourcing Rules: A State-by-State Review.

Under this method, sales tax is assigned based on where the service is received ... i.e. the location of the customer.

Since July 2010 GST/HST place of supply rules in Canada work this way as well.

The article can be found at AICPA.org> Publications> The Tax Advisor> 2012> November> Apportionment Using Market-Based Sourcing Rules: A State-by-State Review.

You may also be interested in reading an October 25, 2012 article by Annette Nellen, Esq., CPA, written for the AICPA Corporate Taxation Insider newsletter, about the trouble states have in collecting sales and use taxes ... and some potential solutions.

How states can improve sales and use tax collection- see blog dated October 30, 2012 and follow Professor Nellen's link.

THE SMALL eBIZ NEWS

Federal Minimum Wage To Increase

February 14, 2013

In Obama's State of Union address on February 12, 2013, he announced that the federal minimum wage will be increased in stages until it reaches $9 in 2015. After that, the minimum wage will be indexed to inflation to help worker's "climb into the middle class."

THE SMALL eBIZ NEWS

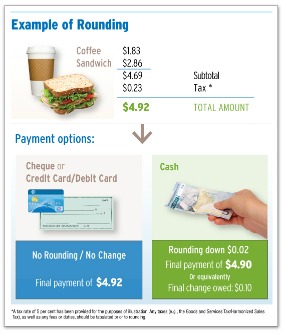

Bookkeeping for Elimination of Penny

January 4, 2013

The penny will no longer be distributed beginning in February. Budget.gc.ca has an excellent pictorial example of how to bookkeep for the elimination of the penny.

The general guidelines were reported by The Bookkeeper News in July last year. See below for the information.

The Bookkeeper News Source: Government of Canada Budget 2012

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

July 30, 2012

As a point of interest, the penny is scheduled to stop circulation as of February 4, 2013.

The Minister of Finance says that "when pennies are not available, cash transactions should be rounded to the nearest five-cent increment in a fair and transparent manner.

A rounding guideline that has been adopted in other countries, and that will be adopted by the Government for its cash transactions with the Canadian public, is attached. Electronic transactions, such as those with debit and credit cards, as well as cheques, will not need to be rounded."

Here are the general guidelines:

"The Royal Canadian Mint will cease distribution of pennies to financial institutions effective Fall 2012. Businesses will then be asked to return pennies through their financial institutions to the Royal Canadian Mint for melting and recycling of the metal content."

THE SMALL eBIZ NEWS

Congress Approves Senate "Fiscal Cliff" Bill

January 2, 2013

Congress approved the Senate The American Taxpayer Relief Act late last night; the vote 257-167. The last step is for Obama to sign the bill.

Journal of Accountancy (JOA) has a good article outlining this act under News> Congress passes fiscal cliff act. You should take a look at the "Business Tax Extenders" section of the article ... it's a long list.

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

U.S. Senate Passes Legislation on The American Taxpayer Relief Act

January 1, 2013

The "fiscal cliff", so talked about in the press, refers to spending cuts and tax increases that were due to expire at the end of 2012. The automatic deadline could create a recession in the U.S. which would also affect Canada's economy.

In the early morning hours of 2013, as the new year came, the U.S. Senate passed legislation (89-8 vote) to prevent middle class tax hikes. Congress now needs to vote later this week.

Individuals earning over $400,000 and households earning over $450,000 annually will see their taxes rise about 13% under this legislation to 39.6%. It affects approximately 2% of taxpayers.

The 2% Social Security payroll tax cut will lapse.

The alternative minimum tax has been permanently adjusted for inflation.

Section 179 expensing (see below) and accelerated bonus depreciation have been extended for one year. JOA states, "It now generally applies to property placed in service before Jan. 1, 2014 (Jan. 1, 2015, for certain property with longer production periods)".

There are of course other items included in this bill that are not directly related to small businesses.

