Bad Debt

by Treat

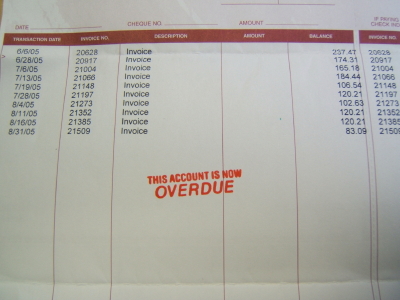

Writing Off Bad Debt

Please differentiate between bad debt and provision for bad debt.

Hi Treat,

Generally, bad debt refers to bad debt expense (on your income statement), which is an estimate of the sales for the period that you do not expect to collect.

Provision for bad debt refers to the Allowance for Doubtful Accounts (on your balance sheet), which is a contra account to the Accounts Receivable account. The amount in this account is the estimate of the sales in total that you do not expect to collect.

You can find more information in Common Bookkeeping Entries where I discuss how to record bad debt allowance and how to write-off a bad debt.

If you follow the links, you will also come to a discussion on how bad debt is treated for tax purposes which is different than for accounting purposes ... which I think is what creates all the confusion sometimes.

Comments for Bad Debt

|

||

|

||

|

||