The Bookkeeper News Source: various media reporting including CTV, CBC, Global, CNN

Journal of Accountancy Article on Fiscal Cliff

October 31, 2012

The Journal of Accountancy has an excellent article that my US visitors may be interested in reading. It looks at ALL the expired and expiring tax items including the expiration of the current tax rates.

Facing The Tax Cliff by Alistair M. Nevius, J.D -- JOA November 2012

Social Security payroll taxes in 2013 could return to 6.2% from the current 4.2%.

Business items on the list are Section 179 expensing is set to expire at the end of 2012; bonus depreciation expired at the end of 2011.

| Fiscal Cliff Items | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|

| Sec 179 expensing limitation | $500,000 | $500,000 | $139,000 inflation adjusted $125,000 |

$25,000 |

| Sec 179 phaseout threshold | $2,000,000 | $2,000,000 | $560,000 inflation adjusted $500,000 |

$200,000 |

| Sec 168(k) 1st year placed in service bonus depreciation |

100% after Sep 8, 2010; 50% before Sep 9, 2010 |

100% | 50% | 50% |

The Bookkeeper News will keep you up-to-date on any fiscal cliff items that may affect your small business.

THE SMALL eBIZ NEWS

Pooled Registered Pension Plans Act (Bill C-25)

December 31, 2012

I'm a little late posting this item ... but I did mention it in the December newsletter.

On December 14, 2012, the Harper government announced the income tax rules for PRPPs were now in force. The tax rules for PRPPs will apply to both federally and provincially regulated PRPPs.

To read the complete announcement, go to fin.gc.ca> News> Harper Government Takes Final Step in Development of Pooled Registered Pension Plans.

PREVIOUSLY REPORTED BOOKKEEPER NEWS - RELATED POSTINGS

October 26, 2012

The Department of Finance Canada will pre-publish the second and final tranche of PRPP regulations on October 27, 2012 in the Canada Gazette for a 15 day public comment period.

“As soon as this last package of regulations is finalized, the federal Pooled Registered Pension Plans Act (PRPP Act) and regulations will be brought into force,” said Minister Menzies. “PRPPs will then be available to the millions of Canadians without access to a workplace pension option as soon as provinces and territories implement their respective sides of the framework.”

You can find more information at fin.gc.ca> News> Harper Government Pre-Publishes Second and Final Tranche of Pooled Registered Pension Plan Regulations.

You will can view the PRPP amending regulations by going to "Publications and Reports> Regulations Amending the Pooled Registered Pension Plans Regulations.

The Bookkeeper News will keep you up-to-date on the progress of this legislation.

August 10, 2012

The Harper government published the proposed Pooled Registered Pension regulations today.

You can find out more information on the Department of Finance Canada website (www.fin.gc.ca) under "News". You will can view the PRPP regulations by going to "Publications and Reports> Pooled Registered Pension Regulations.

June 29, 2012

Minister of State (Finance) Ted Menzies announced the royal assent of Pooled Registered Pension Plans (PRPPs) Act With Small Business Owners and Employees.

PRPPs will be "lower cost, free of payroll taxes and administratively simple" alternative for the 80 percent of business owners and their employees who have no company retirement plans.

You can read more at www.fin.gc.ca> News> News Releases> Harper Government Celebrates Royal Assent of Pooled Registered Pension Plans Act With Small Business Owners and Employees

THE SMALL eBIZ NEWS

WCB Alberta Discontinues Mailing Premium Rate Statements

November 28, 2012

WCB Alberta is moving to electronic premium rate statements for 2013. This means you will not be receiving your statement in the mail mid-December as n pst years.

To access your WCB premium rate statement, you have to open an online account with WCB Alberta at wcb.ab.ca/employers/online_signup.asp . If you outsource your payroll, they will need this information.

A shout out to OnPayroll.ca for this bookkeeping news notification.

THE SMALL eBIZ NEWS

U.S. Patent System Changes

November 12, 2012

The U.S. patent system is undergoing changes. Find out if they affect you by reading U.S. Small Business Administration's (SBA.gov) latest article titled How Sweeping Changes to the U.S. Patent System Will Impact Your Small Business.

The article explains how you can now give input on pending patent applications and how it is easier to resolve patent disputes.

The system moves "from a first-to-invent to a first-inventor-to-file system" in March 2013.

You will also find valuable links to other patent and intellectual property articles.

The Bookkeeper News searches for small business items of interest so that you can use your time to grow to your business.

I've grouped all of the tea breaks together in one spot. If you aren't interested in this post ... just click here to view more bookkeeper news items.

November 20, 2012

The dancing this season has been remarkable. My pick to win the trophy is the Melissa and Tony team. I absolutely loved their Argentine tango last night - score 30. Tony is dancing with a back injury and Melissa had a neck injury 2 weeks previously.

https://www.youtube.com/watch?v=2yTnE422W7o

Their season 8 Argentine Tango was spectular as well - score 29

https://www.youtube.com/watch?v=unSXHj8_mmg

I was sad to see Apolo and Karina leave tonight.

October 15, 2012

I had two favorite performances tonight on Dancing With The Stars - All Stars. Most of the dance styles were new to the show this week, so even the pros were out of their comfort zones.

I liked Val and Kelly's contemporary dance routine. While the dance technique wasn't perfect by any means, I just really like watching these two dance. Kelly's dancing has been surprising me this season.

https://www.youtube.com/watch?v=UN_8lo7vIUI&list=PLQUlGlNi6pJRNlL7I9qzmwCYMZi_ubBtK&index=1&feature=plpp_video

I just LOVE, LOVE, LOVED Shawn and Derek's routine.They got a standing ovation from the judges two weeks in a row! I loved the pause in the dance ... and Derek's jump at the end of the dance was amazing.

https://www.youtube.com/watch?v=a_WARREbiic

I loved their routine from last week too. Even though they broke the rules, the judges gave them a standing ovation. Bruno said it was the best dance in 15 seasons ... so I'm going to post it as well. Just watch for the height of her jumps!

https://www.youtube.com/watch?v=p9ZjX1vtucM

This entire season has been spectacular and so entertaining.

August 25, 2012

The only show I'm watching this summer is So You Think You Can Dance. This week, there were two routines I really enjoyed:

Audrey and Twitch's Hip Hop Dance choreographed by Dave Scott --- https://www.youtube.com/watch?v=Iy1d4gACa6o (https://www.youtube.com/watch?v=JNpVTyeIwEI includes judges comments) ... and Cyrus and Jaimie's Contemporary dance choreographed by Travis Wall --- https://www.youtube.com/watch?v=ZsYTRHKlfLs.

I always enjoy watching anything by Twich. Cyrus's raw talent is a joy to behold. I also liked Eliana and Alex's Contemporary routine by Stacey Tookey, which got a standing ovation from the judges ... just not as much as the two above --- https://www.youtube.com/watch?v=Zl_j8EmgvGY . I am a big Alex fan.

July 2, 2012

I love Phillip Phillips song "Home". It's raining here so I thought I'd share this link. Enjoy your teabreak!

https://www.youtube.com/watch?v=bfRya-P4ffk

Update August 3, 2012

Here is Phillip's "Home" video ... just released ...

https://www.youtube.com/watch?v=HoRkntoHkIE

Absolutely love this song! I hope you are taking time to enjoy the summer weather. :0)

January 8, 2012

This performance by Susan Boyle on Britain's Got Talent 2009 is still one of my favorites. I stilll get goosebumps when I listen to it.

As we start the new year, I thought it was worth watching again just as a reminder that you are never too old to give up on your dreams.

Enjoy your tea break with Susan's performance of I Dreamed A Dream from Les Miserables ...

https://www.youtube.com/watch?v=VSrAJsWvEIc

And there are only three words to describe this performance from the 2010 final - A Maze Ing!

https://www.youtube.com/watch?v=KF2gC8GZWjM

Click here to continue your tea break!

THE SMALL eBIZ NEWS

Market Watch

October 17, 2012

If you like keeping track of things like interest rates and the housing market, Canadian Business has two recent articles on these topics ...

http://www.canadianbusiness.com/article/101876--why-interest-rates-must-rise

http://www.canadianbusiness.com/article/98306--canada-s-housing-crash-begins

THE SMALL eBIZ NEWS

Good Practice Checklist

September 28, 2012

The International Federation of Accountants (IFCA) released a 24 page publication earlier this year titled, "Good Practice Checklist for Small Business". The CA Practice Advantage September newsletter has recommended the publication.

The tool can be downloaded and used to prepare for meeting with your accountant or as a diagnostic tool to determine what kind of advice you, as a small business owner, might need.

You can find it at ifca.org> publications & resources> business advisory (under Tags on the right hand side).

You can also use their search feature to locate the item the report. Set the search fields as follows:

Publication Type = Guidance & Support Tools

Source = SMP Committee

THE SMALL eBIZ NEWS

Your Financial Toolkit

September 25, 2012

The Finance Canada site today released a new tool for Canadian consumers. Your Financial Tookit is a hands-on resource that is divided into 11 modules. It includes videos, case studies, worksheets, quizzes, and questionnaires that deal with:

- banking

- budgeting and saving

- debt management

- fraud protection

- retirement planning

The program is designed to increase the financial literacy of Canadians. Read more here ...

THE SMALL eBIZ NEWS

Carbon Tax Increases

June 29, 2012

The BC carbon fuel tax is set to rise July 1. It annoys me that they raise the rates at the beginning of the vacation season instead of waiting for the fall ...

For anyone interested, you can find a schedule of all carbon tax increases by fuel type on the BC government website www.sbr.gov.bc.ca at

http://www.sbr.gov.bc.ca/documents_library/shared_documents/

Carbon_Tax_Rates_by_Fuel_Type_from_Jan_2010.pdf

It is a pdf document so you can save it to your desktop for future reference.

The BC government announced in its 2012 Budget that all aspects of the carbon tax will be under review. You have until August 31, 2012 to make a written submission. See www.fin.gov.bc.ca> CarbonTax Review and Carbon Tax Overview for more information.

THE SMALL eBIZ NEWS

Bill C-38 Given Royal Assent

June 29, 2012

Royal Assent was given to Bill C-38: the Jobs, Growth and Long-term Prosperity Act. In today's news release, it states:

"Key elements of the Jobs, Growth and Long-term Prosperity Act that will position Canada for long-term success include:

- Making the review process for major economic projects more timely and transparent while protecting the environment.

- Increasing travellers’ exemptions to modernize existing rules and facilitate border processes for Canadians bringing goods home from abroad.

- Enhancing the governance and oversight framework for Canada Mortgage and Housing Corporation.

- Making Employment Insurance (EI) a more efficient program that connects Canadians withavailable jobs.

- Ensuring stable, predictable EI premium rates by limiting premium rate increases to 5 cents each year until the EI Operating Account is in balance, and then moving to a seven-year break-even rate.

- Legislating the Government’s commitment to sustainable and predictable transfers to provinces and territories in support of health care, education and other programs and services.

- Gradually increasing from 65 to 67 the age of eligibility for Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) starting in April 2023.

- Allowing for the voluntary deferral of the basic OAS for up to five years starting on July 1, 2013, resulting in a higher, actuarially adjusted, annual pension.

- Modernizing Canada’s currency by gradually eliminating the penny from Canada’s coinage system."

THE SMALL eBIZ NEWS

The Ontario Sales Tax Transition Benefit

June 29, 2012

A reminder that you must file your 2010 tax return by June 30, 2012 to apply for the last payment. The deadline to apply for the third payment and final is June 30, 2012.

Eligible families (including single parents) receive up to $335 and eligible single people receive up to $100. You can get more information at www.fin.gov.on.ca> credits, benefits and incentives> Ontario sales tax transition benefit.

THE SMALL eBIZ NEWS

Of Interest To Dual Citizens

US Tax Filing Obligations

June 27, 2012

Finance Minister Jim Flaherty praised the IRS decision to help dual citizens with their US tax filing requirements today. Many dual citizens do not know that they are required to file US tax returns and Foreign Bank and Financial Accounts (FBAR) filings.

You can read more at www.fin.gc.ca> News> News Releases>Finance Minister Applauds US Government Decision to Help Dual Citizens with Their Foreign Tax Obligations

You can find the June 26, 2012 IRS announcement at www.irs.gov>newsroom> IRS Announces Efforts to Help U. S. Citizens Overseas Including Dual Citizens and Those with Foreign Retirement Plans.

You can also read more on the changes at Ministry of Finance site ...

http://www.fin.gc.ca/n12/12-072-eng.asp

THE SMALL eBIZ NEWS

BC's Return to PST Legislation

June 22, 2012

This posting has been moved to reimplementing PST.

June 7, 2012

BC's PST Transitional Rules - Residential Properties

This posting has been moved to reimplementing PST.

March 2, 2012

PST Legislation is Introduced in BC

These postings has been moved to reimplementing PST 1 and and reimplementing PST 2.

THE SMALL eBIZ NEWS

Personal Service Business Changes and CRA's Information Highway

June 18, 2012

Deloitte has published two terrific articles in the June issue of Privately speaking: Tax insights; a free newsletter.

The first article that caught my attention was regarding the upcoming changes to personal service businesses (incorporated employees).

The author, Tracy MacKinnon, suggests that you many want to earn your income directly in the future. You can find the article at www.deloitte.com> Insights> Insights and Issues> Personal service businesses: Once a fairy tale, now a horror story. (Make sure you have selected Canada as the country.)

I chat more on the PSB proposed legislation here.

The second article which I enjoyed reading was The CRA's information highway: Tightening up on taxes. Yogesh Bhathella discusses the mutiple sources of information CRA uses to ensure everyone is paying their fair share. The item that caught my attention was reviewing land registry or property tax roll information.

You can read the article at www.deloitte.com> Insights> Insights and Issues> The CRA's information highway.

THE SMALL eBIZ NEWS

Management Fees in Related Party Planning

February 6, 2012

Ernst&Young's TaxMatters@EY - January-February 2012 issue has an excellent article titled Carefully consider management fees in related party planning.

The article shares CRA's views on "establishing a reasonable basis for computing a management fee between a professional practice and its related holding company".

The article gives background, the question posted at a conference roundtable and CRA's response. The conclusion by E&Y is "this technical interpretation serves as a useful reminder to taxpayers that the fair market value (FMV) of the services provided is the only basis on which such related party transactions should be valued".

You can find the complete article www.ey.com> Canada> Services> Tax> TaxMatters@EY - January-February 2012.

Tag: CCPC

THE SMALL eBIZ NEWS

Canadian Accountant Merger Negotiations

February 6, 2012

I thought this piece of bookkeeper new was interesting. Canadian Business released an article about the merger negotiations going on between the three professional accountancy bodies.

They've agreed on 8 overarching principles which can be found at visioncga.org.

There is dissension. One prominent forensic accountant "rejects the suggestions that CAs, CMAs and CGAs do identical work, noting especially a difference between auditing and management accounting. “It’s like you’re having the orderlies merge with the doctors and nurses,” he says. “It’s a bloody stupid idea.”"

To read the entire article, go to canadianbusiness.com> News & Markets / Strategy> Canadian accountants attempt merger, confusion ensues.

Take A Teabreak

November 3, 2011

I've been watching The X Factor.

While all the performances were good last night, these were my two favorite performances.

Enjoy your tea break with my first choice, Josh Krajick ...

http://www.thexfactorusa.com/videos/josh-krajick-performs-on-the-second-live-show

Drew's performance was my second choice ... can you believe she is just 14!

http://www.thexfactorusa.com/videos/drew-performs-on-the-second-live-show

July 20, 2011

It's summer and So You Think You Can Dance and So You Think You Can Dance Canada are on.

I love this couple. I chose this piece for today's tea break because the judge's portion was great fun too!

Enjoy your tea break with Melanie and Marko ...

https://www.youtube.com/watch?v=0BNFh16Wnps&feature=related

I also loved J&J in this Canadian routine. They got a standing ovation from all the judges!

https://www.youtube.com/watch?v=onia7Zgqcg8

May 5, 2011

This video should make you smile ... Talking Beaver on the Highway ... a friendly Canadian beaver on the Canada US highway.

Enjoy your tea break ...

https://www.youtube.com/watch?v=sekLEG8xsOs&

April 22, 2011

Change your works ... Change your world.

Enjoy your tea break ...

https://www.youtube.com/watch?v=Hzgzim5m7oU

March 14, 2011

This video should make you smile ... ventriloquist Paul Zerdin ... with a human dummy.

Enjoy your tea break ...

http://www.boreme.com/boreme/funny-2010/paul-zerdin-ventriloquist-without-dummy-p1.php

October 13, 2010

This dance on So You Think You Can Dance Canada got a standing ovation from all four judges.

Enjoy your tea break ...

https://www.youtube.com/watch?v=STAIB1kYroE

July 4, 2010

For this teabreak, I'm finally posting my favorite dance routine on last week's "So You Think You Can Dance" ... Alex and Twitch.

I had two other favorite dances last week too ... Ashley and Ade ... Adechike and Lauren.

https://www.youtube.com/watch?v=PxpHyT0hf0I

May 25, 2010

On the lighter side, I hope Erin and Maks win Dancing With The Stars this season. Their freestyle was my favourite dance of the night.

... and as this is a tea break, Maks recommends Dr. Tea as a herbal medicinal drink that is an all round remedy for everything. You can find out more about it in the book "The Ultimate Tea Diet". I'm marking this down for my next book purchase.

You can watch Erin and Maks here ...

https://www.youtube.com/watch?v=CeiSmovrP6E

THE SMALL eBIZ NEWS

QuickBooks 2009

November 9, 2011

QuickBooks 2009 live technical and business support will be discontinued as of January 31, 2012.

THE SMALL eBIZ NEWS

Common GST/HST Errors

July 13, 2011

Ernst & Young have a really good article by Alison Pavlin and Patricia Gurdyal of Toronto in their July 2011 Tax Matters newsletter. The article is titled Common GST/HST Processing Errors.

It is worth a read. Restricted and recaptured ITCs, ITC documentation, bad debts, rates of tax, intercompany charges, imports, and accounting for GST/HST are discussed.

(Editor's note: this article is no longer available but other articles are on their website at www.ey.com/CA (for Canada)> Services> Tax> TaxMatters@EY.

THE SMALL eBIZ NEWS

BC HST Referendum Ballots

July 5, 2011

I thought I would just remind BC residents that your HST ballots must be received (not mailed) by Elections BC by August 5th at 4:40 pm. The date was revised due to the postal strike.

You can also deliver it to a Service BC instead of dropping it in the mail.

If you have not received your ballot in the mail yet, call 1-800-661-8683 for a replacement ballot.

Taxtips.ca, my favorite tax website in Canada, has a good posting on Why HST is Good for BC. Take time to be informed before you vote.

THE SMALL eBIZ NEWS

BC HST Referendum Video

June 21, 2011

Here is an excellent BC HST Referendum video by law student Chris Thompson countering some of Chris Delaney and Bill Vander Zalm's arguments. It is titledFightFightHST 2 - Fighting the man who was "The Man," who's fighting "The Man."

https://www.youtube.com/watch?v=frnBgX9QRZM&feature=share

THE SMALL eBIZ NEWS

Proposed HST Rate to Drop

May 25, 2011

The Globe and Mail today reports that the BC Liberals have announced a 2% drop in the HST rate if BC voters keep the tax alive when it goes to referendum.

A 1% drop would occur on July 1, 2012 with a further 1% drop on July 1, 2014.

Small business will be hit as the plan to eliminate this tax, currently at 2.5%, will be postponed.

The tax cut will also be offset by a 2% rise in the corporate tax rate ... rising to 12% from the current 10%. The Globe and Mail article points out that Ontario's corporate tax rate is scheduled to drop to 11% next year.

Other changes being offered if the HST survives the referendum is a one time payment at the end of the year of $175 for each child under 18 and seniors with low-to-modest incomes.

Referendum voting will begin in June using a mail-in ballot system with the results announced in August.

You can find the entire article at:

http://www.theglobeandmail.com/news/national/british-columbia/bc-politics/clark-announces-drop-in-bc-hst-rate-if-tax-survives-referendum/article2034539/

THE SMALL eBIZ NEWS

Minimum Wage Rate Changes

March 16, 2011

BC's new Premier announced changes to the minimum wage rate today. Bookkeeper's take a note:

- Minimum wage will be $8.75 as of May 1, 2011; up from the current $8/hour in place since 2001.

- Training wage of $6/hour has been repealed as of May 1, 2011.

- A new and separate minimum wage for liquor servers will come into effect on May 1, 2011 at $8.50.

- Minimum wage rises again to $9.50 on Nov 1, 2011; $8.75 for liquor servers.

- Minimum wage rises a third time to $10.25 in May 2012; $9 for liquor servers.

THE SMALL eBIZ NEWS

Red Tape Reduction Commission

January 22, 2011

There is a new website, www.reduceredtape.gc.ca. It was started on January 13, 2011 when the Prime Minister announced the new commission tasked with cutting red tape for small and medium sized businesses.

There are links allowing you to weigh in with your opinions and suggestions. If you feel strongly about this subject, you will want to check out the website.

December 16, 2010

The Bookkeeper News

QuickBooks 2011 Payroll Tax Table

The January 2011 Payroll Update release will be released today. The update includes the latest government tax tables (TT93) for QuickBooks 2010 and 2011.

It includes the new tax table effective January 1, 2011 to June 30, 2011 and the ability to amend or cancel T4s and RL-1s for 2010. QuickBooks Payroll 2011 already has this functionality. Other minor issues have been addressed as well.

November 4, 2010

The Bookkeeper News

Canadian's Debt Load Increases to Unhealthy Levels

The Bank of Canada released its Monetary Policy Report in late October. The Governor of the Bank of Canada lowered the economic outlook as Canada struggles to recover from the 2007 meltdown. The report touches on Canadians' need to manage their debt as a pronounced correction in housing prices is expected.

Of interest to bookkeepers is a commentary on the Knowledge Bureau website. Robert Ironside, an instructor at the Knowledge Bureau, specializes in financial literacy. He has commented on how the low interest rate is affecting three different groups of people.

Risk averse retirees struggle as they are forced to touch their capital. Low interest rates (currently 1%) are here to stay for a year or more.

People saving for retirement will have to delay retirement or save more to ensure they have sufficient capital for retirement. Low interest rates mean they are losing the compound effect of growing their retirement savings.

Canadians who have exceeded the historical debt ratios due to the low interest rates will run into trouble once rates return to more normal levels. Many Canadians are carrying debt equal to 146% of disposable income. This is about the same level Americans carried prior to the 2008 economic collapse.

The CGA Association of Canada released a study in May titled, Where the Money is Now: The State of Canadian Household Debt as Conditions for Economic Recovery Emerge.